Global stock markets tumble today after China reported a strong daily increase of 15152 Wuhan coronavirus cases on February 12. That was a huge difference from 2015 new cases reported for a day ago. However, the mass difference was due to change in counting method in Hubei province, which is epicenter of the outbreak. It appears that other provinces are not up to speed with the counting method change yet. The overall announcements show deep disorganization in the Chinese government in fighting the outbreak and raise deep concerns over transparency and accuracy of the data, as well as the situation.

In the currency markets, Yen trading broadly higher today on risk aversion. But it’s outshone by Sterling, which was shot up by resignation of a key official of the UK cabinet. Euro is trading as the weakest one for now, followed by New Zealand and then Australian Dollar. Technically, EUR/GBP is on track to retest 0.8276 low and break will resume larger fall form 0.9324. EUR/JPY breaks 119.24 support and should be on tract to retest 115.86 low. USD/CHF’s break of 0.9788 resistance reaffirm near term bullishness for 0.9851 fibonacci level.

유럽에서는 현재 FTSE가 -1.55% 하락했습니다. DAX는 -0.41% 하락했습니다. CAC는 -0.72% 하락했습니다. 독일 10년물 수익률은 -0.0073 하락한 -0.384입니다. 앞서 아시아에서는 Nikkei가 -0.14% 하락했습니다. 홍콩 HSI는 -0.34% 하락했습니다. 중국 상하이 SSE는 -0.71% 하락했습니다. 싱가포르 스트레이트 타임즈는 -0.10% 하락했습니다. 일본 10년 만기 JGB 수익률은 0.0087 상승한 -0.031을 기록했습니다.

미국 CPI는 2.5%로 상승했고, 핵심 CPI는 2.2%로 변함이 없습니다.

US headline CPI accelerated to 2.5% yoy in January, up from 2.3% yoy, matched expectations. CPI core was unchanged at 2.3% yoy, beat expectation of 2.2% yoy.

Also released, initial jobless claims rose 2k to 205k in the week ending February 8, better than expectation of 210k. Four-week moving average of initial claims was unchanged at 212k. Continuing claims dropped -61k to 1.698m in the week ending February 1. Four-week moving average of continuing claims dropped -17.5k to 1.727m.

Sterling surges as Javid resigns as Chancellor of Exchequer

Sajid Javid surprisingly resigns as UK Chancellor of Exchequer today. He’s expected to be replaced by Rishi Sunak, the chief secretary to the Treasury. The Guardian said that Javid was asked by Prime Minister Boris Johnson to “fire all his special advisers and replace them with No 10 special advisers to make it one team”. Javid believed that “no self-respecting minister would accept those terms.”

Sterling responds positively to the news though. Instead of viewing it as some political uncertainty, markets see that Johnson is gaining more control over the cabinet, and thus creating more certainty for the country.

EU keeps Eurozone 2020, 2021 GDP forecast unchanged, raises inflation projection slightly

European Commission kept Eurozone GDP growth forecast unchanged at 1.2% in both 2020 and 2021. Eurozone inflation forecasts is raised by 0.1% in both 2020 and 201, to 1.3% and 1.4% respectively. For the EU as a whole, GDP forecast was also left unchanged at 1.4% in both 2020 and 2021. EU inflation forecast was also raised by 0.1% to 1.5% in 202, but 2021 projection remains unchanged at 1.6%.

Valdis Dombrovskis, Executive Vice-President, said, “Despite a challenging environment, the European economy remains on a steady path, with continued job creation and wage growth. But we should be mindful of potential risks on the horizon: a more volatile geopolitical landscape coupled with trade uncertainties.”

Paolo Gentiloni, European Commissioner for the Economy, said: “The outlook for Europe’s economy is for stable, albeit subdued growth over the coming two years. This will prolong the longest period of expansion since the launch of the euro in 1999, with corresponding good news on the jobs front… But we still face significant policy uncertainty, which casts a shadow over manufacturing. As for the coronavirus, it is too soon to evaluate the extent of its negative economic impact.”

ECB de Cos: Coronavirus keeps balance of risks to downside

ECB Governing Council member Pablo Hernandez de Cos said monetary policy will remain highly accommodative for a prolonged period of time.

But he also warned that “low-for-long interest rate environment could be encouraging excessive risk-taking by some financial intermediaries.” In particular, “asset valuations appear stretched in several advanced economies in markets such as equity, high-yield debt, and property markets.

Meanwhile, China’s Wuhan coronavirus “does keep balance of risks to downside.” Also, “Brexit entails significant risk of further fragmentation, as some companies may relocate to different financial centres.

RBA Lowe: 글로벌 금리는 수십 년이 아니라도 몇 년 동안 낮게 유지될 것입니다.

RBA Governor Philip Lowe said today, “it is quite likely that we are going to be in this world of low interest rates for years, if not decades, because it is driven by structural factors.” For now, he added that RBA is not “obsessed” with getting inflation back to 2-3% target in a hurry.

Lowe는 더 많은 통화 부양책의 위험 균형에 관한 중앙 은행의 최근 결정을 반복했습니다. "우리는 금리 결정에서 우리가 순환적 관점에서 금리를 인하할 때 이러한 구조적 이유 때문에 사람들이 이미 높은 수준의 부채에서 더 많은 돈을 빌리도록 부추긴다는 것을 의식하고 있습니다."라고 그는 말했습니다. "현재 우리의 결정에서 고려 사항입니다."

Lowe는 또한 경제를 돕기 위해 정부에 더 많은 것을 촉구했습니다. “우리는 호주에서 어떠한 재정 부양책도 갖고 있지 않습니다.”라고 그는 말했습니다. “기업과 정부가 투자 기회를 활용하는 것을 보고 싶습니다. 호주 정부와 기업은 호주가 연방이 된 이후 최저 금리로 차입할 수 있습니다.”

Hawkesby: RBNZ는 진정한 중립 편향을 가지고 있으며 금리는 오랫동안 낮게 유지될 수 있습니다.

RBNZ 부총재 Christian Hawkesby는 블룸버그 인터뷰에서 중앙은행이 금리에 대해 "진정한 중립적 편향"을 가지고 있으며 "여기서부터 일이 어디로 가는지에 대한 진정한 개방성"을 가지고 있다고 말했습니다. 당분간은 "오랫동안 금리를 낮게 유지하면서 보류할 수 있습니다."

중국의 코로나바이러스 발생의 영향과 관련하여 뉴질랜드 경제에 대한 혼란은 단 0.3주 동안 지속될 수 있으며 1분기 성장에서 XNUMX%만 절약할 수 있습니다. 그는 “상황이 훨씬 더 나빠지면 예측과 정책 대응이 달라질 것”이라고 말했다. “현재 시장은 아마도 이달 초보다 더 완화되었을 것입니다. 그러나 동등하게 우리는 그것이 비대칭이라는 것을 압니다. 중앙값이 XNUMX주라면 그보다 훨씬 짧을 수는 없지만 상당히 길 수 있습니다.”

금리 인상에 대해 RBNZ는 현재 관망하는 방식을 채택하고 있습니다. 그는 “남아 있는 여력이 없고 인플레이션이 오랫동안 목표치 이하로 떨어지지 않은 시기에 있다면 금리 인상을 시작하는 것이 더 안전한 환경에 있는 것입니다. 우리는 그 시간에 가깝지 않습니다. 우리는 아직 기다리며 지켜볼 수 있는 긴 시간이 있습니다.”

EUR / GBP 중기 전망

일일 피벗 : (S1) 0.8372; (P) 0.8401; (R1) 0.8421; 더…

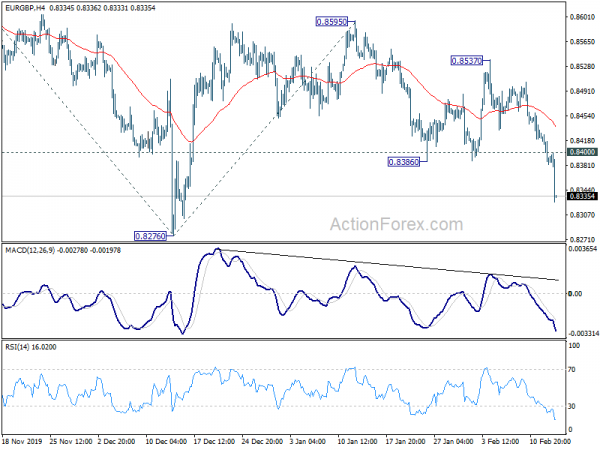

EUR/GBP’s break of 0.8386 support suggests resumption of fall from 0.8595. Intraday bias is back on the downside for 0.8276 low. Decisive break there will resume larger decline from 0.9324. Next downside target will be 61.8% projection of 0.9019 to 0.8276 from 0.8595 at 0.8136. On the upside, above 0.8400 minor resistance will turn bias neutral first.

In the bigger picture, decline from 0.9324 medium term top is still in progress. As long as 0.8786 support turned resistance holds, further fall is expected to 61.8% retracement of 0.6935 to 0.9324 at 0.7848. Nevertheless, break of 0.8786 will argue that fall from 0.9324 has completed and turn focus back to this high.

경제 지표 업데이트

| GMT | 싸이 | 이벤트 | 실제 | 예보 | 이전 보기 | 수정 |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y / Y Jan | 1.70% | 1.50% | 0.90% | |

| 00:00 | AUD | 소비자 인플레이션 기대 XNUMX월 | 4.00% | 4.70% | ||

| 00:01 | GBP | RICS 주택 가격 잔고 XNUMX월 | 17% | 3% | -2 % | |

| 07:00 | EUR | 독일 CPI M/M XNUMX월 F | -0.60 % | -0.60 % | -0.60 % | |

| 07:00 | EUR | 독일 CPI Y/Y XNUMX월 F | 1.70% | 1.70% | 1.70% | |

| 13:30 | USD | 최초 실업 수당 청구 (7 월 XNUMX 일) | 205K | 210K | 202K | 203K |

| 13:30 | USD | CPI M / M Jan | 0.10% | 0.20% | 0.20% | |

| 13:30 | USD | CPI Y / Y Jan | 2.50% | 2.50% | 2.30% | |

| 13:30 | USD | CPI Core M / M Jan | 0.20% | 0.20% | 0.10% | |

| 13:30 | USD | CPI 핵심 Y / Y Jan | 2.30% | 2.20% | 2.30% | |

| 15:30 | USD | 천연 가스 저장 | - 106B | - 137B |

Signal2forex.com - 최고의 Forex 로봇 및 신호

Signal2forex.com - 최고의 Forex 로봇 및 신호