Trump finally got his wish from the Fed, but not for the reasons he wanted

The Federal Reserve likely just stalled interest rate increases for the year. The move announced Wednesday should please President Donald Trump, who has repeatedly urged the central bank to hit the brakes on rate hikes. But he may not like...

Another Dovish FOMC Meeting Sees 2019 Rate Hike Plans Abandoned

The fed funds target range was held steady at 2.25-2.50% in a unanimous decision The updated dot plot shows a majority of FOMC members (11 of 17) don’t see the need for any rate hikes this year; the median call...

Fed Chair Powell says Chinese and European economies have slowed ‘substantially’

Weakening Chinese and European economies are acting as a deterrent to U.S. growth, Federal Reserve Chairman Jerome Powell said Wednesday. Speaking just after the central bank decided to hold the line on interest rates this week and likely maintain that...

Market sees nearly 50% chance of a Fed rate cut by the end of January 2020

Markets are becoming more convinced that the Federal Reserve will be more accommodative on interest rates. The fed funds futures market is assigning a 47.8 percent probability of at least one rate cut by Jan. 29, according to the CME’s...

Fed Goes All in on Dovish Commitment (Dot Plots No More Hikes in 2019)

The Federal Reserve delivered a very clear dovish message. The dovish pivot that has been in place in January was cemented. The decision was considered dovish as the Fed cut the 2019 dot plots forecast from two hikes to none,...

How Central Banks Impact on currency and market. Hawkish dovish

The role of central banks in the forex market Central banks are mainly responsible for maintaining inflation in the interest of sustainable economic growth while contributing to the overall stability of the financial system. When they deem it necessary central...

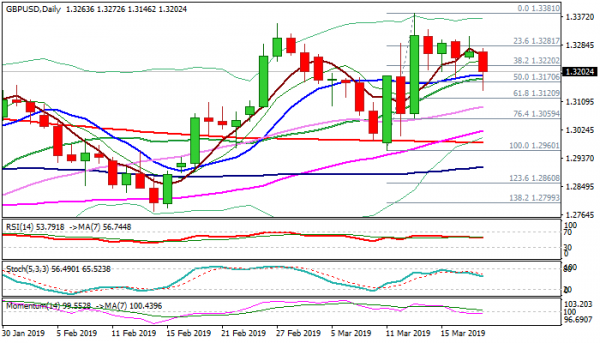

Sterling Falls to One-Week Low, But May’s Request for Delay Could Slow Bears

Cable fell to one-week low at 1.3146 on Wednesday, as renewed risk of no-deal Brexit keeps the currency under pressure. Several scenarios remain on the table and keep high uncertainty in Brexit drama, as PM May asked the EU for...

UK 100 Index Runs Towards 5-Month High; SMAs Act as Supports

UK 100 stock index (FTSE 100) has advanced considerably after touching the 38.2% Fibonacci retracement level of the downleg from 7900 to 6533, around 7060. During Tuesday’s session the price gained some more ground driving the market towards a fresh...

Sterling Dives as Markets Disapprove May’s Short Brexit Extension, Dollar Mixed ahead of FOMC

Sterling suffers another round of selloff today as the markets clearly disapprove of UK Prime Minister Theresa May’s next step on Brexit. In short, she’s just seeking a short delay until June 30. But any date beyond May 23, when...

More than free money: How long-shot 2020 candidate Andrew Yang would reshape the US economy

Until recently, Andrew Yang has been flying under the radar as one of a swarm of Democratic candidates vying to challenge President Donald Trump in 2020. Yang, a 44-year-old lawyer-turned-entrepreneur, has no political experience and is far from a household...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals