Euro is trading as one of the weakest major currencies, together with Canadian Dollar, for today. There is little inspiration from ECB rate decision and press conference. Canadian Dollar is weak on free fall in oil price, with WTI pressing 55 handle now. Australian Dollar continues to be the strongest one for today, as supported by better than expected employment data. But upside is relatively limited. Yen is the second strongest on risk aversion. Global sentiments are pressured after China locks up two cities today to contain the outbreak of the new coronavirus.

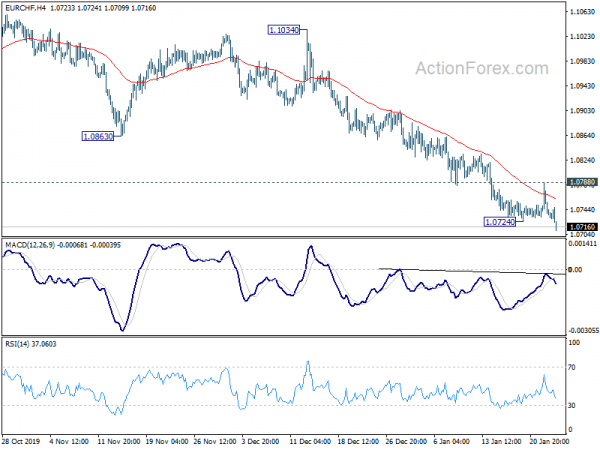

Technically, EUR/USD is now pressing 1.1066 support. Decisive break there will add to the case of completion of corrective rebound from 1.0879 at 1.1239. Deeper fall should then be seen to 1.0981 support for confirmation. EUR/CHF has already broken 1.0724 support to resume medium term down trend towards 1.0648 projection level.

In Europe, currently, FTSE is down -0.41%. CAC is down -0.59%. CAC is down -0.31%. German 10-year yield is down -0.028 at -0.287. Earlier in Asia, Nikkei dropped -0.98%. Hong Kong HSI dropped -1.52%. China Shanghai SSE dropped -2.75%. Singapore Strait Times dropped -0.60%. Japan 10-year JGB yield dropped -0.0208 to -0.024.

US initial jobless claims rose to 211k, below expectations

US initial jobless claims rose 6k to 211k in the week ending January 18, below expectation of 214k. Four-week moving average of initial claims dropped -3.25k to 213.25k. Continuing claims dropped -37k to 1.731m in the week ending January 11. Four-week moving average of continuing claims rose 2k to 1.758m.

ECB left policy statement unchanged, keeps forward guidance

ECB left monetary policy unchanged as widely expected. Main refinancing rate is held at 0.00%. Marginal lending facility and deposit facility rates were held at 0.25% and -0.50% respectively. The asset purchase program will continue at a monthly pace of EUR 20B.

The forward guidance was also kept unchanged. “The Governing Council expects the key ECB interest rates to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics.”

ECB lagarde: Manufacturing remains a drag on ongoing but moderate growth

In the post meeting press conference, ECB President Christine Lagarde said incoming data since last meeting were in line with the baseline scenario of “ongoing, but moderate, growth” of the economy. Weakness in manufacturing sector remains a “drag” on momentum. But employment and wages growth continue to “support the resilience” of the economy. Inflation remains “subdued overall” but there were signs of moderate increase in underlying inflation.

Lagarde also repeated that “risks surrounding the euro area growth outlook, related to geopolitical factors, rising protectionism and vulnerabilities in emerging markets, remain tilted to the downside”. But risks were “less pronounced as some of the uncertainty surrounding international trade is receding.”

Headline inflation is “likely to hover around current levels” in the coming months. Inflation expectations have stabilized or ticked up slightly. Underlying inflation remained generally muted by there were indications of a moderate increase. weaker growth momentum is “delaying” pass-through of labor cost pressures to inflation.

France and US agreed to work on digital taxation at OECD

French Finance Minister Bruno Le Maire said France and the US has agreed today on the way to push digital taxation at the OECD level. The bilateral dispute between the two countries on the issue is set aside. The development reduces the risk of US retaliation on France’s digital taxes.

“We had long talks this morning with the US Treasury Secretary and the OECD Secretary General, and I am happy to announce to you that we have found an agreement between France and the United States, providing the basis for work on digital taxation at the OECD,” Le Maire said. “It’s good news, because it reduces the risk of American sanctions and opens up the prospect of an international solution on digital taxation.”

A series of proposals were hammered out for redrafting of international tax rules. The proposals will be put to OECD next week for discussions between 137 governments.

UK Leadsom wants both a trade deal with US and digital tax

UK Secretary of State for Business, Energy and Industrial Strategy Andrea Leadsom said the government is still pushing for digital tax despite repeated objections by the US. At the same time, it’s just one particular issues which will not stand in the way of a UK-US trade agreement.

She told Talk Radio: “The United States and the United Kingdom are committed to entering into a trade deal with each other and we have a very strong relationship that goes back centuries so some of the disagreements that we might have over particular issues don’t in any way damage the excellent and strong and deep relationship between the U.S. and the UK,”

“There are always tough negotiations and tough talk but I think where the tech tax is concerned it’s absolutely vital that these huge multinationals who are making incredible amounts of income and profit should be taxed and what we want to do is to work internationally with the rest of the world to cover with a proper regime that ensures that they’re paying their fair share.”

SNB Jordan: Negative interest rates and intervention still necessary

SNB Chairman Thomas Jordan maintained today that negative interest rates are necessary for the Swiss economy. The board is aware of the side effects, and “that is the reason why we changed the threshold”, referring to raising the deposit limit before the charging -0.75% interest. He added, “that gives us the freedom to maintain negative rates for longer and also to cut the rate if necessary.”

Jordan also reiterated that the Franc is still “highly valued” and interventions are also necessary. But he emphasized that “we don’t manipulate Swiss Franc exchange rate… never intend to weaken the franc for any advantage”.

Yesterday, SNB Governing Board Member Andrea Maechler said there is no change in the monetary policy after US Treasury put Switzerland back into currency manipulator watchlist. She added, “we are doing monetary policy for Switzerland.”

مارڪيٽ مضبوط ملازمت جي ڊيٽا کان پوءِ آر بي اي ڪٽ جي اميد رکي ٿي

آسٽريليا جي ملازمت ڊسمبر ۾ 28.9k کان 12.98m تائين وڌي وئي، 14.0k جي توقع کان گهڻو بهتر. مڪمل وقت جون نوڪريون ٿورو گھٽجي ويون -0.3k کان 8.83m تائين. پارٽ ٽائيم نوڪريون 29.2k کان 4.15m تائين وڌي ويون. بيروزگاري جي شرح گهٽجي وئي -0.1٪ کان 5.1٪، 5.2٪ جي توقع کان بهتر. شرڪت جي شرح 66.0% تي مستحڪم رهي.

ABS جي چيف اقتصاديات بروس هاڪمين چيو ته: ”رجحان بيروزگاري جي شرح ٿورو گهٽجي 5.1 سيڪڙو ٿي وئي، اپريل 2019 کان ان جي گهٽ ترين سطح. جڏهن ته گذريل سال پارٽ ٽائيم ملازمت ۾ مضبوط ترقي ٿي آهي، بيروزگاري جي شرح اڃا تائين آهي جتي اها آخري هئي. ڊسمبر، 8.3 سيڪڙو تي.

آسٽريلوي ڊالر بحال ٿيو جيئن مارڪيٽن فيبروري جي آر بي اي جي شرح جي ڪٽ جي اميد کي پوئتي ڌڪي ڇڏيو، نوڪري جي ڊيٽا ۾ حيران ڪندڙ تعجب جي ڪري. ANZ چيو ڊيٽا RBA جي نظر کي مضبوط ڪري ٿو ته معيشت ظاهر ٿئي ٿي "نرم موڙ" تي پهچي چڪو آهي. فيبروري ۾ آر بي اي جي نرمي کي ڏسڻ ڏکيو ٿيندو جيتوڻيڪ 2020 جي ڀيٽ ۾ شرحن ۾ گهٽتائي جو امڪان وڌيڪ آهي. CBA چيو آهي ته RBA هاڻي فيبروري جي بدران اپريل ۾ 25bps کان 0.50٪ تائين ڪٽ ڪندو.

EUR/CHF Mid-Day Outlook

روزاني پيوٽ: (S1) 1.0719؛ (P) 1.0753؛ (R1) 1.0774؛ وڌيڪ…

EUR/CHF’s down trend resumes by takin gout 1.0724 temporary low and hits as low as 1.0709 so far. Intraday bias is back on the downside. Next target is 61.8% projection of 1.1476 to 1.0811 from 1.1059 at 1.0648. On the upside, break of 1.0788 resistance is needed to indicate short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

In the bigger picture, down trend from 1.2004 is (2018 high) is still in progress. More importantly, it’s likely a long term down trend itself, rather than a correction. Further fall should be seen to 1.0629 support and possibly below. On the upside, break of 1.1059 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish in case of rebound.

اقتصادي اشارن جي تازه ڪاري

| GMT | سي سي | سرگرمين | اصل ۾ | اڳڪٿي | نظارو | سڌاريل |

|---|---|---|---|---|---|---|

| 23:50 | JPY | واپاري بيلنس (JPY) ڊسمبر | -0.10T | -0.24T | -0.06T | -0.09T |

| 00:00 | AUD | صارفين جي مهانگائي جون اميدون جنوري | 4.70٪ | 4.00٪ | ||

| 00:30 | AUD | روزگار جي تبديلي ڊسمبر | 28.9K | 14.0K | 39.9K | 38.5K |

| 00:30 | AUD | بيروزگاري جي شرح ڊسمبر | 5.10٪ | 5.20٪ | 5.20٪ | |

| 04:30 | JPY | سڀ صنعتي سرگرمي انڊيڪس M/M نومبر | 0.90٪ | 0.40٪ | -4.30٪ | -4.80٪ |

| 12:45 | EUR | اي سي بي جي دلچسپي جي شرح جو فيصلو | 0.00٪ | 0.00٪ | 0.00٪ | |

| 13:30 | EUR | ECB پريس ڪانفرنس | ||||

| 13:30 | ناشر | ابتدائي بيروزگاري دعويٰ (جنوري 17) | 211K | 214K | 204K | 205K |

| 15:00 | EUR | صارفين جو اعتماد جان پي | -8 | -8 | ||

| 15:30 | ناشر | قدرتي گئس اسٽوريج | -88B | -109B | ||

| 16:00 | ناشر | خام تيل جي ذخيري | -0.1M | -2.5M |

Signal2forex.com - بهترين فاریکس روبوٽ ۽ سگنل

Signal2forex.com - بهترين فاریکس روبوٽ ۽ سگنل