Robinhood takes its 3 percent savings account back to the drawing board amid widespread criticism

Robinhood is going back to the drawing board. Just a day after unveiling what it called checking and savings accounts, the financial technology startup said it is re-launching and re-naming the product, which came under immediate scrutiny from Wall Street...

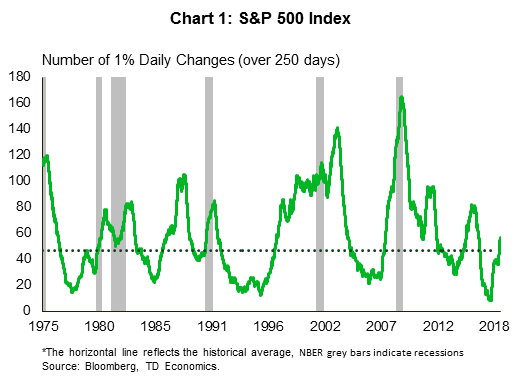

The Only Thing We Have To Fear… Is Fear Itself

Amidst the Great Depression in 1933, U.S. president Franklin Roosevelt’s inaugural address cited the now-famous phrase “the only thing we have to fear is fear itself” . Today’s financial markets and economic environment bear zero resemblance to that period, but...

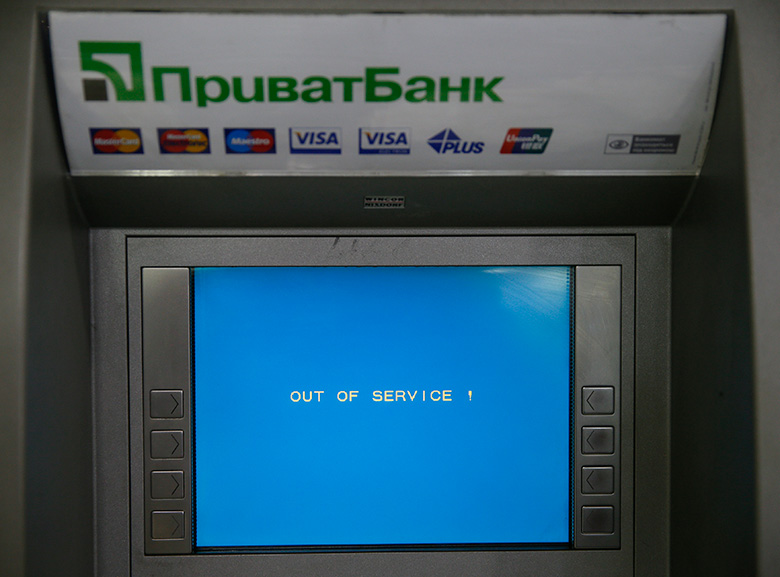

EEMEA: PrivatBank suffers legal setback in bid to recover missing billions

Efforts to recover billions of dollars allegedly stolen from Ukraine’s PrivatBank suffered a setback on December 4 when a judge in London threw out a $1.9 billion fraud claim against the bank’s former owners. PrivatBank was taken over by the...

How to Know if Trading is Right for You | Podcast

Key points covered in this podcast Should you trade? Ability and willingness Running the numbers Active or passive mindset Should you trade? Should you trade? It is a simple question, but not easy to answer. There are many factors to...

Fed’s Economic Projections to Provide Guidance as Concerns on Global Slowdown Intensify

Sterling and Brexit was the center of focus during the early part of last week. The parliament vote on Brexit was postponed to at least January. UK Prime Minister Theresa May survived leadership challenge but her position is shaky with...

Weekly Economic and Financial Commentary: A Holly Jolly Price Reprieve

U.S. Review A Holly Jolly Price Reprieve Falling gasoline prices kept consumer price inflation flat in November, supporting real income just in time for the holiday shopping season. Holiday sales got off to a solid start in November. Excluding sales...

The Weekly Bottom Line: Stretch That Loonie (You Have To)

U.S. Highlights After some optimism early in the week, financial market sentiment soured as focus shifted back to fears of an escalation in trade tensions, Brexit uncertainty, and a potential economic downturn in 2019. The U.S. consumer remained unbowed in...

Week ahead: Fed Rate Hike Looms But Long Pause Could Follow

We are arguably heading to one of the most important weeks in months for the dollar, certainly the most vital one before the year is out, as the Federal Reserve decides on interest rates. In addition to the Fed meeting,...

US Dollar Index Tags a Fresh 2018 High on Mixed Economic Data

Generally speaking, US traders have been focused on the other side of the Atlantic this week, with particular attention on the continued Brexit drama and the mostly as-expected ECB meeting. With those situations (at least temporarily) behind us, the market’s...

Dollar Higher Ahead of Crucial Fed Meeting

Safe-haven currencies soared on Friday as disappointing data from China and Europe heightened concerns over global growth. The greenback finished the week stronger against its major trading partners as investor eagerly await Wednesday’s FOMC interest rate decision and updated economic...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals