S&P 500 closes at another record Friday, gains 2% on week

Stocks rose on Friday as traders wrapped up a strong week amid decreasing political uncertainty and positive vaccine news. The S&P 500 gained 0.3% to end the day at 3,638.35, notching a record closing high. The Nasdaq Composite advanced 0.9%...

Stocks making the biggest moves midday: Amazon, Tesla, AstraZeneca, Carnival & more

An Amazon.com Inc worker prepares an order in which the buyer asked for an item to be gift wrapped at a fulfillment center in Shakopee, Minnesota, U.S., November 12, 2020. Amazon.com Inc | Reuters Check out the companies making headlines...

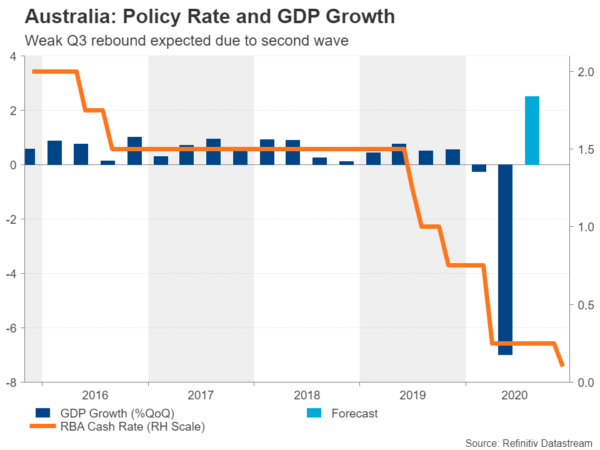

RBA Meeting: A More Optimistic Take

The Reserve Bank of Australia will hold its final meeting for the year at 03:30 GMT Tuesday. Having cut rates last month, no action is expected this time, so the market reaction will depend on the language of the accompanying...

Week Ahead – Data Overload May Spoil Vaccine Euphoria; NFP to Lead the Pack

It’s NFP week and as investors battle the vaccine optimism against the short-term gloom, the latest jobs report from the United States may determine which way sentiment sways next. Canada will also publish jobs numbers along with its Q3 GDP...

Sterling Weighed Down by Same Old Brexit Concerns, as UK-EU Divergences Remain

Sterling turns generally lower in quiet holiday-mood trading today. Sellers are back in control as there appears to be no path out of the Brexit trade talk deadlocks yet. And, time is running out clearly. Overall, Yen and Dollar remain...

Gold Analysis: Trades Sideways

The yellow metal has continued to trade almost flat. However, it has started to do so in a different range, as the price has been fluctuating between 1,805.00 and 1,820.00 levels. In the meantime, the price had began to ignore...

USD/JPY Analysis: Passes Support Levels

On Friday morning, the USD/JPY currency exchange rate passed the support levels near 104.20. Due to that reason, the pair had no technical support as low as the 103.32 level. In theory, the rate should decline to this mark. However,...

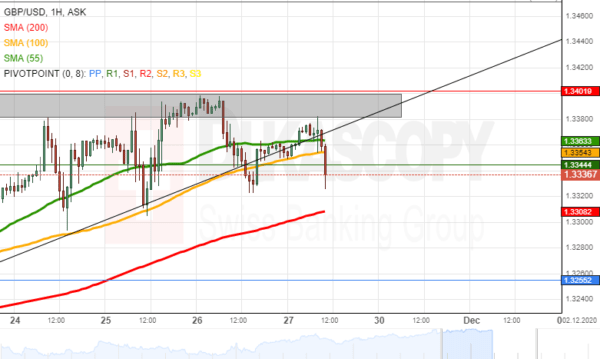

GBP/USD Analysis: Breaks Pattern

The resistance zone of 1.3380/1.3400 continued to hold on Thursday and Friday. The resistance caused a breaking of the supporting trend line and the 100-hour simple moving averages, which pushed the rate up. By the middle of Friday’s GMT trading...

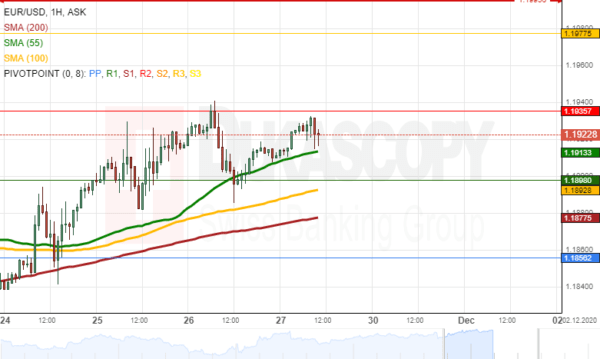

EUR/USD Analysis: Is Pushed By 55-Hour SMA

The common European currency has found support in the 55-hour simple moving average, which has been pushing the pair up since the afternoon of Thursday. In the meantime, the pair faces the resistance of the weekly pivot point at 1.1935....

EUR/USD Outlook: A Low Is Formed Near 1.1885 And The Pair Is Currently Rising

The Euro remained in a positive zone above the 1.1880 pivot level against the US Dollar. The EUR/USD pair traded as high as 1.1940 recently before starting a downside correction. The pair traded below the 1.1900 level, but it remained...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals