Swiss Franc jumps broadly in otherwise quiet markets today. Canadian Dollar is second strongest, then Dollar, but both are staying inside yesterday’s ranges. Sterling is currently the worst performing one, followed by New Zealand Dollar and then Yen. But the selling in the two are far from being clear. In other markets, Gold has a second attempt on 1900 handle but fails to sustain above there again. WTI crude oil is trading lower, eyeing 68 handle. Bitcoin is back below 33k handle, heading towards 30k.

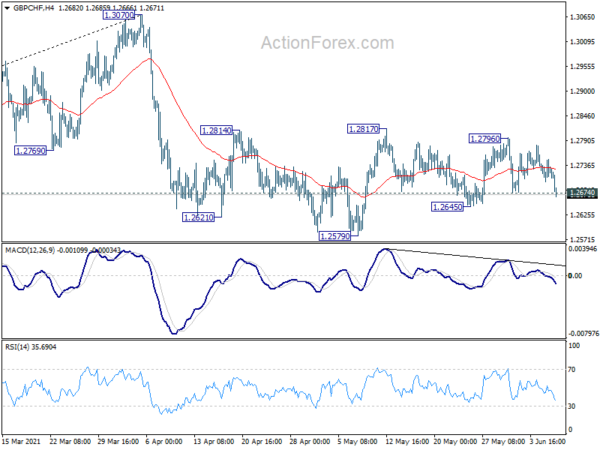

Technically, EUR/CHF’s breach of 1.0915 key medium term resistance turned support suggests that downside momentum might be accelerating. Sustained break there will also carry larger bearish implication, for 1.0737 support. One focus now is 0.8929 support in USD/CHF and break will resume larger fall from 0.9471 to retest 0.8756 low. GBP/CHF’s break of 1.2674 puts focus on 1.2645 support now. Firm break there will argue that larger decline from 1.3070 is resuming through 1.2579 low. We’ll see if these three Franc pairs move lower in tandem.

In Europe, at the time of writing, FTSE is up 0.47%. DAX is up 0.11%. CAC is up 0.29%. Germany 10-year yield is down -0.0313 at 0.226. Earlier in Asia, Nikkei dropped -0.19%. Hong Kong HSI dropped -0.02%. China Shanghai SSE dropped -0.54%. Singapore Strait Times dropped -0.27%. Japan 10-year JGB yield dropped -0.0060 to 0.075.

US exports rose 1.1% in April, imports dropped -1.4%

US goods and services exports rose 1.1% mom to USD 205.0B in April. Imports dropped -1.4% mom to USD 273.9B. Trade deficit narrowed to USD 68.9B, from March’s USD 75.0B, matched expectations.

Trade deficit dropped USD 7.1B to USD 32.4B, while exports rose USD 1B and imports dropped USD 6B. Deficit with EU dropped USD 1B to USD 16.1B, while exports rose USD 2B and imports rose USD 1B.

From Canada, trade balance turned into CAD 0.6B surplus in April, versus expectation of CAD 0.5B deficit.

Germany ZEW economic sentiment dropped to 79.8, current situation surged to -9.1

Germany ZEW economic sentiment dropped from 84.4 to 79.8 in June, below expectation of 85.3. Current situation index improved from -40.1 to -9.1, well above expectation of -28.0. Eurozone ZEW economic sentiment dropped from 84.0 to 81.3, below expectation of 85.5. Eurozone current situation rose 27.0 pts to -24.4.

“The economic recovery is progressing. Although the ZEW Indicator of Economic Sentiment has experienced a drop in June, it remains at a very high level. The decline in expectations is probably largely due to the considerably better assessment of the economic situation, which is now back at pre-crisis levels. The financial market experts therefore continue to expect a strong economic recovery for the next six months,” comments ZEW President Professor Achim Wambach on current expectations.

Eurozone GDP contracted -0.3% qoq in Q1, EU down -0.1% qoq

Eurozone GDP contracted -0.3% qoq in Q1, according to latest estimate by Eurostat. Compared with the same quarter of the previous year, GDP dropped -1.3% yoy. EU GDP contracted -0.1% qoq, -1.2% yoy in Q1.

Among EU member states, Ireland (+7.8%) and Croatia (+5.8%) recorded the sharpest increases of GDP compared to the previous quarter, followed by Estonia (+4.8%) and Greece (+4.4%). The strongest declines were observed in Portugal (-3.3%) and Slovakia (-2.0%), followed by Germany (-1.8%) and Latvia (-1.7%).

Also released, Germany industrial production dropped -1.0% mom in April, below expectation of 0.7% mom. France trade deficit came in at EUR -6.2B in April, larger than expectation of EUR -5.3B. Italy retail sales dropped -0.4% mom in April, versus expectation of 0.2% mom.

Australia NAB business conditions rose to record 37, entering growth period after rapid rebound

Australia NAB business conditions rose from 32 to 37, setting another record high. Trading conditions rose from 41 to 47. Profitability conditions rose from 34 to 40. Employment conditions rose from 20 to 25. All three sub-components also reset last month’s highs. Business confidence dropped from 23 to 20 in May.

NAB said: “Overall, this was another very strong read for the business sector – and forward indicators point to ongoing strength in the near-term. This is a pleasing result coming after last week’s national accounts which showed that the economy has now surpassed its pre-COVID level. The economy now appears to be entering a new period of growth after a very rapid rebound”.

Japan Q1 GDP finalized at -1.0% qoq, -3.9% annualized

Japan Q1 GDP contraction was finalized at -1.0% qoq, revised up from -1.3% qoq. Annualized rate was finalized at -3.9%. Capital expenditure shrank -1.2% qoq, revised up from -1.4% qoq. Government consumption dropped -1.1%, revised up from -1.8% qoq. Private consumption contracted -1.5% qoq, revised down from -1.4% qoq. External demand contracted -0.2% qoq. GDP deflator was finalized at -0.1%.

Economy Minister Yasutoshi Nishimura said after the release that consumption spending is expected to return ahead. “If infections subside, there’ll be pent-up demand from not having been able to go eating out or travelling,” he said.

Also released, labor cash earnings rose 1.6% yoy in April, above expectation of 0.8% yoy. Current account surplus narrowed to JPY 1.55T in April, versus expectation of JPY 1.60T. Bank lending rose 2.9% yoy in May, below expectation of 5.6% yoy.

ລາຄາ USD / CHF ໃນກາງວັນ

Pivots ປະຈໍາວັນ: (S1) 0.8959; (P) 0.8984 (R1) 0.9002 More ...

USD/CHF is still staying in consolidation from 0.8929 and intraday bias remains neutral at this point. Outlook stays bearish for deeper decline. On the downside, break of 0.8929 will resume the fall from 0.9471 to retest 0.8756 low. However, firm break of 0.9052 will turn bias to the upside for stronger rebound, and target 38.2% retracement of 0.9471 to 0.8929 at 0.9136 first.

In the bigger picture, prior rejection by 61.8% retracement of 0.9901 to 0.8756 at 0.9464 argues that rebound from 0.8756 was probably just a corrective move. That is, larger down trend from 1.0237 might be still in progress. Medium term bearish is also affirmed as the pair is now far below falling 55 week EMA. Firm break of 0.8756 low will target 61.8% projection of 1.0237 to 0.8756 from 0.9471 at 0.8556 next.

Economic Indicators Update

| GMT | Ccy | ກິດຈະກໍາ | ຕົວຈິງ | ການຄາດຄະເນ | ກ່ອນຫນ້ານີ້ | ສະບັບປັບປຸງ |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Like-For-Like Retail Sales Y/Y May | 18.50% | 39.60% | ||

| 23:30 | JPY | Labor Cash Earnings Y/Y Apr | 1.60% | 0.80% | 0.20% | 0.60% |

| 23:50 | JPY | Bank Lending Y/Y May | 2.90% | 5.60% | 4.80% | |

| 23:50 | JPY | GDP Q/Q Q1 | 1.00-% | 1.20-% | 1.30-% | |

| 23:50 | JPY | GDP Deflator Y/Y Q1 | 0.10-% | 0.20-% | 0.20-% | |

| 23:50 | JPY | Current Account (JPY) Apr | 1.55T | 1.60T | 1.70T | |

| 01:30 | AUD | NAB Business Confidence May | 20 | 26 | 23 | |

| 01:30 | AUD | NAB Business Conditions May | 37 | 32 | ||

| 05:00 | JPY | Eco Watchers Survey: Current May | 38.1 | 33.9 | 39.1 | |

| 06:00 | EUR | Germany Industrial Production M/M Apr | 1.00-% | 0.70% | 2.50% | 2.20% |

| 06:45 | EUR | France Trade Balance (EUR) Apr | -6.2B | -5.3B | -6.1B | |

| 08:00 | EUR | Italy Retail Sales M/M Apr | 0.40-% | 0.20% | 0.10-% | 0.00% |

| 09:00 | EUR | Eurozone GDP Q/Q Q1 | 0.30-% | 0.60-% | 0.60-% | |

| 09:00 | EUR | ການປ່ຽນແປງການຈ້າງງານຂອງເອີໂຣໂຊນ Q/Q Q1 F | 0.30-% | 0.30-% | 0.30-% | |

| 09:00 | EUR | Germany ZEW Economic Sentiment Jun | 79.8 | 85.3 | 84.4 | |

| 09:00 | EUR | Germany ZEW Current Situation Jun | -9.1 | -28 | -40.1 | |

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Jun | 81.3 | 85.5 | 84 | |

| 10:00 | USD | NFIB Business Optimism Index May | 99.6 | 99.8 | ||

| 12:30 | USD | Trade Balance (USD) Apr | -68.9B | -68.9B | -74.4B | -75.0B |

| 12:30 | CAD | Trade Balance (CAD) Apr | 0.6B | -0.5B | -1.1B |

Signal2forex.com - ຫຸ່ນຍົນ Forex ທີ່ດີທີ່ສຸດແລະສັນຍານ

Signal2forex.com - ຫຸ່ນຍົນ Forex ທີ່ດີທີ່ສຸດແລະສັນຍານ