The world got one big step closer to Wuhan coronavirus pandemic with explosion of number of cases outside China in the past last week. South Korea (3150 cases, 16 deaths), Italy (888 cases, 21 deaths) and Iran (388 cases, 34 deaths) are now the new epicenters, while Japan (235 cases and 5 deaths) is not far behind. Fear global recessions prompted steepest selloff in stocks since 2008 financial crisis. In particular, gold also lost its safe haven status and suffered the worst decline since 2013. Also traders and investors are in panic.

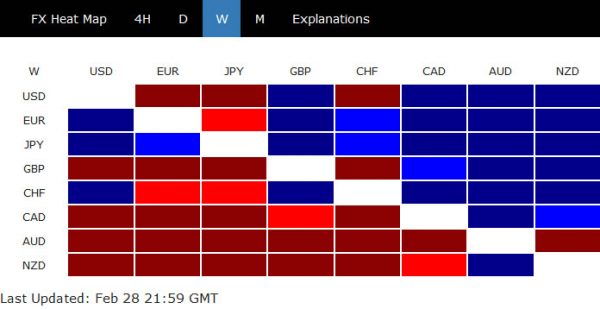

In the currency markets, Australian Dollar was the worst performing one even though corona virus cases are just limited to 25. New Zealand Dollar followed as second weakest while Canadian Dollar was the next, as pressure by free fall in oil prices. Yen reversed its fortune and ended as the strongest one, followed by Euro and then Swiss Franc. Euro was indeed helped by some selling pressure in Dollar, bets on a March rate cut surged sharply. Traders are seeing near 100% of -50bps cuts to 1.00-1.25%.

For the near term tough, DOW and Gold are both close to important support zones. Last week’s could also be partly due to month end adjustments. There is prospect of stabilization of risk sentiments initially this week. But what’s next will very much depends on how quickly the coronavirus spreads, and how well is China’s productions resume.

Niektoré odporúčané čítania:

DOW close to key support zone after the worst week since 2008

DOW registered the worst week since October 2008 after losing 3583 pts to close at 25409.36. S&P 500 and NASDAQ also had the worst week since the global financial crisis. Nevertheless, a recovery of some sort should be due considering that DOW is now in proximity to a key support zone. The levels are 38.2% retracement of 15450.56 to 29568.57 at 24175.49 and long term trend line support. The coming recovery could provide some hints on the length and depth of the current correction.

However, sustained strong break of 24175.49 could open up the case of long term correction, to up trend from 2009 low at 6469.95 to 29568.57. The correction target could then be 38.2% retracement at 20744.89.

10-year yield hit record low, heading through 1% next

10-year yield was in free fall last week after gapping through 1.429 key support, and dived to new record low at 1.127. 100% projection of 1.949 to 1.512 from 1.639 at 1.202 was taken out with relative ease. Next downside target is 161.8% projection at 0.931, below 1% handle.

In the bigger picture, we’re talked about 61.8% projection of 3.248 to 1.429 from 1.949 at 0.8248 last week and this level suddenly feels not too far away. As long as 1.429 support turned resistance holds, this will be the next medium term target a multi-decade down trend extends.

Gold suffered biggest one-day fall since 2013, but recovery should be due

Gold suffered biggest single-day decline since 2013 on Friday. While that caught many traders surprised, the lack of follow through rally after Monday, despite strong risk aversion elsewhere, was actually some sort of a hint. The selloff seemed to be a result of gold’s role as a commodity overshadowing its safe haven one, as markets are now foreseeing global recession due to the world-wide coronavirus pandemic. Another explanation is that traders are simply getting rid of everything on hand and jumped in to treasuries.

Technically, Gold should now be in a place for a short term bottom and rebound. 1557.04 resistance turned support and 50% retracement of 1445.59 to 1689.31 at 1567.45 are both in proximity. A recovery is likely due and the structure will reveal how much deeper the correction form 1689.31 would be.

However, firm break of 1557.04 will open up the case for large scale correction and could target 1445.59 cluster, 38.% retracement of 1046.37 to 1689.31 at 1443.70.

Dollar index suffered deeper than expected correction as Fed cut bet soared

Bets on a Fed rate cut in march skyrocketed last week on fear of coronavirus pandemic prompted global recession. Fed fund futures are now pricing in 94.9% chance of -50bps cut in the federal funds rate to 1.00-1.25%. A week ago, markets were just pricing in 57.6% chance of a -25bps cut to 1.25-1.50%. Such sharp change in expectation was probably a factor in DOW’s late recovery, closing down -357.28 pts only on Friday, after losing more than -1000 pts again.

Dollar index suffered steep selloff as a combined result of Fed expectations and falling yields. While the fall from 99.91 was deeper than expected, it’s still viewed as a corrective move for now. Hence, we’d expect strong support from 61.8% retracement of 96.35 to 99.91 at 97.71 to contain downside and bring rebound. The corresponding level in EUR/USD is 61.8% retracement of 1.1239 to 1.0777 at 1.1063.

However, sustained break of 97.71 will raise the chance of medium term bearish reversal. That is, up trend form 88.26 might have completed. Focus will then turn to make or break support level at 96.35.

AUD/USD’s down trend continued last week with downside acceleration to as low as 0.6433. Initial bias remains on the downside this week for further fall. Next target is 161.8% projection of 0.6933 to 0.6662 from 0.6750 at 0.6479. On the downside, break of 0.6592 minor resistance will turn intraday bias neutral first. But recovery should be limited below 0.6750 resistance to bring fall resumption.

Na väčšom obrázku stále pokračuje pokles AUD / USD z 0.8135 (maximum 2018). Je to súčasť väčšieho klesajúceho trendu z 1.1079 (vysoký 2011). Zamietnutie do 55 týždňov potvrdzuje EMA strednodobú medvedivosť. Ďalší cieľ je 0.6008 (minimum 2008). Výhľad zostane medvedí, kým bude v platnosti rezistencia 0.7031, a to aj v prípade výrazného odrazu.

Z dlhodobejšieho hľadiska si predchádzajúce odmietnutie 55-mesačným EMA udržalo dlhodobú medvediu hodnotu v AUD/USD. To znamená, že klesajúci trend z 1.1079 (max. v roku 2011) stále prebieha. Ďalším smerom nadol je projekcia 61.8 % z 1.1079 na 0.6826 z 0.8135 na 0.5507.

Signal2forex.com - Najlepšie Forex roboty a signály

Signal2forex.com - Najlepšie Forex roboty a signály