Dollar’s selloff resumes today as stocks rallies on more positive news on coronavirus treatment. British drugmaker AstraZeneca said it’s vaccine could be around 90% effective, and as many as 200 millions doses could be ready by year end. The news also lifts Sterling to be the best performer so far today. New Zealand Dollar and Euro are not far behind the Pound. Meanwhile, Yen and Swiss Franc are the worst ones next to the greenback, as traders leave the safe haven currencies behind.

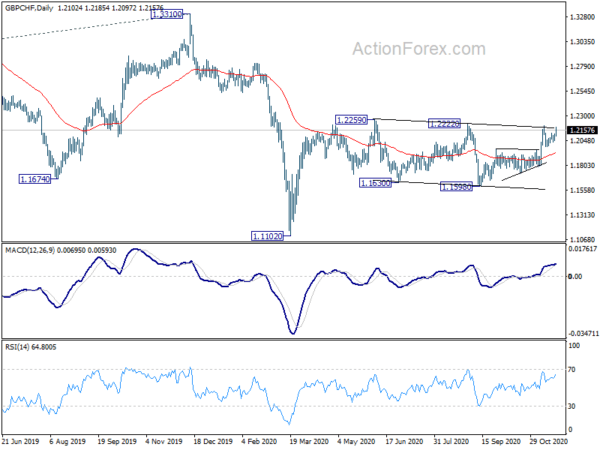

Technically, developments in Dollar and Sterling are both worth a note. USD/CHF’s break of 0.9088 minor support suggests that fall from 0.9192 is resuming for a test on 0.8982 low. 1.1920 resistance in EUR/USD and 0.7339 resistance in AUD/USD will be watched to confirm more Dollar weakness. GBP/JPY breaches 138.83 minor resistance, nullifying near term bearishness and turn focus back to 140.31 resistance. 0.8866 support in EUR/GBP is a key level and firm break there would solidify deeper decline back to 0.8670 support and below. Firm break of 1.2222/59 resistance zone in GBP/CHF will also carry larger bullish implication and confirm resumption of whole rebound from 1.1102.

In Europe, currently, FTSE is flat. DAX is up 0.57%. CAC is up 0.46%. Germany 10-year yield is up 0.013 at -0.568. Earlier in Asia, Hong Kong HSI rose 0.13%. China Shanghai SSE rose 1.09%. Singapore Strait Times rose 1.27%. Japan was on holiday.

BoE Haldane: Reasonable to speak of 2021 as turning a leaf

BoE Chief Economist Andy Haldane said, “the vaccine announcements of the past few weeks offer hope at the end of the tunnel”. However, “even with a vaccine, it’s clear this crisis will lead to some lasting scars, particularly on the poorest and the most disadvantaged.”

Haldane added that around two-thirds of pandemic economic loss had been recouped so far. “It’s now reasonable and realistic to speak of next year as turning a leaf for us economically,” he said.”

UK PMI Composite dropped to 47.4, double-dip recession

UK PMI Manufacturing rose to 55.2 in November, up from October’s 53.7, well above expectation of 50.5, and hit a 3-month high. PMI Services, however, dropped sharply to 45.8, down from 51.4, hitting a 6-month low but beat expectation of 42.5. The results pushed PMI Composite to 47.4, down from 52.1, a 6-month low.

Chris Williamson, Chief Business Economist at IHS Markit, said: “A double-dip is indicated by the November survey data, with lockdown measures once again causing business activity to collapse across large swathes of the economy… Some comfort comes from the data suggesting that the impact of the lockdown has not been as severe as in the spring, and manufacturing has also received a significant boost from inventory building and a surge in exports ahead of the UK’s departure from the EU at the end of the year, providing a fillip for many companies. However, while the lockdown will be temporary, so too will this pre-Brexit boost.”

Eurozone PMI composite dropped to 45.1, plunged back into a severe decline

Eurozone PMI Manufacturing dropped to 53.6 in November, down from 54.8, a 3-month low but above expectation of 53.1. PMI Services dropped to 41.3, down from 46.9, a 6-month low and missed expectation of 42.5. PMI Composite dropped to 45.1, down from 50.0, also a 6-month low.

Chris Williamson, Chief Business Economist at IHS Markit said: “The eurozone economy has plunged back into a severe decline in November amid renewed efforts to quash the rising tide of COVID-19 infections. The data add to the likelihood that the euro area will see GDP contract again in the fourth quarter…. The further downturn of the economy signalled for the fourth quarter represents a major set-back to the region’s health and extends the recovery period. After a 7.4% contraction of GDP in 2020, we are expecting only a 3.7% expansion in 2021.”

Germany PMI composite dropped to 52.0, resilient manufacturing

Germany PMI Manufacturing dropped to 57.9 in November, down from October’s 58.2, above expectation of 56.5. . PMI Services dropped to 46.2, down from 49.6, a 6-month low, similar to expectation of 46.3. . PMI Composite dropped to 52.0, down from 55.0, a 5-month low.

Phil Smith, Associate Director at IHS Markit said: “As expected, the introduction of new lockdown measures in November to combat the spread of COVID-19 has had a disruptive impact on German economic activity, with the flash PMI data showing the service sector suffering its worst performance since May. However, the resilience being exhibited by the manufacturing sector, which the survey shows is benefitting for growing sales to Asia in particular, supports our view that any downturn in the final quarter is expected to be far shallower than those seen in the first half of the year.”

France PMI composite dropped to 39.9, businesses adapting well to new restrictions

France PMI Manufacturing dropped to 49.1 in November, down from October’s 51.3, missed expectation of 50.1. PMI Services dropped to 38.0, down from 46.5, matched expectations. PMI Composite dropped to 39.9, down from 47.5. All are 6-month lows.

Eliot Kerr, Economist at IHS Markit said: “With the renewed tightening of restrictions in France at the end of October, a sharp decline in private sector activity during November was almost inevitable. However, it is somewhat positive to see that the latest contraction in activity was substantially slower than during the previous lockdown. These results suggest that some French businesses have been able to adapt their operations to the new conditions and are subsequently less susceptible to sharp downturns in activity when tighter restrictions are imposed.

Аустралијска производња ПМИ порасла је на 35 месеци

Аустралијска производња ЦБА ПМИ порасла је на 56.1 у новембру, са 54.2, достигавши највиши ниво од 35 месеци. ПМИ услуге порасле су на 54.9, са 53.7, највиших 4 месеца. ПМИ Цомпосите је порастао на 54.7, са 53.5, такође 4 месеца.

Бернард Ав, главни економиста у ИХС Маркит, рекао је: „Најновији подаци ПМИ-а показују да је опоравак аустралијске економије приватног сектора убрзао током новембра, постављајући сцену за снажније перформансе БДП-а током последњег квартала 2020. године. То је рекао, пригушени раст у новом послу остаје забрињавајућа. Обновљене мере закључавања у деловима света због других таласа инфекција могу задржати граничну контролу и ограничења путовања на дужи период, а тиме и пригушити спољну потражњу. Ако аустралијски раст продаје настави да заостаје за растом пословне активности у наредним месецима, тренутни економски опоравак могао би да изгуби замах. “

Малопродајна продаја на Новом Зеланду порасла је за 28% у К3

Малопродајна продаја на Новом Зеланду порасла је за К28.0 за 3%, док је продаја ек-аутомобила порасла за 24.1%. У поређењу са трећим кварталом 3. године, укупан обим малопродајне продаје порастао је за 2019% међугодишње. Међутим, за период од 8.3 месеци од октобра 12. до септембра 2019, укупна вредност малопродајне продаје и даље је била у паду -202%.

„Снажан септембарски квартал допринео је да продаја на крају године заостаје за прошлогодишњом вредношћу“, рекла је менаџер статистике малопродаје Суе Цхапман.

ГБП / УСД Мид-Даи Оутлоок

Даили Пивотс: (СКСНУМКС) КСНУМКС; (П) КСНУМКС; (РКСНУМКС) КСНУМКС; Више…

GBP/USD’s break of channel resistance suggests upside acceleration. Intraday bias stays on the upside for retesting 1.3482. Decisive break there will resume whole rise from 1.1409. Further rally should be seen to 61.8% projection of 1.1409 to 1.3482 from 1.2675 at 1.3956 next. On the downside,break of 1.3195 minor support is needed to indicate short term topping. Otherwise, outlook will stay cautiously bullish in case of retreat.

На широј слици, фокус остаје на отпору кључа 1.3514. Одлучујући прекид би такође требало да дође са континуираним трговањем изнад 55-месечног ЕМА-е (сада на 1.3308). То би требало да потврди средњорочно дно на нивоу од 1.1409. Оутлоок ће постати биковски за отпор од 1.4376 и више. Ипак, одбијање од 1.3514 задржат ће средњорочно медвједиште за још нижи ниво испод 1.1409 у каснијој фази.

Ажурирање економских индикатора

| GMT | Цци | Дешавања | Стваран | Прогноза | Претходна | Ревисед |

|---|---|---|---|---|---|---|

| 21:45 | НЗД | К / К ККСНУМКС | 100% | -14.60% | -14.80% | |

| 21:45 | НЗД | Малопродаја ек Аутос К / К ККСНУМКС | 100% | -13.70% | ||

| 22:00 | ЕУР | ЦБА Мануфацтуринг ПМИ Нов П | 56.1 | 54.2 | ||

| 22:00 | ЕУР | ЦБА Сервицес ПМИ Нов П | 54.9 | 53.7 | ||

| 8:15 | ЕУР | Француска Производња ПМИ Нов П | 49.1 | 50.1 | 51.3 | |

| 8:15 | ЕУР | Француска Услуге ПМИ Нов П | 38 | 38 | 46.5 | |

| 8:30 | ЕУР | Немачка Производња ПМИ Нов | 57.9 | 56.5 | 58.2 | |

| 8:30 | ЕУР | Немачка Услуге ПМИ Нов П | 46.2 | 46.3 | 49.5 | |

| 9:00 | ЕУР | Еврозона Производња ПМИ Нов | 53.6 | 53.1 | 54.8 | |

| 9:00 | ЕУР | Услуге еврозоне ПМИ Нов | 41.3 | 42.5 | 46.9 | |

| 9:30 | цену | Производња ПМИ Нов П | 55.2 | 50.5 | 53.7 | |

| 9:30 | цену | Услуге ПМИ Нов П | 45.8 | 42.5 | 51.4 | |

| 14:45 | Амерички долар | Производња ПМИ Нов П | 52.5 | 53.4 | ||

| 14:45 | Амерички долар | Услуге ПМИ Нов П | 55.5 | 56.9 |

СигналКСНУМКСфорек.цом - Најбољи Форек роботи и сигнали

СигналКСНУМКСфорек.цом - Најбољи Форек роботи и сигнали