Bank of America boosts CEO Brian Moynihan’s pay 15% to $26.5 million after record profit last year

Bank of America CEO Brian Moynihan got a 15 percent raise, the biggest increase among bank chiefs to disclose pay so far, after the lender reported record earnings last year. Moynihan’s compensation rose to $26.5 million from $23 million in...

Trade could be the biggest catalyst in week ahead

The earnings deluge continues and inflation reports are due, but it will be the tone of trade talks in Beijing that could have the biggest impact on markets in the week ahead. U.S. Trade Representative Robert Lighthizer and Treasury Secretary...

The fate of the market this year could be in the hands of the ‘Powell Put’

Call it the “Powell Put” or the “Powell Pivot” or something else, but the Federal Reserve chairman’s recent change in approach to monetary policy is reverberating through the markets. In just a matter of a few months, central bank chief...

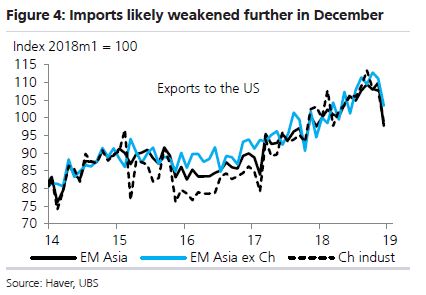

Trade war headlines could get much worse before they get better as the US looks to Europe

With little apparent progress in U.S.-China trade talks, the Trump administration could be about to open up a new front in the trade wars by taking on the European auto industry — and that could spook markets. U.S. negotiators head...

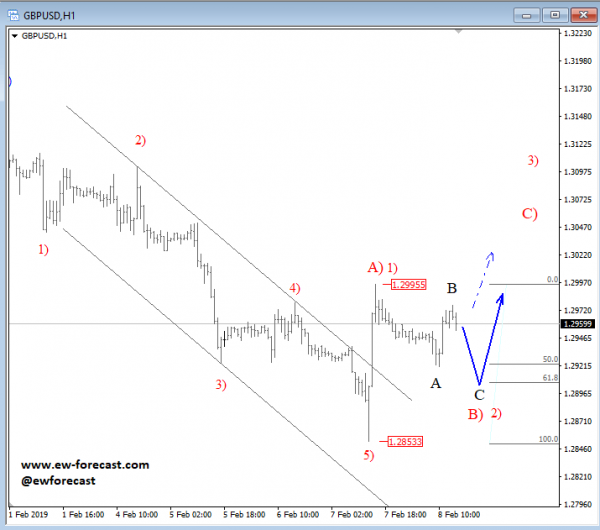

Elliott Wave Analysis: GBP/USD Unfolding A Minimum, Three-Wave Bullish Reversal

GBPUSD made a nice break higher, through the upper Elliott wave channel line, which is the first evidence of a completed decline and that a minimum three-wave recovery in is progress. We labelled wave A)/1) as completed, that is now...

Australia & New Zealand Weekly: RBA Shifts to a More Balanced View

Week beginning 11 February 2019 RBA shifts to a more balanced view. RBA: Head of Economics and Assistant Governor Financial Markets speak. Australia: Westpac-MI Consumer Sentiment, housing finance, NAB business survey. NZ: RBNZ meeting, RBNZ Governor Orr testimony, card spending,...

UK GDP Growth to Decelerate in Q4

The Bank of England joined its dovish counterparts on Thursday after leaving interest rates steady as expected amid mounting fears that Brexit coinciding with a global economic slowdown could further sink British markets. Of more importance, policymakers surprisingly decided to cut...

Week Ahead – Japanese & UK Q4 GDP in Focus; Kiwi Readies for Dovish Noises from RBNZ

Japan and the United Kingdom will be next to publish economic growth numbers for the final quarter of 2018, while the Eurozone will release its second GDP estimate for the period. Inflation data out of the US and the UK...

Weekly Focus – Signs of a German Sector Recovery

This publication has been prepared by Danske Markets for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents...

Canadian January Employment Bounces Back

Highlights: Employment jumped 66.8k which was up strongly from the 7.8k recorded in December and market expectations of a 5k increase. The solid increase in employment did not prevent an unexpectedly large 0.2 percentage point jump in the unemployment rate...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals