There is not much change in the global investor sentiments today, as stock markets continue to rally on lockdown exit optimism. Much better than expected job data from the US also provide something to cheer. Though, in the currency markets, recent moves appear to have been exhausted. Australian Dollar turns notably weaker on profit taking after a long bull run. But Swiss Franc is the weakest while Canadian Dollar is not far behind ahead of BoC rate decision. On the other hand, New Zealand Dollar and Euro are currently the stronger ones for today. Markets could be turning into mixed consolidative trading.

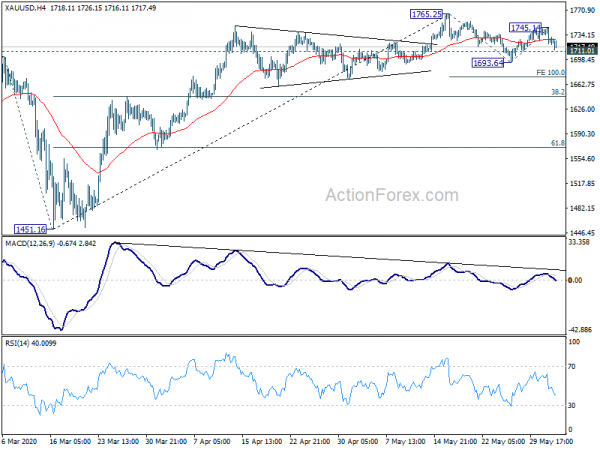

Technically, Gold is back eying 1711.01 minor support with this week’s fall. Break will likely extend the corrective pattern from 1765.25 with another down leg, towards 100% projection of 1765.25 to 1693.54 from 1745.14 at 1673.53. That might be a sign of a rebound in Dollar elsewhere. Meanwhile, AUD/NZD continues to struggle to sustain above 1.0865 near term resistance. Break of 1.0667 minor support will indicate short term topping and bring deeper pull back. If both happens as mentioned, they could together point to a deeper pull back in the powerful AUD/USD.

In Europe, currently, FTSE is up 1.16%. DAX is up 2.37%. CAC is up 2.01%. German 10-year yield is up 0.02277 at -0.384. Earlier in Asia, Nikkei rose 1.29%. Hong Kong HSI rose 1.37%. China Shanghai SSE rose 0.07%. Singapore Strait Times rose 3.40%. Japan 10-year JGB yield rose 0.0022 to 0.013.

US ADP employment dropped -2760k, job loss likely peaked

US ADP report showed only -2760k contraction in private sector jobs in May, well below prior months -19557k. By company size, small businesses lost -435k jobs, medium businesses lost -722k, large businesses lost -1604k. By sector, goods-producing companies lost -794k, service-providing companies lost -1967k.

“The impact of the COVID-19 crisis continues to weigh on businesses of all sizes,” said Ahu Yildirmaz, co-head of the ADP Research Institute. “While the labor market is still reeling from the effects of the pandemic, job loss likely peaked in April, as many states have begun a phased reopening of businesses.”

Eurozone unemployment rate rose to 7.3% in Apr, 11.9m people jobless

Eurozone unemployment rate rose to 7.3% in April, up from March’s 7.1%. EU unemployment rose to 6.6%, up from 6.4%. Eurostat estimates that 14.079 million men and women in the EU, of whom 11.919 million in the euro area, were unemployed in April 2020. Compared with March 2020, the number of persons unemployed increased by 397000 in the EU and by 211000 in the euro area.

Eurozone PPI came in at -2.0% mom, -4.5% yoy in April, below expectation of -1.8% mom, -.4% yoy. Germany unemployment rose 238k in May, above expectation of 200k. Unemployment rate rose to 6.3%, up from 5.8%, above expectation of 6.2%.

Eurozone PMI composite finalized at 31.9, still point to -9% GDP contraction in 2020

Eurozone PMI Services was finalized at 30.5 in May, up from April’s 12.0. PMI Composite was finalized at 31.9, up from 13.6. Among the member states where data are available, improvement were seen in Italy, Germany, France and Spain. But all PMI composite stayed well below 50, with Italy at 33.9, Germany at 32.3, France at 32.1, Spain at 29.2.

Chris Williamson, Chief Business Economist at IHS Markit said:

Eurozone GDP is consequently set to fall at an unprecedented rate in the second quarter, accompanied by the largest rise in unemployment seen in the history of the euro area.” But ” the downturn has already eased markedly in all countries surveyed.”

“Providing there is no resurgence of infection numbers, the planned lifting of lockdowns will inevitably help boost business activity and sentiment further in coming months. “However, the outlook is scarred by the prospect of demand remaining weak due to household spending being hit by high levels of unemployment and corporate spending being subdued as companies repair balance sheets.”

“We therefore remain cautious with respect to the recovery. Our forecasters expect GDP to slump by almost 9% in 2020 and for a recovery to prepandemic levels of output to take several years.”

UK PMI services finalized at 29.0, deep cuts to corporate spending a major dragging factor

UK PMI Services was finalized at 29.0 in May, up from April’s 13.4. PMI Composite was finalized at 30.0, up from April’s record low of 13.8. Markit said new works slumped amid cutbacks to business and consumer spending. Employment remains on sharp downward trajectory. Business expectations, however, rise again from March’s record low.

Tim Moore, Economics Director at IHS Markit: “The COVID-19 pandemic continued to have a severe impact on UK service sector activity in May, despite a boost in some areas from the gradual easing of lockdown measures. Survey respondents noted that deep cuts to corporate spending had been a major factor dragging down business activity in May, leading to a lack of work to replace completed projects.

Ny GDP Swiss dia nahitana fifanarahana -2.6% tamin'ny Q1, ratsy noho ny niandrasana

Ny GDP Swiss dia nahitana fifanarahana -2.6% qoq tao amin'ny Q1, ratsy noho ny niandrasana ny -2.2% qoq. "Noho ny areti-mifindra coronavirus sy ny fepetra ho amin'izany dia voaferana mafy ny hetsika ara-toekarena tamin'ny volana martsa. Ny fihenan'ny toekarena iraisam-pirenena dia nampihena ny fanondranana ihany koa. "

Amin'ny alàlan'ny fomba famokarana, nidina -1.3% qoq ny famokarana. Nidina -4.2% qoq ny fananganana. Nidina -4.4% ny varotra. Ny trano sy ny sakafo nilatsaka -23.4% qoq. Ny serivisy raharaham-barotra dia nidina -1.9% qoq. Ny asa ara-pahasalamana sy ara-tsosialy dia nidina -3.9% qoq. Nianjera -5.4% qoq ny zava-kanto, fialamboly sy fialamboly. Amin'ny lafiny iray, mitombo 1.5% qoq ny famatsiam-bola sy ny fiantohana. Niakatra 0.8% qoq ny fitantanan-draharaham-panjakana.

Amin'ny alàlan'ny fomba fandaniana, ny fanjifana tsy miankina dia nidina -3.5% qoq. Ny fampiasa amin'ny fampitaovana sy ny logiciel dia nilatsaka -4.0% qoq. Nidina -0.4% qoq ny fampiasam-bola amin'ny fananganana. Nidina -4.4% qoq ny fanondranana serivisy. Nidina -1.1% qoq ny fanafarana entana raha nihena -1.2% qoq ny fanafarana entana. Amin'ny lafiny iray koa, ny fidiram-bolan'ny governemanta dia nitombo 0.7% qoq. Niakatra 3.4% qoq ny fanondranana entana.

Ny GDP aostralia dia nanao fifanekena -0.3% tamin'ny Q1, nanomboka ny fihemorana voalohany tao anatin'ny 29 taona

Ny GDP aostralia dia nanao fifanekena -0.3% qoq tamin'ny Q1, nifanandrify tamina andrasana. Izay no fifanarahana voalohany tao anatin'ny 9 taona. Koa, tokony ho nanomboka tamin'ny Q1 ny fiverimberenana, tao anatin'ny 29 taona. Isan-taona dia nihena hatramin'ny 1.4% ny fitomboana, ambany indrindra hatramin'ny volana septambra 2009 rehefa tao anatin'ny krizy ara-bola maneran-tany i Aostralia.

Josh Frydenberg, mpahay vola dia nanamafy fa ao anatin'ny famerenan'ny toe-karena ny toe-karena ary "izany dia mifanaraka amin'ny toro-hevitra azoko avy amin'ny departemantan'ny Tahirim-bola momba ny toerana tokony hisy ny volana jona." "Miorina amin'ny zavatra fantatsika avy amin'ny Tahirim-bolam-panjakana, hahita ny fifanarahana isika amin'ny ampahefan'ny volana Jiona, izay tena lehibe lavitra noho izay hitantsika tamin'ny ampahefatry ny volana martsa," hoy izy.

Na dia izany aza dia nilaza i Frydenberg "na dia eo aza ny areti-mifindra eran-tany 100 taona, ny toekarena Aostraliana dia milamina tokoa." “Io hery io dia nanome anay ny mpamono vola amin'ny lafiny ara-bola hamaly toy ny nataontsika; Manodidina ny $ 260 miliara dolara eo amin'ny fanohanana ara-toekarena, na ny mitovy amin'ny an'ny GDP mihoatra ny 13 isan-jato. ”

Avy any Aostralia koa, tafakatra 24.9 tamin'ny volana Mey ny AiG Performance of Index Index, tamin'ny 21.6. Ny fahazoan-dàlana amin'ny fanorenana dia nidina -1.8% reny tamin'ny volana Aprily, tsara kokoa noho ny fiandrandrana -15.0% reny.

Ny composite PMI Japon dia niakatra hatramin'ny 27.8 tamin'ny volana Mey, izay nanondro ny -10% famerenan'ny GDP isan-taona

Ny PMI Services Japoney dia nihatsara ho 26.5 tamin'ny volana Mey, nanomboka tamin'ny 21.5 tamin'ny firaketana tamin'ny volana aprily. Niakatra kely ihany koa ny PMI Composite tamin'ny 27.8, ambany 25.8. Ny angon-drakitra nosoniavina ny fihenan'ny "ara-tantara tsy nisy dikany".

Hoy i Joe Hayes, mpahay toekarena ao amin'ny IHS Markit: "Na dia nahita ny governemanta tamin'ny volana jona aza ny governemanta japoney dia nihena ny fanakatonana azy, ny antontan-kevitra farany momba ny fanadihadiana dia nanambara fa nitohy hatrany ny hetsika ara-toekarena izay mbola tsy nifanarahana talohan'ny krizy coronavirus. nanomboka… Raha jerena ny angon-drakitra nataon'ny fanadihadiana nataon'ny May dia mitokana, ny famakiana ny PMI Composite dia manondro ny GDP mitotongana manodidina ny 10% isan-taona. Raha dinihina ny famakiana ny volana aprily, izay vao ratsy kokoa aza, dia mazava fa hisy fiantraikany lehibe ny fiantraikan'ny GDP amin'ny faharoa. ”

Shina Caixin PMI composite dia niakatra ho 54.5, fotoana bebe kokoa mbola mila miverina amin'ny ara-dalàna

Ny servisy PMI Chinaxx Caixin dia tafakatra 55.0 tamin'ny volana Mey, nanomboka tamin'ny taona 44.4. Ny PMI Composite dia tafakatra hatramin'ny 54.5, avy amin'ny 47.6, miverina amin'ny faritany fanitarana. Nilaza i Markit fa ny asa ara-barotra sy ny asa vaovao dia haingana kokoa hatramin'ny fiandohan'ny taona 2010. Ny fanavakavahana dia nitohy nihanaka be tamin'ny didin'ny fanondranana. Nianjera kely ny asa raha nijery ny firongatry ny orinasa hampitombo ny fahombiazana.

Wang Zhe, Mpahay toekarena ambony ao amin'ny Caixin Insight Group nilaza hoe: "Amin'ny ankapobeny, ny fanatsarana ny famatsiana sy ny fangatahana dia mbola tsy afaka nanadino tanteraka ny fihenan'ny valan'aretina, ary fotoana bebe kokoa no ilaina amin'ny toe-karena miverina amin'ny laoniny ny toe-karena. Nijanona tany amin'ny faritany ratsy ny tarehimarika momba ny asa satria nitandrina ny orinasa ny fisondrotam-bokatra. Saingy ny fiandrasan-dry zareo dia mahomby amin'ny firosoan'ny toe-karena, ary miandrandra ny fampiharana ireo politika nambara nandritra ny fivoriana fanao isan-taona ny mpanao lalàna ambony any Sina. ”

USD/CHF Fijery mitataovovonana

Daily Pivots: (S1) 0.9586; (P) 0.9612; (R1) 0.9650; Bebe kokoa…

USD/CHF’s recovery form 0.9573 continues in early US session, but upside is held well below 0.9736 resistance. Intraday bias stays neutral and another fall remains in favor. Break of 0.9573 will extend the corrective pattern form 0.9901 to 0.9502 support. But downside should be contained by 61.8% retracement of 0.9181 to 0.9901 at 0.9456 to rebound. On the upside, break of 0.9736 resistance will turn bias back to the upside instead.

Ao amin'ny sary lehibe kokoa, ny fihenan'ny 1.0237 dia hita ho ny tongotra fahatelo amin'ny lamina avy amin'ny 1.0342 (2016 ambany). Mety ho vita tamin'ny 0.9181 izany taorian'ny namelezana ny fanohanana fototra 0.9186 (ambany 2018). Ny fiatoana amin'ny 0.9901 dia hanitatra ny endrika rebound 0.9181 amin'ny fanoherana 1.0023. Raha ny marina, ny varotra antonony dia mety hitohy eo anelanelan'ny 0.9181 / 1.0237 mandritra ny fotoana fohy.

Fampitandremana ara-toekarena

| GMT | Ccy | Events | Actual | Forecast | Previous | nohavaozina |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index May | 24.9 | 21.6 | ||

| 23:01 | GBP | BRC Shop Price Index Y / Y Apr | -2.40% | -1.70% | ||

| 01:30 | AUD | GDP Q / Q Q1 | -0.30% | -0.30% | 0.50% | |

| 01:30 | AUD | Fahazoandàlana fanorenana M / M Apr | -1.80% | -15.00% | -4.00% | -2.50% |

| 01:45 | CNY | Caixin Services PMI Mey | 55 | 47.4 | 44.4 | |

| 05:45 | CHF | GDP Q / Q Q1 | -2.60% | -2.20% | 0.30% | |

| 07:45 | EUR | Italy Services PMI May | 28.9 | 27 | 10.8 | |

| 07:50 | EUR | France Services PMI May F | 31.1 | 29.4 | 29.4 | |

| 07:55 | EUR | Tolotra any Soisa PMI May F | 32.6 | 31.4 | 31.4 | |

| 07:55 | EUR | Ny tahan'ny tsy fananana asa any Alemana | 6.30% | 6.20% | 5.80% | |

| 07:55 | EUR | Fiovan'ny asa any Alemana | 238K | 200K | 373K | 372K |

| 08:00 | EUR | Tsy an'asa any Italia | 6.30% | 9.20% | 8.40% | 8.00% |

| 08:00 | EUR | Eurozone Services PMI May F | 30.5 | 28.7 | 28.7 | |

| 08:30 | GBP | Services PMI May | 29 | 27.9 | 27.8 | |

| 09:00 | EUR | Eurozone ny isan'ny tsy an'asa Apr. | 7.30% | 8.20% | 7.40% | 7.10% |

| 09:00 | EUR | Eurozone PPI M / M Apr | -2.00% | -1.70% | -1.50% | |

| 09:00 | EUR | Eurozone PPI Y / Y Apr | -4.50% | -4.00% | -2.80% | |

| 12:15 | USD | Hanova ny ADP ny asa | -2760K | -9500K | -20236K | -19557K |

| 12:30 | CAD | Fahombiazana amin'ny asa fanaovan-tsoa Q / Q Q1 | 3.40% | -0.10% | ||

| 13:45 | USD | Sampana PMI May F | 36.9 | 36.9 | ||

| 14:00 | USD | ISM Tsy Manamboatra PMI Apr | 43 | 41.8 | ||

| 14:00 | USD | ISM Tsy Manamboatra Indostria | 35.8 | 30 | ||

| 14:00 | USD | Baiko amin'ny orinasa F / M Apr | -12.40% | -10.40% | ||

| 14:00 | CAD | Fanapahan-kevitra momba ny tahan'ny vola mahaliana BoC | 0.25% | 0.25% | ||

| 14:30 | USD | Fitrandrahana solika | 3.0M | 7.9M |

Signal2forex.com - Best robots Forex sy famantarana

Signal2forex.com - Best robots Forex sy famantarana