A big change in accounting will put $3 trillion in liabilities on corporate balance sheets

A new corporate accounting rule is about to pull an estimated $3 trillion out of the shadows. Starting this year, companies are required to record the cost of renting assets used in their operations, such as office space, equipment, planes...

Risk Appetite Boosted by Unknown Progress in US-China Trade Negotiation, More Talks Ahead

Trade talk optimism, trade pessimism, drove markets up and down last week. In the end, Presidents of US and China decided to give markets some lip service and boosted stocks towards weekly close. Words, rather than substance, are enough to...

Weekly Economic and Financial Commentary: More Subdued Data from the Global Economy

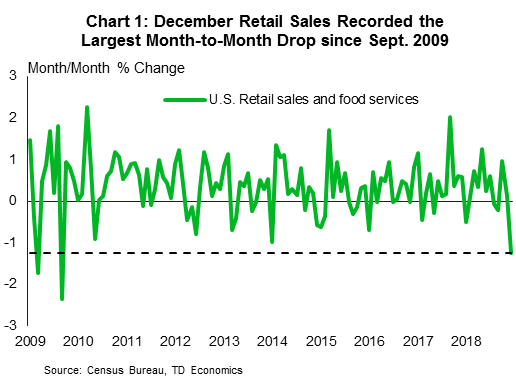

U.S. Review Retail Sales Go Rogue Energy prices weighed on both headline CPI and PPI. The January CPI was unchanged, while PPI fell 0.1%. Core measures were more firm, rising 0.3% and 0.2%, respectively. Retail sales unexpectedly plunged 1.2% during...

USDCHF Backs Off Higher Prices On Loss Of Momentum

USDCHF backs off higher prices on loss of upside momentum on Friday. This development leaves risk of more weakness on the cards. Resistance comes in at the 1.0100 level. A break of here will clear the way for more gain...

The Weekly Bottom Line: Wall of Uncertainty

U.S. Highlights December retail sales came in significantly weaker than expected, falling 1.2% m/m, with the decline being broad-based. Consumption in Q4 is now tracking around 2.6% annualized – softer than expected, but still a pretty good showing. The retail...

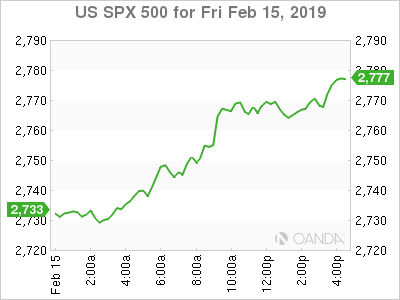

Stocks Surge on Optimism US-China Trade War Nearing An End

The global equity rally continues to be bolstered by optimism that the trade war could finally see a framework agreement. The US also avoided a second government shutdown as President Trump accepted the deal lawmakers worked on, only to declare...

NZD/USD Riding High on RBNZ and Optimistic Trade Talk Fumes

In the middle of the week, the RBNZ opted to leave its primary interest rate unchanged at 1.75%, where the central bank expects it to remain for a “considerable period.” Governor Orr and company noted that there were both upside...

Quick read: How and why MEMX could take on the exchange incumbents

What is important is who it is, not what it is The new firm’s stated aim is to offer a simple trading model with basic order types, the latest technology and a simple, low cost fee structure; but just how...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals