Sales of existing homes rise slightly as more listings finally hit the market

After four straight months of declines, sales of previously owned homes rose 1.4% in June month to month to a seasonally adjust annualized rate of 5.86 million units, according to the National Association of Realtors. These sales represent closings, so...

U.S. jobless claims show surprise gain, well above expectations

Weekly jobless claims unexpected moved higher last week despite hopes that the U.S. labor market is poised for a strong recovery heading into the fall. Initial filings for unemployment insurance totaled 419,000 for the week ended July 17, well above...

USDCHF Ranges Between 23.6% and 76.4% Fibonacci Levels

USDCHF is struggling to dip beneath the 100-day simple moving average (SMA) at 0.9155 following the recent evaporation of upside momentum. That said, the pair is somewhat presently stuck between the stabilized upper and lower frontiers of the Bollinger bands...

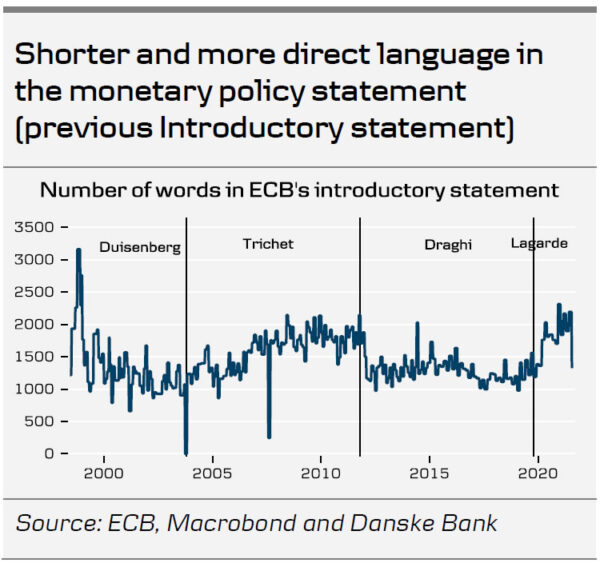

ECB Pledges to Continue Front-load QE Purchases until Inflation Reaches 2% Sustainable

The ECB has updated the forward guidance on the policy rate, reflecting the new inflation target concluded in the strategic review. All monetary policy measures stay unchanged as it strives to achieve the symmetric 2% inflation target: The deposit rate...

ECB Research: Stepping Up on Inflation Ambitions, But Not on Tools

ECB’s first meeting since the new strategy took effect was mostly about aligning the language from the June decision to the review outcome. The bond buying (APP and PEPP) guidance were unchanged. The main new element worth highlighting is the...

Sterling Extends Rally

The British pound has posted considerable gains for a second consecutive day. Currently, GBP/USD is trading at 1.3767, up 0.37% on the day. It has been a volatile week for the pair, which declined by 1% early in the week...

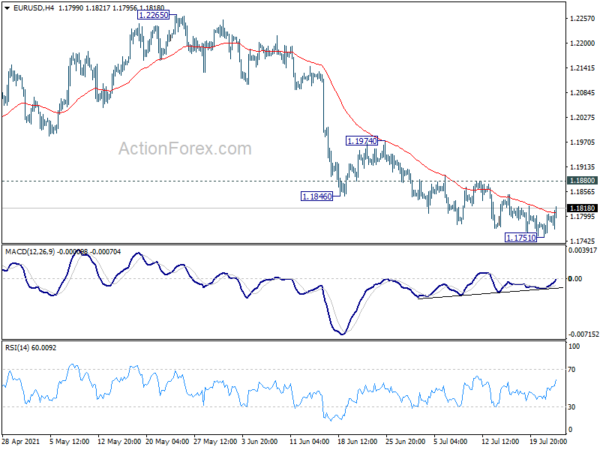

Euro Steady Against Dollar after ECB, Jobless Claims

Euro is trading steadily in US session after ECB finally revealed it’s new forward guidance. Though, the common currency is notably weak against Sterling and commodity currencies. Meanwhile, Dollar and Swiss are also weak, together with Yen, as market sentiments...

EURJPY Flirts with 130.00 Mark; Falling Trend Line Holds

EURJPY has been trading higher over the last couple of days, keeping its footing around the 130.00 level and above the short-term simple moving averages (SMAs). As regards the market momentum, some optimism seems to be building over an upside...

UK digital bank Starling trims losses as revenue skyrockets 600%

The Starling Bank banking app on a smartphone. Adrian Dennis | AFP via Getty Images LONDON — British digital bank Starling reported a sevenfold increase in revenue in the 16 months ending March 2021 as its lending soared, helping to...

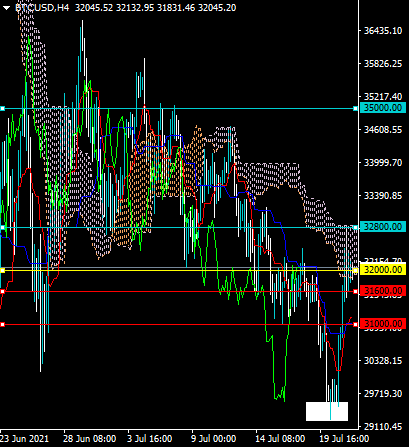

BTCUSD Strongly Bullish

Technical analysis The four-hour time frame shows that a bullish inverted head and shoulders pattern has formed after the BTCUSD pair rallied back above the $32,000 resistance level. The Ichimoku indicator shows that the BTCUSD pair will break above the...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals