Lagging indicators are often misunderstood in their foundations however, they are a great way to analyse financial markets. This article will outline:

- What lagging indicators are

- Examples of lagging indicators

- Benefits of lagging indicators

What is a lagging indicator?

A lagging indicator is a tool used by traders to analyse the markets using an average of previous قيمت عمل data. There are multiple lagging indicators, all of which are used to examine market گڻ, داخل ٿيو ۽ ٻاھر نڪتو.

Lagging indicators are presumed to be most effective during trending markets however, many signals occur after the actual trade movement has occurred leaving traders fewer profitable pips.

What are some examples of lagging indicators?

The most frequently used lagging indicators are those pertaining to the moving average. Examples of these are the سادي حرڪت وارو (SMA), بااختیار هوا اوسط (EMA) ۽ MACD – see below. All these indicators use past price movements alongside different formulae to create unique market signals. Further to this, these indicators can be edited to suit the trader by changing the defining parameters within each formula.

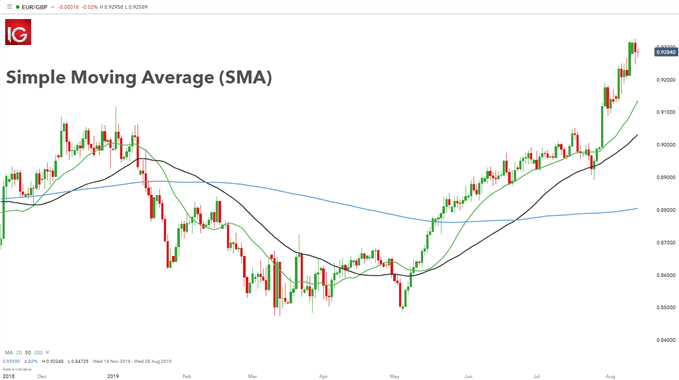

سادي روانگي جي اوسط (سينيئر هاءِ اسڪول):

The SMA is a lagging indicator that characterises the average closing price of a financial instrument over a particular time frame.

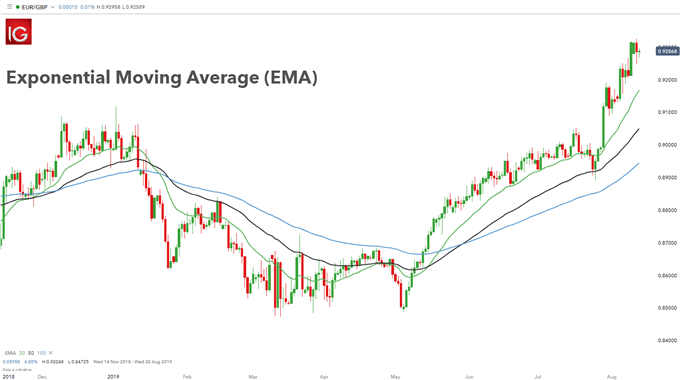

متوقع منتقل ڪندڙ اوسط (EMA):

The EMA is a lagging indicator that is a resultant from the SMA calculation; the only difference being that the EMA favours more recent price movements.

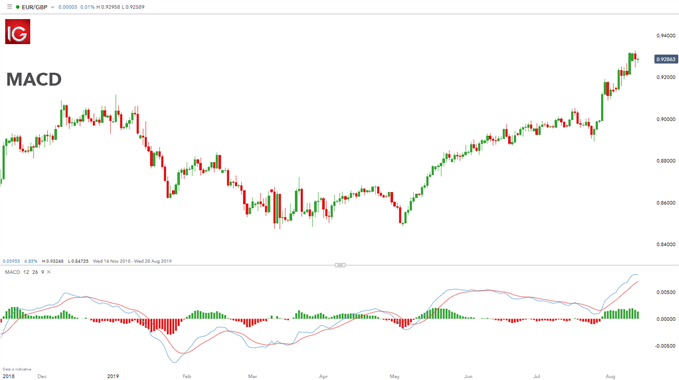

MACD:

The MACD is a lagging indicator that calculates the association between various EMAs.

Benefits of lagging indicators

There are several benefits of using lagging indicators that are often taken for granted by novice traders. Below is a list of these benefits which will assist traders in identifying when to implement them:

- The lagging aspect of indicators will get traders into trades that have greater confirmation behind them as they are based on more data. In other words, the indicator will force traders to wait a bit before entering

- Entry and exit points can be identified

- Lagging indicators work extremely well in strong trending markets

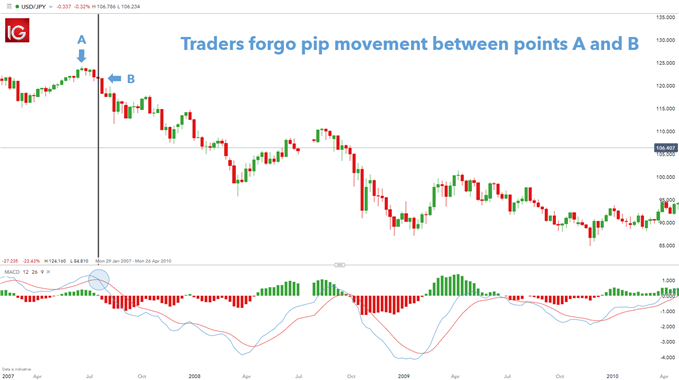

The weekly chart below depicts a trading strategy on USD/JPY using a MACD crossover strategy. Entry occurs when the MACD line crosses the signal line as highlighted. Initially traders forgo the positive price movement between point A and point B on the chart due to the lagging nature of MACD. However, after entry the trade is set up to maximize the pip movement from point B through to the swing low. As can be seen in this example, traders can be successful even though there are some forgone gains prior to entry.

Lagging Indicators: A Summary

Lagging indicators are a great tool to utilise when trading the markets. They are extremely flexible in what they offer which can enhance a واپار جي حڪمت عملي or provide additional support to a trader’s analysis. These indicators are a great tool to understand and potentially incorporate into every trader’s repertoire.

Signal2forex.com - بهترين فاریکس روبوٽ ۽ سگنل

Signal2forex.com - بهترين فاریکس روبوٽ ۽ سگنل