Dollar is relatively directionless in after mixed job data. The headline number is a slight miss and wage growth disappoints. Yet, unemployment rate dropped to lowest level since 1969. For today, Sterling is the weakest one as it looks like EU is not so happy with UK’s new Brexit plan. Yen is the second weakest, followed by Dollar. Swiss Franc, on the other hand, is the strongest, followed by New Zealand and then Canadian Dollar.

Technically, USD/CHF dips sharply today but stays well above 0.9843 support further rise is till expected. EUR/USD’s recovery from 1.0879 appears to be losing some upside momentum. USD/JPY is staging a strong recovery and break of 107.39 minor resistance will turn focus back to 108.47 resistance.

In Europe, currently, FTSE is up 0.55%. DAX is up 0.28%. CAC is up 0.43%. German 10-year yield is up 0.009 at -0.579. Earlier in Asia, Nikkei rose 0.32%. Hong Kong HSI dropped -1.11%. Singapore Strait Times dropped -0.31%. Japan 10-year JGB yield dropped -0.0217 to -0.211.

US NFP rose 136k, unemployment rate dropped to 3.5%

US Non-Farm Payroll report showed 136k job growth in September, slightly below expectation of 140k. Job growth has averaged 161,000 per month thus far in 2019, compared with an average monthly gain of 223,000 in 2018. Unemployment rate dropped to 3.5%, down from 3.7% and beat expectation of 3.7%. That’s the lowest level since December 1969. The labor force participation rate held at 63.2%. Average hourly earnings rose 0.0% mom, missed expectation of 0.3% mom.

Also released, US trade deficit widened to USD -54.9B in August. Canada trade deficit narrowed to CAD -0.96B.

German Maas: Europe is united and ready to negotiate with US on aviation subsidies

German Foreign Minister Heiko Maas said today that the EU is ready to negotiate with US to settle the aircraft subsidies disputes. Yet, EU is also ready to react to new US tariffs on European goods. He said “the European Union now will have to react and, after obtaining the approval of the World Trade Organisation, probably impose punitive tariffs as well.”

Maas also tweeted, “Europe is united on this question. We remain ready to negotiate common rules for subsidies in the aviation industry. We can still prevent further damage.”

Tusk: EU remains open but still unconvinced by Johnson’s Brexit proposals

European Council President said EU “remain open but still unconvinced” by UK Prime Minister Boris Johnson’s new Brexit proposals. And the bloc remained fully united behind Ireland.

Irish Foreign Minister Simon Coveney said “my judgment is that Boris Johnson does want a deal and that the paper that was published yesterday was an effort to move us in the direction of a deal. But…if that is the final proposal, there will be no deal”. And, “I think the prime minister’s room for maneuver is very tight, but the truth is he boxed himself into that corner.”

German government spokesperson Steffen Seibert said, “for us, it remains the case that a settlement must secure the safeguarding of the internal market, a settlement must be operable, and it must avoid a hard border between Northern Ireland and Ireland.”

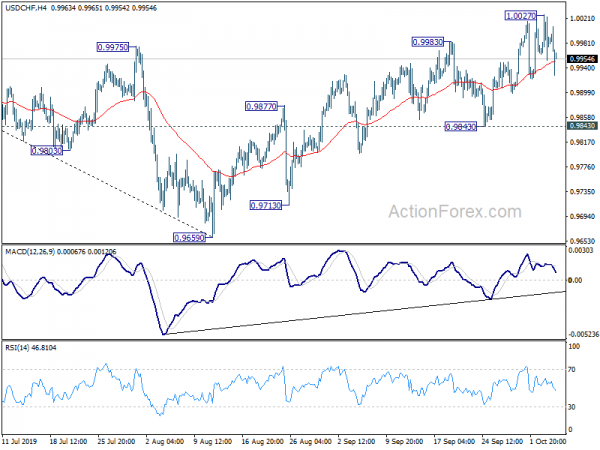

USD/CHF Mid-day Outlook

روزاني پيوٽ: (S1) 0.9918؛ (P) 0.9972؛ (R1) 1.0024؛ وڌيڪ…

Intraday bias in USD/CHF retreats sharply with a temporary top formed at 1.0027. Some consolidations could be seen but further rise is expected as long as 0.9843 support holds. On the upside, break of 1.0027 will extend the rally from 0.9659 to 78.6% retracement of 1.0237 to 0.9659 at 1.0113 next. Break will target retest on 1.0237 high.

In the bigger picture, the structure of the fall from 1.0237 suggests that it’s a corrective move. Sustained break of 0.9975 will argue that such correction has completed at 0.9659, ahead of 61.8% retracement of 0.9186 to 1.0237 at 0.9587. But decisive break of 1.0237 is needed to indicate up trend resumption. Otherwise, medium term outlook will stay neutral first. Meanwhile, break of 0.9695 support will extend the correction to 0.9541 support instead.

اقتصادي اشارن جي تازه ڪاري

| GMT | سي سي | سرگرمين | اصل ۾ | اڳڪٿي | نظارو | سڌاريل |

|---|---|---|---|---|---|---|

| 01:30 | AUD | پرچون سيلز M/M آگسٽ | 0.40٪ | 0.50٪ | -0.10٪ | 0.00٪ |

| 12:30 | ناشر | Nonfarm Payrolls Sep | 136K | 140K | 130K | 168K |

| 12:30 | ناشر | Unemployment Rate Sep | 3.50٪ | 3.70٪ | 3.70٪ | |

| 12:30 | ناشر | Average Hourly Earnings M/M Sep | 0.00٪ | 0.30٪ | 0.40٪ | |

| 12:30 | ناشر | Trade Balance (USD) Aug | -54.9B | -54.7B | -54.0B | |

| 12:30 | CAD | International Merchandise Trade (CAD) Aug | -0.96B | -1.1B | -1.1B | -1.38B |

| 14:00 | CAD | Ivey PMI Sep | 62.6 | 60.6 |

Signal2forex.com - بهترين فاریکس روبوٽ ۽ سگنل

Signal2forex.com - بهترين فاریکس روبوٽ ۽ سگنل