Moving averages have a number of uses in technical analysis but can be particularly helpful as a trend filter when analyzing trades. This article touches on the concept of moving averages and takes an in-depth look at using the indicator to identify strong trending environments.

Identifying a Fresh Trend

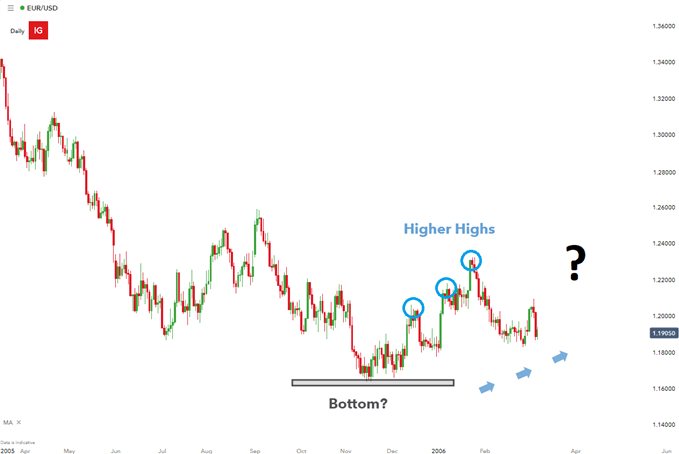

There often is a period of uncertainty in the moments that follow soon after a bottoming or topping pattern, where price starts to trade in the opposite direction. This can cause much confusion in the mind of traders because it’s not yet clear if this is the start of a new fironana or price taking a breather before continuing in the direction of the previous trend. This is where moving averages can provide some assistance.

For a in-depth exploration of moving averages in general and how to calculate them, read our article, ‘Moving Average (MA) nohazavaina ho an'ny mpivarotra'

The content and concepts described below are applicable for both long and short trades.

Diniho ny EUR / USD chart below. It is unclear if this is the early stages of a new trend or inconsistent price action that may result in a continued move lower.

To get a better idea of trend, traders can incorporate the 200 day simple moving average, also known as the 200 DMA. The 200 DMA is widely regarded as a strong trend filter as it takes a considerable amount of data (price points) into its calculation.

The 200 DMA is a tsotra mihetsika (SMA) but traders looking to assign greater importance to recent price action may gravitate towards the exponential moving average (EMA).

Find out the difference between the SMA sy EMA to discover which suits your trading style better.

The 200 DMA should be regarded as a trend filter and not an teny signal. Therefore, only when price moves above the 200 DMA should potential entries be considered. The example below highlights this concept as price moved above the 200 DMA on a number of occasions before dipping lower.

The entry criteria is likely to vary among traders as this comes down to trader preference. In this example, the bullish bias was established through price trading above the 200 DMA (trend filter) with a rebound off fanohanana (200 DMA), followed by a move above the recent swing high.

Therefore, look for price above the 200 DMA to get a feel for the trend and then make use of fanadihadiana ara-teknika to spot potential entry levels. Lastly, traders should adopt sound teknika fitantanana risika and implement a positive reward-risk ratio.

How to Stay in the Trade Using the 200 DMA

Once the trend has been confirmed, it is important to manage the trade as time goes on. Ideally, traders seek to remain in the trade as long as the trend continues. Therefore, further clarity is need to gauge whether the trend is still intact, or if a potential reversal is unfolding.

The 200 DMA can be used as ‘dynamic support’ during uptrends. The trend remains in force as long as price continues to trade above the 200 DMA.

A move below the 200 DMA could signal that the trend is slowing down or in fact, reversing. At this stage traders can consider potential exits if the limit has not yet been triggered.

Pros and Cons of Using MAs when Trend Trading

Like all indicators, there are conditions when moving averages thrive and others where they aren’t as useful. The table below summarizes the pros and cons of using moving averages when trend trading:

| matihanina | maharatsy ny mifampiresaka |

|---|---|

| malefaka (more responsive MA can be created by reducing the number of days/periods observed) | Famaritana lagging (generally there is a lag period between the strong initial move and the period where price trades above the 200 DMA) |

| Large data set (considers 200 price points) | Volatile or ranging markets (signals will be inappropriate for non-trending markets |

| Easily Interpreted |

Signal2forex.com - Best robots Forex sy famantarana

Signal2forex.com - Best robots Forex sy famantarana