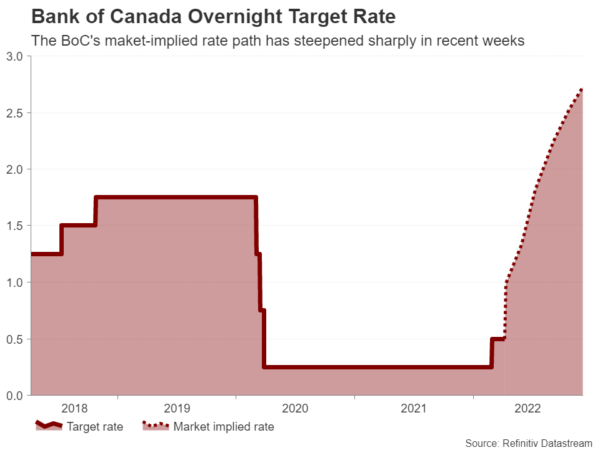

Will the Bank of Canada Opt for a 50-bps Rate Hike at its April Meeting?

The Bank of Canada announces its next monetary policy decision on Wednesday (14:00 GMT) and the odds of a double rate hike are very high. The Canadian economy has been going from strength-to-strength after emerging from the first lockdown in...

US 500 Index’s Positive Tone Shaky Near 38.2% Fibonacci

The US 500 stock index (Cash) is consolidating slightly north of the 4,446 level, which is the upper part of a support border and coincidentally the 38.2% Fibonacci retracement level of the up wave from 4,137 until 4,638. The rolling...

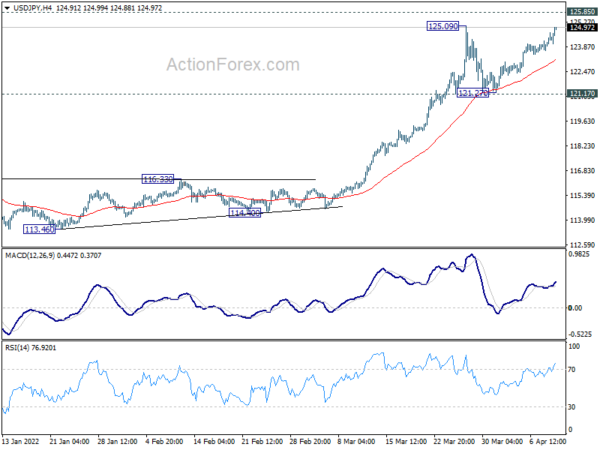

Yen Selling Steps Up a Gear on Rising Treasury Yields

Yen’s selloff intensifies today, following extended rally in major benchmark treasury yields. US 10-year yields breaks 2.75% handle for the first time since March2 019. Germany 10-year bund yield also breaches 0.8% handle. On the other hand, Japan 10-year JGB...

GBPUSD Wave Analysis

GBPUSD reversed from round support level 1.3000 Likely to rise to resistance level 1.3160 GBPUSD currency pair today reversed up with the daily Hammer from the round support level 1.3000 (which stopped the previous sharp impulse wave 1 in the...

Pound Tests 1.3000 Again, Risks Falling to 1.2600

The British pound returned to the $1.3000 area, a significant circular level from which the British currency bounced in the middle of last month. The bulls continue to hold for the second consecutive trading session. The intraday charts clearly show...

Yen Lower as a Busy Week Starts, RBNZ, BoC, ECB, UK GDP, US CPI Featured

Yen is trading broadly lower in Asian session today. But commodity currencies are also soft on mild risk-off sentiment. On the other hand, Euro and Dollar are the stronger ones, while Sterling and Swiss Franc follow. UK data will be...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals