Infrastructure names could be winners and pharmaceutical stocks losers in President Donald Trump’s State of the Union speech Tuesday night if he goes after two areas where Wall Street strategists expect there might be some bipartisan support.

Trump may also tout defense spending, and he may mention progress on trade talks with China after meetings last week in Washington.

“I suppose he could talk harshly about prescription drug prices. That would be a worthwhile angle to look at,” said Greg Valliere, chief global strategist at Horizon Investment. “That would probably be No. 1 in terms of some kind of headline risk.”

Senate Republicans, in fact, announced Wednesday that they have called executives from seven pharmaceutical companies to testify Feb. 26 about pricing practices before the Senate Finance Committee. Sens. Ron Wyden and Chuck Grassley sent letters Monday to AbbVie, AstraZeneca, Bristol-Myers Squibb, Merck, Pfizer, Sanofi and Johnson & Johnson

“[Drug pricing] is an easy one. He’ll say, ‘We’ll get bipartisan support for this, and it’s good for America.’ That’s always a popular political football, and he could mention infrastructure, and that tends to put a pop in engineering and construction stocks,” said Art Hogan, chief market strategist at National Securities.

Hogan said in addition to big pharma, providers and insurers like CVS Health and UnitedHealth could be affected by an effort to rein in pricing.

Trump is also expected to push spending on infrastructure, which Democrats have supported in theory in the past but it could be difficult to get an agreement on a large spending plan because of the funding.

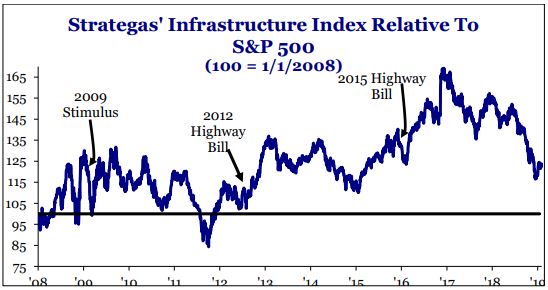

“It is likely President Trump will push an infrastructure bill at the State of the Union this week and Democrats will probably offer their large package paid for with tax increases that are unlikely to pass the Senate,” notes Dan Clifton, head of policy research at Strategas Research.

Clifton points out that there has been talk of a bipartisan bill, which would be good for stocks, but it’s unlikely to make it through, unless Trump agrees to raise the gasoline tax or corporate tax rate.

“Rather, we would anticipate a small amount of infrastructure funding to be included as part of the sequestration spending deal. We expect this to be $20-$30bn for a couple of years, thereby making the number look small. This funding level will move the needle on stocks levered to federal infrastructure spending, but it will not be a macro event,” Clifton wrote in a note.

Source: Strategas Research

Strategas has created an index from infrastructure names, like Fluor, Jacobs Engineering, Granite Construction, Griffon, Dycom and Vulcan Materials. It has picked up slightly recently but has mostly traded lower after surging on Trump’s election. Trump speaks to the nation at 9 p.m. ET.

“He’ll be supporting a very vigorous defense budget. It looks like he will not give the Pentagon a haircut. He’ll give everyone else a haircut,” Valliere said. Defense stocks have already benefited from Trump with the ishares U.S. Aerospace and Defense ETF, up 12.5 percent in January, its best month since April 2009.

If Trump talks up potential trade peace with China, John Davi, chief investment officer at Astoria Portfolio Advisors, says investors may want to look iShares MSCI China ETF MCHI. While not nearly as large as the iShares Chinese large-cap FXI, the ETF gives investors exposure to Alibaba, Tencent and Baidu.

Hogan said investors could also look at U.S. stocks with exposure to China, like Apple and Caterpillar.

Strategas created an index of companies with large Chinese revenue exposure. The index is doing better lately after sliding through the last year.

Source: Strategas Research

Some of the names are: A.O. Smith, Micron, Qualcomm, Skyworks, Texas Instruments, Wynn Resorts, Intel and Broadcom.

Pikeun padagang: urang Portopolio tina robot forex pikeun dagang otomatis boga resiko lemah sareng kauntungan stabil. Anjeun tiasa nyobian nguji hasil urang ngundeur forex ea

Signal2forex review

Signal2forex.com - robot Best Forex jeung sinyal

Signal2forex.com - robot Best Forex jeung sinyal