Dollar drops notably in early US session after another NFP miss. It has now reversed all of yesterday’s late gains. Canadian Dollar also turns softer after weaker than expectation job data. On the other hand, other commodity currencies strengthen mildly. In other markets, US future turn up on expectation Fed is not closer to tapering. Gold recovers on Dollar weakness.

Technically, in the end, GBP/USD failed to sustain below 1.4090 support and rebounds. USD/CHF also failed to break through 0.9046 minor resistance and drops sharply. Dollar’s near term weakness is generally retained first. Focus is indeed back on 109.32 minor support in USD/JPY. Break there could prompt deeper selling in the green back next week.

In European, at the time of writing, FTSE is down -0.24%. DAX is up 0.05%. CAC is up 0.03%. Germany 10-year yield is down -0.011. Earlier in Asia, Nikkei dropped -0.40%. Hong Kong HSI dropped -0.17%. China Shanghai SSE rose 0.21%. Singapore Strait Times dropped -0.44%. Japan 10-year JGB yield dropped -0.0014 to 0.085.

US NFP grew only 559k, unemployment rate dropped to 5.8%

US non-farm payroll employment grew 559k in May, below expectation of 621k. Prior month’s figure was revised slightly up from 266k to 278k. Total non-farm payroll employment is down by -7.6m, or -5.0%, from its pre-pandemic level in February 2020.

Unemployment rate dropped to 5.8%, down from 6.1%, slightly below expectation of 5.9%. Number of unemployed persons fell by -496k to 9.3m. The unemployment measures are still well above pre-pandemic levels of 3.5% and 5.7m, in February 2020. Labor force participation rate was little changed at 61.6%, and remained in range of 61% to 61.7% since June 2020.

Wage growth was strong, as average hourly earnings rose 0.5% mom, versus expectation of 0.2% mom.

Canada employment dropped -68k, unemployment rate ticked up to 8.2%

Canada employment dropped -68k, or -0.4% in May, much worse than expectation of -20.3k. That’s the decline consecutive month of contraction. Almost all of the decline was in part-time work (-54k, -1.6%). Unemployment rate edged up to 8.2%, from April’s 8.1%, matched expectations.

Eurozone retail sales dropped -3.1% mom in Apr, EU down -3.1% mom

Eurozone retail sales dropped -3.1% mom in April, worse than expectation of -0.9% mom. For the month, volume of retail trade decreased by -5.1% for non-food products and by -2.0% for food, drinks and tobacco, while it increased by 0.4% for automotive fuels.

EU retail sales dropped -3.1% mom too. Among Member States for which data are available, the largest monthly decreases in total retail trade were registered in Slovenia (-10.4%), Denmark (-8.6%) and France (-6.0%). The highest increases were observed in Portugal (+4.3%), Latvia (+3.8%) and Lithuania (+3.7%).

UK PMI construction rose to 64.2, another month of rapid output growth

UK PMI Construction rose to 64.2 in May, up from April’s 61.6, above expectation of 62.3. The data signaled the strongest rate of output growth for just under seven years.

Tim Moore, Economics Director at IHS Markit: “UK construction companies reported another month of rapid output growth amid a surge in residential work and the fastest rise in commercial building since August 2007. Total new orders increased at the strongest rate since the survey began more than two decades ago, but supply chains once again struggled to keep pace with the rebound in demand.”

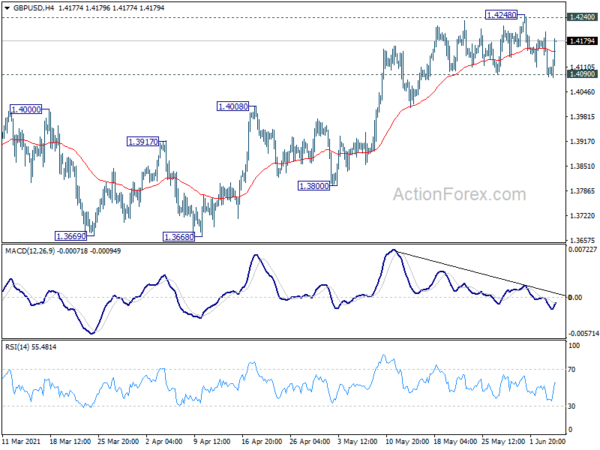

GBP / USD Outlook ກາງຄືນ

Pivots ປະຈໍາວັນ: (S1) 1.4062; (P) 1.4132 (R1) 1.4179 ເພີ່ມເຕີມ

GBP/USD rebounds after drawing support from 1.4090. Intraday bias remains neutral and near term bullishness is retained. On the upside, sustained break of 1.4240, will indication resumption of larger up trend from 1.1409, for 1.4376 resistance next. On the downside, break of 1.4090 will indicate the start of the third leg of the consolidation pattern from 1.4240. Intraday bias will be turned back to the downside for 1.4008 resistance turned support and below.

ໃນຮູບໃຫຍ່ກວ່າ, ຕາບໃດທີ່ 1.3482 ຄວາມຕ້ານທານຫັນໄປສູ່ການສະຫນັບສະຫນູນ, ແນວໂນ້ມທີ່ເພີ່ມຂຶ້ນຈາກ 1.1409 ຄວນສືບຕໍ່. ການຢຸດເຊົາການຕໍ່ຕ້ານ 1.4376 ຈະປະຕິບັດຜົນກະທົບທີ່ມີທ່າອ່ຽງທີ່ໃຫຍ່ກວ່າແລະເປົ້າຫມາຍ 38.2% retracement ຂອງ 2.1161 (ສູງ 2007) ຫາ 1.1409 (2020 ຕ່ໍາ) ທີ່ 1.5134. ຢ່າງໃດກໍ່ຕາມ, ການຢຸດຢ່າງຫນັກແຫນ້ນຂອງການສະຫນັບສະຫນູນ 1.3482 ຈະໂຕ້ຖຽງວ່າການເພີ່ມຂຶ້ນຈາກ 1.1409 ໄດ້ສໍາເລັດແລະເຮັດໃຫ້ການຫຼຸດລົງເລິກລົງໄປສູ່ການສະຫນັບສະຫນູນ 1.2675 ແລະຂ້າງລຸ່ມນີ້.

Economic Indicators Update

| GMT | Ccy | ກິດຈະກໍາ | ຕົວຈິງ | ການຄາດຄະເນ | ກ່ອນຫນ້ານີ້ | ສະບັບປັບປຸງ |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Household Spending Y/Y Apr | 13.00% | 8.90% | 6.20% | |

| 08:30 | GBP | Construction PMI May | 64.2 | 62.3 | 61.6 | |

| 09:00 | EUR | Eurozone Retail Sales M/M Apr | 3.10-% | 0.90-% | 2.70% | 3.30% |

| 12:30 | CAD | Net Change in Employment May | -68K | -20.3K | -207.1K | |

| 12:30 | CAD | ອັດຕາການຫວ່າງງານເດືອນພຶດສະພາ | 8.20% | 8.20% | 8.10% | |

| 12:30 | CAD | Labor Productivity Q/Q Q1 | 1.70-% | 1.00-% | 2.00-% | |

| 12:30 | USD | Nonfarm Payrolls May | 559K | 621K | 266K | 278K |

| 12:30 | USD | ອັດຕາການຫວ່າງງານເດືອນພຶດສະພາ | 5.80% | 5.90% | 6.10% | |

| 12:30 | USD | Average Hourly Earnings M/M May | 0.50% | 0.20% | 0.70% | |

| 14:00 | USD | Factory Orders M/M Apr | 0.40% | 1.10% | ||

| 14:00 | CAD | Ivey Purchasing Managers Index May | 62.3 | 60.6 |

Signal2forex.com - ຫຸ່ນຍົນ Forex ທີ່ດີທີ່ສຸດແລະສັນຍານ

Signal2forex.com - ຫຸ່ນຍົນ Forex ທີ່ດີທີ່ສຸດແລະສັນຍານ