Selloff in Sterling remains the focus in Asian session today, as markets are adding their best to no-deal Brexit. The currency markets are relatively quiet elsewhere. Canadian Dollar is currently the second weakest, then Euro. Yen and Swiss Franc are the strongest, with help by falling treasury yields. Dollar is the third strongest as markets await Fed’s rate cut tomorrow.

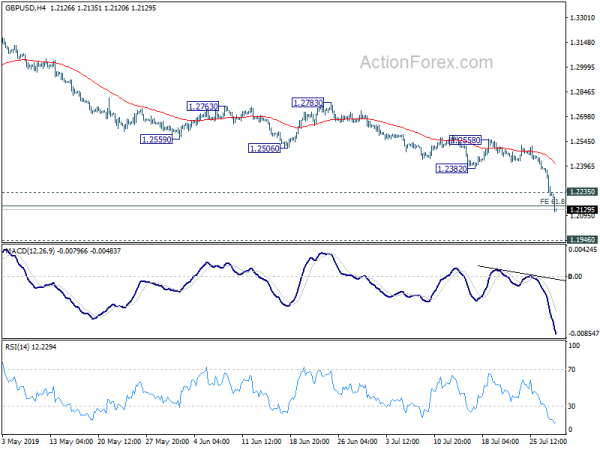

Technically, GBP/USD is in downside acceleration and should be targeting 1.1946 low next. GBP/JPY is on track to retest 131.51 low and break will resume fall from 156.96 towards 122.36 low in medium term. EUR/GBP’s strong break of 0.9101 key resistance also carry long term bullish implication and the cross should target 0.9305 (2017 high). Both upside USD/CHF and USD/JPY lost upside moment ahead of near term resistance. The greenback will likely turn into consolidation first, in general, except versus Pound.

In Asia, Nikkei is trading up 0.33%. Hong Kong HSI is up 0.32%. China Shanghai is up 0.56%. Singapore Strait Times is up 0.15%. Japan 10-year JGB yield is down -0.0033 at -0.149. Overnight, DOW rose 0.11%. S&P 500 dropped -0.16%. NASDAQ dropped -0.44%. 10-year yield dropped -0.026 to 2.055.

UK Johnson: Brexit presents enormous opportunities for our country

Sterling’s selloff continues today as markets are adding their bets to no deal Brexit. UK Prime Minister Boris Johnson is insisting that he could get a new Brexit deal with the EU. He said in televised comments that “we’re very confident, with goodwill on both sides, two mature political entities — the U.K. and EU — can get this done”.

And, “it’s responsible for any government to prepare for a no deal if we absolutely have to. That’s the message I’ve been getting across to our European friends. I’m very confident we’ll get there.” He also insisted that the Irish backstop is “dead” along with former PM Theresa May’s withdrawal agreement.

Johnson also emphasized that “Once we leave the EU on Oct. 31, we will have a historic opportunity to introduce new schemes to support farming – and we will make sure that farmers gets a better deal”. And, “Brexit presents enormous opportunities for our country, and it’s time we looked to the future with pride and optimism.”

At this point, there is no sign of EU shifting its position yet. That is, the negotiation for the Brexit Withdrawal Agreement was closed and won’t be re-opened. European Commission also indicated that while an orderly withdrawal is in everyone’s interest, the bloc is well-prepared for a no-deal Brexit.

BoJ stands pat, economy to continue on an expanding trend

BoJ اڄ جي طور تي وڏي پيماني تي توقع ڪئي وئي ته اڄ تائين اڻڄاتل پئسي پاليسي ڇڏي. پيداوار وکر ڪنٽرول فريم ورڪ جي تحت، مختصر مدت جي پاليسي سود جي شرح -0.10٪ تي رکيل آهي. 10 سال جي جي بي جي پيداوار تقريبن صفر سيڪڙو جي جي بي جي خريداري سان منعقد ڪئي ويندي. پئسي جو بنياد وڌندو وڌندو سالياني رفتار جي چوڌاري JPY 80T. فيصلا ڪيا ويا 7-2 ووٽن سان Y. Harada ۽ G. Kataoka ٻيهر اختلاف ڪيو.

In the outlook for economic activity and prices report, BoJ said the economy is “likely to continue on an expanding trend throughout the projection period” through fiscal 2021. Exports are projected to “show some weakness” for the time being, but are still expected to be on a “moderate increasing trend”. Domestic demand would “follow an uptrend” against the background of highly accommodative financial conditions and government spending.

Regarding inflation, all item CPI “continued to show relatively weak developments”. But “further price rises are likely”. Year-on-year rate of change in CPI is “likely to increase gradually toward 2 percent”. And both growth and CPI projections are “more or less unchanged” from previous projections.

Risks to economic activity are “skewed to the downside”, particularly regarding overseas developments. Risks to prices are also “skewed to the downside”. The momentum towards 2% inflation target is “maintained” but is “not yet sufficiently firm”.

جاپان جي صنعتي پيداوار گهٽجي وئي -3.6٪ غير فيصلي واري وهڪري ۾

جاپان جي صنعتي پيداوار جون ۾ -3.6٪ ماء طرفان تيزيء سان گهٽجي وئي، -1.8٪ ماء جي توقع کان تمام گهڻو خراب. اهو پڻ جنوري 2018 کان وٺي سڀ کان وڏي گهٽتائي آهي. موڪلون گهٽجي ويون -3.3٪ ماء جڏهن ته انونٽريز گلاب 0.3٪ ماء.

اقتصاديات، واپار ۽ صنعت واري وزارت پريس بريفنگ ۾ چيو ته اها گهٽتائي گذريل مهينن ۾ غير متوقع طور تي مضبوط پيداوار جي رد عمل هئي. هن وڌيڪ شامل ڪيو، "اسان يقين نه ٿا ڪريون ته اتي هڪ هيٺيون رجحان آهي، جيتوڻيڪ اتي به مٿي وارو رجحان ناهي". پيداوار صرف "غير جانبدار طور تي fluctuates".

جاپان کان پڻ، بيروزگاري جي شرح جون ۾ 2.3٪ تائين بهتر ٿي، 2.4٪ کان هيٺ. ڪم ڪندڙ ماڻهن جو تعداد رڪارڊ 67.5 ملين. اندروني معاملن ۽ مواصلات واري وزارت چيو ته ”بيروزگاري جي شرح مضبوط ٿي چڪي آهي ۽ ان سطح تي تنگ ٿي رهي آهي“.

اڳتي وڌي رهيو آهي

Lots of Eurozone data will be featured in European session. France GDP, Germany Gfk consumer sentiment and CPI will be released. Eurozone will publish confidence indicators. Swiss will release KOF economic barometer.

Later in the day, US personal income and spending, with PCE inflation will be the major focus, together with consumer confidence. Pending home sales and S&P Case-Shiller house price will also be released.

روزاني پيوٽ: (S1) 1.2159؛ (P) 1.2272؛ (R1) 1.2331؛ وڌيڪ…

GBP/USD’s decline continues today and accelerates to as low as 1.2119 so far, breaking 61.8% projection of 1.4376 to 1.2391 from 1.3381 at 1.2154. There is no sign of bottoming yet. Intraday bias stays on the downside for 1.1946 low next. We’d be cautious on bottoming there. But break will target 100% projection at 1.1396. On the upside, above 1.2235 minor resistance will turn intraday bias neutral and bring consolidation. But recovery should be limited by 1.2383 support turned resistance to bring fall resumption.

In the bigger picture, down trend from 1.4376 (2018 high) is still in progress and is resuming. Such decline should target a test on 1.1946 long term bottom (2016 low) next. For now, we don’t expect a firm break there yet. Hence, focus will be on bottoming signal as it approaches 1.1946. However, firm break of 1.1946 will resume down trend from 2.1161 (2007 high) to 61.8% projection of 1.7190 to 1.1946 from 1.4376 at 1.1135. In any case, medium term outlook will stay bearish as long as 1.3381 resistance holds, in case of strong rebound.

| GMT | سي سي | سرگرمين | اصل ۾ | Consensus | نظارو | سڌاريل |

|---|---|---|---|---|---|---|

| 22:45 | NZD | بلڊنگ پرمٽس M/M جون | -3.90٪ | 13.20٪ | 13.50٪ | |

| 23:30 | JPY | بيروزگاري جي شرح جون | 2.30٪ | 2.40٪ | 2.40٪ | |

| 23:50 | JPY | صنعتي پيداوار M/M جون P | -3.60٪ | -1.80٪ | 2.00٪ | |

| 1:30 | AUD | بلڊنگ جي منظوري M/M جون | -1.20٪ | 0.20٪ | 0.70٪ | 0.30٪ |

| 2:00 | JPY | BOJ جي شرح جو فيصلو | -0.10٪ | -0.10٪ | -0.10٪ | |

| 5:30 | EUR | فرانسيسي جي ڊي پي Q/Q Q2 P | 0.30٪ | 0.30٪ | ||

| 6:00 | EUR | جرمن GfK صارفين جي اعتماد آگسٽ | 9.7 | 9.8 | ||

| 7:00 | CHF | KOF معروف اشارو Jul | 93.3 | 93.6 | ||

| 9:00 | EUR | يوروزون ڪاروباري موسمي اشارو جولاء | 0.1 | 0.17 | ||

| 9:00 | EUR | يوروزون اقتصادي اعتماد جولاء | 102.7 | 103.3 | ||

| 9:00 | EUR | يوروزون صنعتي اعتماد جولاء | -6.7 | -5.6 | ||

| 9:00 | EUR | يوروزون سروسز اعتماد جولاء | 10.7 | 11 | ||

| 9:00 | EUR | يوروزون صارفين جي اعتماد جول ايف | -6.6 | -6.6 | ||

| 12:00 | EUR | جرمن CPI M/M Jull P | 0.30٪ | 0.30٪ | ||

| 12:00 | EUR | جرمن CPI Y/Y Jull P | 1.50٪ | 1.60٪ | ||

| 12:30 | ناشر | ذاتي آمدني جون | 0.30٪ | 0.50٪ | ||

| 12:30 | ناشر | ذاتي خرچ جون | 0.30٪ | 0.40٪ | ||

| 12:30 | ناشر | PCE Deflator M/M جون | 0.10٪ | 0.20٪ | ||

| 12:30 | ناشر | PCE Deflator Y/Y جون | 1.50٪ | 1.50٪ | ||

| 12:30 | ناشر | PCE ڪور M/M جون | 0.20٪ | 0.20٪ | ||

| 12:30 | ناشر | PCE ڪور Y/Y جون | 1.70٪ | 1.60٪ | ||

| 13:00 | ناشر | S&P/Case-Shiller Composite-20 Y/Y مئي | 2.40٪ | 2.54٪ | ||

| 14:00 | ناشر | التوا ۾ گھر جي وڪرو M/M جون | 0.30٪ | 1.10٪ | ||

| 14:00 | ناشر | صارفين جي اعتماد جي انڊيڪس جولاء | 125 | 121.5 |

Signal2forex.com - بهترين فاریکس روبوٽ ۽ سگنل

Signal2forex.com - بهترين فاریکس روبوٽ ۽ سگنل