Markets are generally back on risk on mode today as the concerns of US-Iran tensions faded. Also, it’s finally confirmed that Chinese Vice Premier Liu He will travel to the US for signing the trade deal phase one. Dollar rises broadly with deeper pull back in oil prices and gold. Some resilience is seen in Euro and Swiss Franc too. On the other hand, Sterling is some way weighed down by dovish comments of outgoing BoE Governor Mark Carney. For the week, the greenback is the strongest while Aussie is the weakest together with Yen.

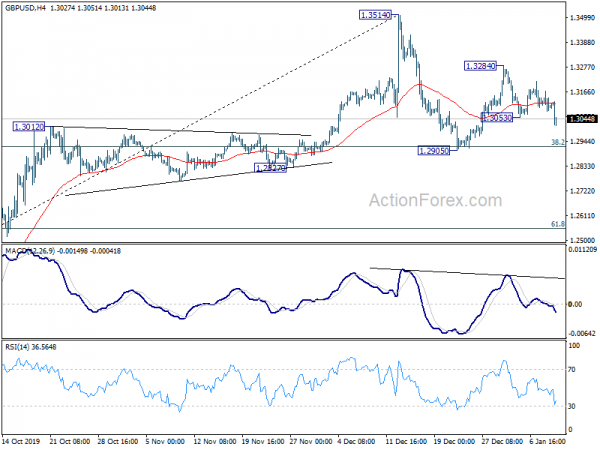

Technically, GBP/USD’s break of 1.3053 minor support should now bring deeper fall to retest 1.2905 support. But corresponding weakness is not seen in other Sterling pairs yet. USD/JPY is on track to retest 109.27 key resistance. Break will resume whole rise from 104.45.

In Europe, currently, FTSE is up 0.43%. DAX is up 1.19%. CAC is up 0.21. German 10-year JGB yield is up 0.0068 at -0.234. Earlier in Asia, Nikkei rose 2.31%. Hong Kong HSI rose 1.68%. China Shanghai SSE rose 0.91%. Singapore Strait Times rose 0.05%. Japan 10-year JGB yield rose 0.0124 to 0.005.

УС почетни захтеви за без посла су пали -КСНУМКСк у КСНУМКСк

US initial jobless claims dropped -9k to 214k in the week ending January 4, below expectation of 222k. Four-week moving average of initial claims dropped -9.5k to 224k. Continuing claims rose 75k to 1.803m in the week ending December 28. Four-week moving average of continuing claims rose 33k to 1.745m.

From Canada, housing starts dropped to 197k in December. Building permits dropped -2.4% mom in November.

BoE Carney: If weakness persists, risk management favors prompt response in monetary policy

Outgoing BoE Governor Mark Carney said today that over the past year, UK growth has “slowed below potential” because of “weaker external backdrop and a persistent drag from entrenched Brexit uncertainties”. However, growth is expected to pick up ahead as “supported by the reduction of Brexit-related uncertainties, an easing of fiscal policy and a modest recovery in global growth.”

However, the rebound is “not, of course, assured”. there was a debate at the MPC “over the relative merits of near term stimulus to reinforce the expected recovery in UK growth and inflation”. “If evidence builds that the weakness in activity could persist, risk management considerations would favour a relatively prompt response.”

Eurozone unemployment rate unchanged at 7.5%, lowest since 2008

Eurozone unemployment rate was unchanged at 7.5% in November, matched expectations. That’s the lowest rate since July 2008. The number of persons unemployment dropped by -10k for the month, to 12.315m.

EU28 unemployment was unchanged a 6.3%, a record low since January 2000. Among the Member States, the lowest unemployment rates in November 2019 were recorded in Czechia (2.2%), Germany (3.1%) and Poland (3.2%). The highest unemployment rates were observed in Greece (16.8% in September 2019) and Spain (14.1%).

Also released in European session, Germany industrial production rose 1.1% mom in November, beat expectation of 0.7% mom. Trade surplus narrowed to EUR 18.3B, below expectation of EUR 20.9B. Swiss retail sales rose 0.0% yoy in November, below expectation of 0.5% yoy.

EU Barnier: More than 11 month needed for comprehensive agreement with UK

EU chief Brexit negotiator Michel Barnier warned that more time than 11 months is needed to complete a comprehensive agreement with UK. He said in a speech that “we simply cannot expect to agree on every single aspect of this new partnership in under one year.””We are ready to do our best and to do the maximum in the 11 months to secure a basic agreement with the UK, but we will need more time to agree on each and every point of this political declaration,” he added.

“We will strive for a partnership that goes well beyond trade … covering everything from services and fisheries to climate action energy transport, space, security and defence,” he said. “But that is a very huge agenda and we simply cannot expect to agree on every single aspect of this new partnership in under one year.”

China confirms Liu He to go to US next week for trade deal signing

Chinese Ministry of Commerce spokesman Gao Feng confirmed that Vice Premier Liu He will travel to Washington next week to sign the first phase of trade agreement with US. Liu will be in US from January 13 to 15 as head of the delegation. Also, he will travel with the titles of Politburo member, vice premier and top trade negotiator.

There are no details regarding the 86-page trade deal yet. US Trade Representative Robert Lighthizer expected the document to be released after signing. One of the mostly concerned part is China’s USD 200B purchases of US goods and services. But Gao declined to comment on the amount of the purchase.

Released in Asian session, in seasonally adjusted term, Australia goods and services exports rose AUD 706M to AUD 40.89B in November. Goods and services imports dropped AUD 1020m to AUD 35.09B. Trade surplus widened by AUD 1.73B to AUD 5.80B. From China, CPI was unchanged at 4.5% yoy in December, PPI improved to -0.5% yoy.

ГБП / УСД Мид-Даи Оутлоок

Даили Пивотс: (СКСНУМКС) КСНУМКС; (П) КСНУМКС; (РКСНУМКС) КСНУМКС; Више….

GBP/USD’s break of 1.3053 suggests resumption of fall from 1.3284. Intraday bias is turned to the downside for 1.2905 support. Overall, price actions from 1.3514 are seen as a corrective pattern. Sustained break of 38.2% retracement of 1.1958 to 1.3514 at 1.2920 will target 61.8% retracement at 1.2552. On the upside, break of 1.3284 will bring retest of 1.3514 high.

На великој слици, очекује се да ће се пораст са дна 1.1958 средњег рока проширити на виши, да би се поново тестирао кључни отпор од 1.4376. Реакције од тамо би одлучивале да ли је у консолидацији од 1.1946 (најнижа 2016). Или, чврсти прекид од 1.4376 указиват ће на дугорочни биков преокрет. У сваком случају, за сада ће изглед остати букиран све док траје подршка од 1.2582 отпора.

Ажурирање економских индикатора

| GMT | Цци | Дешавања | Стваран | Прогноза | Претходна | Ревисед |

|---|---|---|---|---|---|---|

| 00:01 | цену | БРЦ Ретаил Салес Монитор И / И Дец | 100% | -4.90% | ||

| 00:30 | ЕУР | Трговински биланс (АУД) Нов | КСНУМКСБ | КСНУМКСБ | КСНУМКСБ | КСНУМКСБ |

| 01:30 | ЗАР | ЦПИ И / И дец | 100% | 100% | 100% | |

| 01:30 | ЗАР | ППИ И / И Дец | -0.50% | -0.40% | -1.40% | |

| 07:00 | ЕУР | Немачка Индустријска производња М / М Нов | 100% | 100% | -1.70% | -1.00% |

| 07:00 | ЕУР | Трговински биланс Немачке (ЕУР) нов | КСНУМКСБ | КСНУМКСБ | КСНУМКСБ | КСНУМКСБ |

| 07:30 | ЦХФ | Реална малопродаја И / И Нов | 100% | 100% | 100% | 100% |

| 10:00 | ЕУР | Стопа незапослености у еурозони Нов | 100% | 100% | 100% | |

| 13:15 | ЦАД | Становање почиње И / И Дец | КСНУМКСК | КСНУМКСК | КСНУМКСК | КСНУМКСК |

| 13:30 | ЦАД | Грађевинска дозвола М / М Нов | -2.40% | 100% | -1.50% | |

| 13:30 | Амерички долар | Почетна потраживања без посла (3. јануара) | КСНУМКСК | КСНУМКСК | КСНУМКСК | КСНУМКСК |

| 15:30 | Амерички долар | Складиштење природног гаса | -КСНУМКСБ | -КСНУМКСБ |

СигналКСНУМКСфорек.цом - Најбољи Форек роботи и сигнали

СигналКСНУМКСфорек.цом - Најбољи Форек роботи и сигнали