Whilst currency markets paused for breath overnight, much of the Asian share market was trading lower ahead of today’s open.

Azijos indeksai:

- Australijos ASX 200 indeksas nukrito -113.4 punkto (-1.54 %) ir šiuo metu prekiauja 7,228.00 XNUMX

- Japonijos Nikkei 225 indeksas nukrito -507.23 punkto (-1.8%) ir šiuo metu prekiauja ties 27,608.05 XNUMX

- Honkongo Hang Seng indeksas pakilo 177.58 punkto (0.65 %) ir šiuo metu prekiauja 27,330.71 XNUMX

JK ir Europa:

- JK FTSE 100 ateities sandoriai šiuo metu krito -3.5 punkto (-0.05%), o grynųjų pinigų rinka šiuo metu atsidarys ties 7,027.16 XNUMX

- Euro STOXX 50 futures are currently down 0 points (0%), the cash market is currently estimated to open at 3,991.66

- Vokietijos DAX ateities sandoriai šiuo metu yra padidėję 6 tašku (0.04%), manoma, kad grynųjų pinigų rinka šiuo metu atsidarys 15,426.64

JAV ateities sandoriai:

- DJI ateities sandoriai šiuo metu krito -259.86 punkto (-0.75%)

- S&P 500 ateities sandoriai šiuo metu krito -43.75 punkto (-0.3 %)

- Nasdaq 100 ateities sandoriai šiuo metu krito -11.5 punkto (-0.27%)

Asia in the red, futures point lower

Rising coronavirus cases continued to weigh on Asian equity markets, with Japan’s markets on track for their worst week in a year and South Korea’s on track for its worst week since February. The FTSE 100 managed to close just above 7,000 after a brief spell beneath it, ad closed below its 50-day eMA for the first time since February. With futures markets pointing lower is suggests a weaker open for cash indices so, unless we see any signs of risk appetite emerging traders may favour selling into minor rallies if they occur. A break above 7075 today invalidates that bias.

In yesterday’s report we noted that the STOXX 50 had drifted towards a key support zone and that we were waiting for “momentum to tip its hand”. Well, the clear break beneath 4020 support certainly did just that, so we have now switched to a bearish bias. Although the caveat ties in with today’s video, in that we are yet to see if the holding patterns seen across Asian trade is a pause in breath before further losses, or the beginnings of a sympathy bounce. Therefore, traders would be wise to keep an eye on AUD/JPY and yields to assess which way equities will break today.

Yesterday’s low respected the lower trendline of its bearish channel, so if we see prices ounce then 4020-4040 is a key resistance zone today for bears to consider fading into (prior support, 200-hour eMA, weekly S2 and monthly S1 pivots).

FTSE 350: rinkos vidus

FTSE 350: 4035.66 (-1.68%) 08 July 2021

- 27 (7.69%) akcijos pakilo į priekį, o 317 (90.31%) sumažėjo

- 18 akcijų pakilo į naują 52 savaičių rekordą, 4 sumažėjo iki naujų žemiausių

- 81.2% akcijų uždarė virš savo 200 dienų vidurkio

- 19.09% akcijų uždarė virš savo 20 dienų vidurkio

Nugalėtojai:

- + 2.20% – Auction Technology Group PLC (ATG.L)

- + 1.33% – Easyjet PLC (EZJ.L)

- + 1.27% – Cairn Energy PLC (CNE.L)

Neveiksmingi:

- -6.01% – Restaurant Group PLC (RTN.L)

- -5.40% - traukinių linija (TRNT.L)

- -5.05% – Intermediate Capital Group PLC (ICP.L)

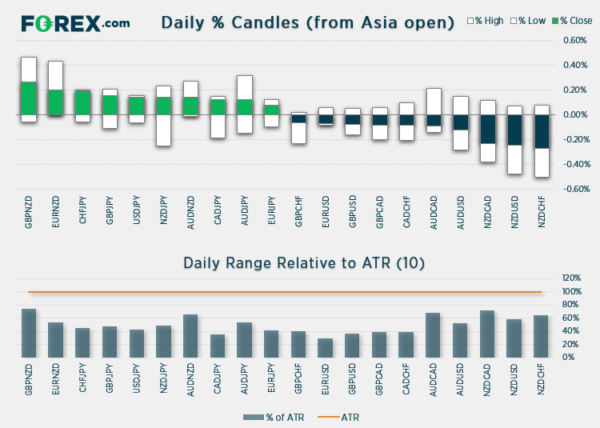

forex:

GBP pairs will be in focus around a host of UK data points around 07:00 BST. Q2 data showed a record rise of 27.6% as lockdown measures were eased, and today’s monthly growth estimates are likely to signal a cooldown of the breakneck speed. Industrial and manufacturing output and trade data are also released, so it could be a volatile hour should data come in heavily skewed above or below expectations.

GBP/CHF probed the May low during its most bearish session since September 2020 yesterday. Whilst it closed just above it, prices are consolidating into a potential bear flag formation ahead of UK’s data. So a strong data set could see a bounce from current levels, or send it back beneath 1.2583 should it disappoint enough. GBP/JPY is in a similar position and sat on the June low of 151.29 and bears may be tempted to fade into rallies up to 152.29 resistance.

Canada will release their employment data at 13:30 BST, and an improvement is expected due to the summer hiring boom. Unemployment is estimated to fall to 7.7% from 8.2% and 195k jobs are forecast to be added and make up for the disappointing -68k read in May.

EUR/CAD broke above a two-month range yesterday and is now trying to build a base above the 1.4820 breakout level, making it a pivotal level for today’s session. USD/CAD is building a decent bullish trend on the hourly chart, but take note of yesterday’s high as it respected the monthly R1 pivot level, so a strong employment report could mark it as the high for the week.

Prekės:

There wasn’t a great deal of movement from commodity markets overnight, although relative to equity and currency markets they mostly escaped the mayhem of yesterday’s European and US sessions.

Oil prices are a touch higher and could take advantage of a weaker dollar, should it fall further ahead of the weekend.

Gold continues to flatline as it struggles to break above the 200 and 50-day eMA’s (despite dollar weakness). Our bias is for another dip lower given the series of bearish reversal candles, but we’d likely need to see a resurgence of dollar strength coupled with higher real-yields (TIPS have traded higher for the past 3 days which could indicate the potential for gold weakness over the coming day/s).

And we are still waiting for copper to break beneath 4.20 support to signal its next leg lower, yet the series of inside days suggests we may nee to wait a while longer.

Kitas laikas (laikas BST)

Signal2forex.com - geriausi Forex robotai ir signalai

Signal2forex.com - geriausi Forex robotai ir signalai