Dollar’s selloff resumes in Asian session today, while Yen is also trading lower. Risk-on markets in Asia lift New Zealand and Australian Dollar. European majors are mixed for the moment, with Euro trying to recover against Sterling and Swiss Franc. The economic calendar is rather light today, and focuses will mainly be on the development in overall market sentiments, as well as comments from Fed officials later in the day.

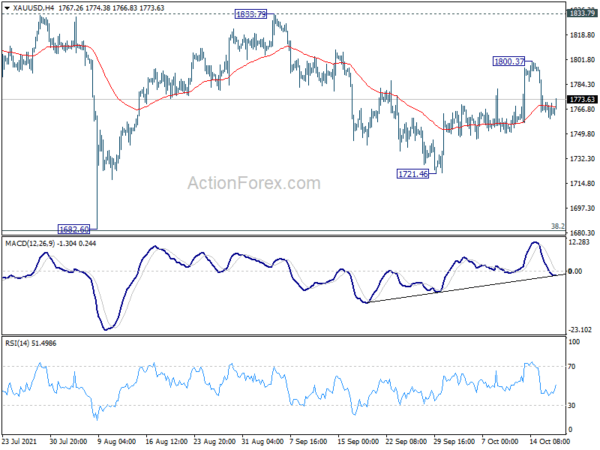

Technically, EUR/USD’s breach of 1.1639 minor resistance suggests short term bottoming at 1.1523 already, which suggests more downside in Dollar in general. We’d now keep an eye on Gold too. While the retreat from 1800.37 might have disappointed some Gold bulls, it’s resiliently holding on to 4 hour 55 EMA, which maintains the chance of further rally. Break of 1800.37 will resume the rebound from 1721.46 towards 1833.79 key near term resistance. Such development would at least confirm Dollar’s weakness for the near term.

In Asia, at the time of writing, Nikkei is up 0.65%. Hong Kong HSI is up 1.49%. China Shanghai SSE is up 0.63%. Singapore Strait Times is up 0.50%. Japan 10-year JGB yield is down -0.0050 at 0.091. Overnight, DOW dropped -0.10%. S&P 500 rose 0.34%. NASDAQ rose 0.84%. 10-year yield rose 0.008 to 1.584, after reversing much of earlier gains to 1.627.

RBA: Global supply chain disruptions had limited effect on inflation

In the minutes of October 5 meeting, RBA reiterated that economic recovery was interrupted by the outbreak of Delta. Economy is expected to return to growth in Q4, after contraction in Q3, and then back to pre-Delta path in H2 of 2022. Economy recovery was “likely to be slower than in late 2020/early 2021” and “much would depend on health outcomes and the nature and timing of the easing of restrictions on activity.”

RBA also noted, “while disruptions to global supply chains were affecting the prices of some goods, the effect of this on the overall rate of inflation in Australia was limited”. Wages growth and underlying inflation were “expected to pick up only gradually as the economy recovers.

It acknowledged that house prices and credit growth had continued to rise strongly. “while less accommodative monetary policy would, all else equal, see lower housing prices and credit growth, it would result in fewer jobs and lower wages growth, which would in turn create further distance from the goals of monetary policy – namely, full employment and inflation sustainably within the target range.”

Overall, the conditions for rate hike “will not be met before 2020”. “Meeting this condition will require the labour market to be tight enough to generate materially higher wages growth than at the time of the meeting.”

NZD/USD extending rally to 0.7169 resistance first

New Zealand Dollar is leading commodity currencies higher again this today. It’s additionally backed by expectation of more RBNZ rate hike ahead, after report of decade high consumption inflation earlier this week.

NZD/USD is extending the rebound from 0.6858 and further rise should be seen to 0.7169 resistance. Decisive break there will resume the rise from 0.6804 and target 100% projection of 0.6804 to 0.7169 from 0.6858 at 0.7223. Sustained break there would firstly indicate upside acceleration. Secondly, it will reaffirm the case that correction form 0.7463 has completed with three waves down to 0.6804. Stronger rally would then be seen to 161.8% projection at 0.7449, which is close to 0.7463 high. This will be the favored case as long as 0.7048 minor support holds.

Privind înainte

Swiss will release trade balance in European session. US will release housing starts and building permits later in the day. Main focuses will be more on comments from a batch of Fed officials, including Daly, Bowman, Bostic and Waller.

EUR / USD zilnic

Pivoți zilnice: (S1) 1.1581; (P) 1.1602; (R1) 1.1632; Mai Mult…

Focus is now on 1.1639 resistance in EUR/USD as rebound from 1.1523 extends today. Sustained break there will confirm short term bottoming at 1.1523. Intraday bias will be turned back to the upside for stronger rebound, to 55 day EMA (now at 1.1712). Break there will pave the way to 1.1908 resistance. On the downside however, break of 1.1523 will resume larger decline from 1.2265 to 1.1289 medium term fibonacci level.

În imaginea de ansamblu, acțiunile de preț de la 1.2348 ar trebui să fie cel puțin o corecție pentru a crește de la 1.0635 (minimum din 2020). Atâta timp cât rezistența de 1.1908 se menține, o scădere mai profundă ar fi observată la 61.8% retragere de la 1.0635 la 1.2348 la 1.1289. Cu toate acestea, spargerea rezistenței de 1.1908 va reînvia optimismul pe termen mediu și va întoarce atenția la nivelul maxim de 1.2348.

Analiza indicatorilor economici

| GMT | CCY | Evenimente | Real | Prognoză | Pagina Anterioară | revăzut |

|---|---|---|---|---|---|---|

| 00:30 | AUD | RBA Minute | ||||

| 06:00 | CHF | Balanța comercială (CHF) sept | 6.23B | 5.06B | ||

| 12:30 | USD | Începerea locuinței în septembrie | 1.61M | 1.62M | ||

| 12:30 | USD | Permise de construcție Sep | 1.67M | 1.72M |

Signal2forex.com - Cele mai bune roboți și semnale Forex

Signal2forex.com - Cele mai bune roboți și semnale Forex