Kevin O’Leary chides the Fed for claiming data-dependence while still forecasting two 2019 rate hikes

Investor and entrepreneur Kevin O’Leary told CNBC Thursday he’s not fond of the Federal Reserve’s plans for interest rates next year. Fed Chairman Jerome Powell “made a mistake” during his highly-anticipated news conference Wednesday afternoon, said O’Leary, chairman of O’Shares...

Elliott Wave Analysis: EURCAD at Interesting Levels; More Weakness in View

Let’s take a look at daily chart of EURCAD. What we see is a leading diagonal into wave A/1 from highs and a current recovery since the beginning of October definitely looks slow and corrective. But, the most important part...

What is Forex? Forex Trading Explained

What is Forex? The market for foreign exchange, or forex (FX) for short, is the largest financial market in the world and involves the buying and selling of currency. Without knowing it, you have probably already participated in the foreign...

Dollar Under Pressure But Loss Limited, BoE Dovish Shift Ignored

Dollar remains in the spotlight today as it suffers renewed selling in European session. It could be part of delayed reaction to the dovish FOMC rate hike yesterday. But then, while the greenback is the worst performing one today, loss...

BOE Turns Dovish as Brexit Deadline Nears, Yet No Deal is Secured

BOE voted 9-0 to leave the Bank rate unchanged at 0.75% in December. The committee also voted unanimously to leave the asset purchase program at 435B pound .It has turned more cautious than November, warning that Brexit uncertainty has “intensified...

Two more rate hikes could spark a recession, market researcher warns

He’s been worried the Federal Reserve would go too far. And now, market researcher James Bianco thinks his fear may be a reality. His updated outlook follows the Fed’s decision to plan for additional interest rate hikes next year. Bianco...

US weekly jobless claims rise less than expected

The number of Americans filing applications for jobless benefits rose marginally from near a 49-year low last week, suggesting underlying strength in the labor market and broader economy. Initial claims for state unemployment benefits increased 8,000 to a seasonally adjusted...

Canadian Dollar Higher, Investors Eye US Jobless Claims

USD/CAD is down slightly in the Thursday session. Currently, the pair is trading at 1.3470, down 0.07% on the day. On the release front, Canadian Wholesale Sales are expected to post a gain of 0.4% after two straight declines. Canada...

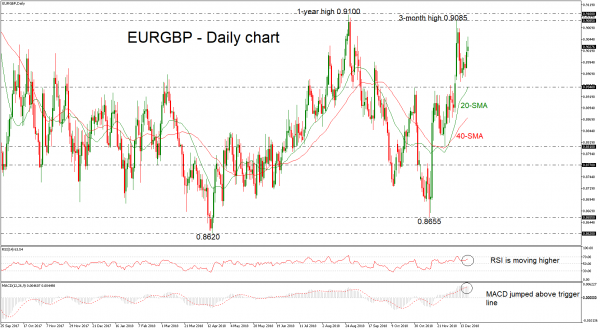

EURGBP Moves Slightly Higher, Remaining above SMAs

EURGBP has been edging higher since Wednesday’s session, remaining above the strong support level of 0.8940. The technical structure endorses the short-term bullish sentiment as the RSI is heading towards the overbought level and the MACD oscillator created a positive...

David Tepper: Fed is done supporting stock prices, so cash is ‘not so bad’ as an investment now

Hedge fund titan David Tepper said Thursday the Federal Reserve is sending the market a message, and it’s not a good one. A day after the Fed raised interest rates for the fourth time this year, the influential investor made...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals