Asian markets opened higher earlier today, following another day of strong rebound in the US overnight. But buying lost momentum entering into European session. Australian Dollar is currently the strongest one for today as RBA minutes indicates the central bank will stand pat in September first. New Zealand Dollar follows as second strongest, and then Yen. Sterling is the weakest one as last week’s corrective recovery lost momentum. Dollar and Euro are currently following as next weakest. Change in risk sentiments ahead could set another tone for the markets.

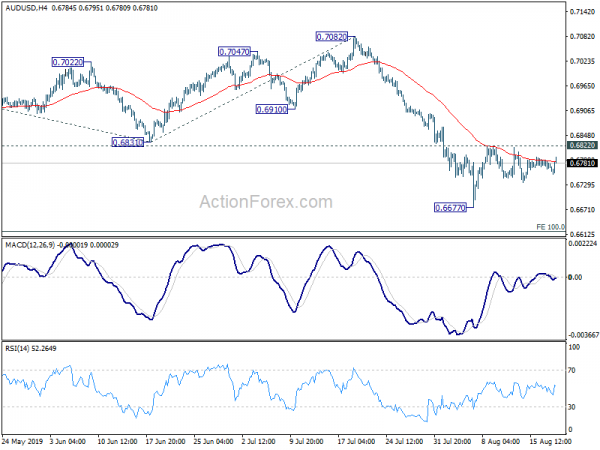

Technically, despite today’s recovery, AUD/USD is held below 0.6822 minor resistance and intraday bias remains neutral. Break of 0.6677 low is expected sooner or later to recent recent down trend. USD/CAD is eyeing 1.3345 resistance again after drawing support from 4 hour 55 EMA and rebounded. Break will resume the choppy rise from 1.3016 to 1.3432/3564 resistance zone. GBP/USD and GBP/JPY will continue to be focuses today. Corrective recoveries from 1.2014 and 126.54 started to lose momentum. Retest of these temporary lows could be seen soon.

In Asia, Nikkei rose 0.55%. Hong Kong HSI is down -0.20%. China Shanghai SSE is down -0.21%. Singapore Strait Times is up 0.22%. Japan 10-year JGB yield is down -0.0005 at -0.235. Overnight, DOW rose 0.96%. S&P 500 rose 1.21%. NASDAQ rose 1.35%. 10-year yield rose 0.059 to 1.597. 30-year yield rose 0.085 to 2.085.

menit RBA nunjukkeun bias easing, tapi bakal dilaksanakeun dina pasamoan Sept munggaran

Dina menit 6 Agustus rapat kawijakan RBA, bank sentral nyatet yén "jaman nambahan suku bunga low" bakal diperlukeun. Sareng saatos dua pamotongan suku ka tukang dina bulan Juni sareng Juli, éta "cocog pikeun ngira-ngira kamajuan dina ékonomi global sareng domestik sateuacan nimbangkeun parobihan deui kana setting kawijakan moneter". Jeung anggota bakal "mertimbangkeun hiji easing salajengna kawijakan moneter" lamun diperlukeun. Menit éta saluyu sareng ekspektasi yén RBA bakal nangtung dina bulan Séptémber, sateuacan ngalakukeun tindakan deui dina taun éta.

Sacara global, RBA nyatet yén "escalation tina sengketa dagang jeung téhnologi geus ngaronjat resiko downside kana outlook pertumbuhan global". Sareng, "kateupastian ngeunaan kawijakan perdagangan parantos ngagaduhan pangaruh négatip kana investasi di seueur ékonomi." Inflasi low disadiakeun bank sentral jeung "wengkuan betah" salajengna.

Domestik, pertumbuhan di Australia parantos "leuwih handap tina harepan" dina satengah munggaran tapi diperkirakeun "nguatkeun laun-laun" ka 2.75% langkung ti 2020, teras sakitar 3% langkung ti 2021. Pamekaran anu ngadukung outlook kalebet suku bunga anu langkung handap, panghasilan rumah tangga anu langkung luhur. pertumbuhan, depreciation Nilai tukeur, investasi sektor sumberdaya positif, sababaraha stabilisasi pasar perumahan, sarta lumangsung tingkat luhur investasi infrastruktur. Résiko condong ka handap dina waktos anu caket, tapi langkung saimbang engké dina periode ramalan.

PBoC Liu said there is room for RRR and rate cut, as new LPR starts

Under the revamped Loan Prime Rate mechanism, China’s PBoC lowered the new one year LPR by -6 basis points to 4.25%, down from 4.31%, today. It’s currently -10 basis points lower than then existing benchmark one-year lending rate. The new five-year LPR was set at 4.85%, below five-year benchmark lending rate of 4.90%.

It’s the first day of operation of the new LPR, kicking off the rate reform to lower corporate borrowing costs. But the tiny reduction would only have marginal impact of economic activity. And PBOC would need to take other steps to boost lending.

PBoC Vice Governor Liu Guoqiang said the country still needs time to observe effects of LPR reform but it will not scrap benchmark lending rate for the time being. He added that there is room for cuts in both reserve requirement ratio and lending rate.

Liu added that there is urgency for interest rate reform due to trade war with the US, industrial transformation, rate cuts from global central banks. But China is not experience deflation for now, and markets rates are at basically reasonable level.

PPI Jerman naek 0.1% mom, 1.1% yoy dina bulan Juli

PPI Jerman naros 0.1% mom, 1.1% yoy dina bulan Juli, di luhur ekspektasi 0.0% mom, 1.0% yoy. Dampak greatest dina tumuwuhna indéks sakabéh dibandingkeun Juli 2018 miboga ngembangkeun harga listrik. Ieu naék 8.4% (+ 2.2% dibandingkeun Juni 2019). Harga barang konsumen anu henteu awét ningkat 1.7% dibandingkeun Juli 2018 (-0.2% dina Juni 2019). Harga pangan naék 2.2%. Harga barang modal naék 1.5%, harga barang konsumen awét naék 1.3%. Harga barang panengah turun 0.7% dibandingkeun Juli 2018 (-0.4% dina Juni 2019).

pilari payun

The economic calendar si rather light today. UK CBI trends total orders and Canada manufacturing sales will be featured.

Outlook poean AUD / USD

Pivots poean: (S1) 0.6754; (P) 0.6772; (R1) 0.6781; Tambih deui…

No change in AUD/USD’s outlook and intraday bias remains neutral for the moment. Some more consolidation from 0.6677 is in progress. On the upside, break of 0.6822 will extend the rebound from 0.6677. But upside should be limited below 0.6910 support turned resistance to bring fall resumption. On the downside, break of 0.6677 will target 100% projections of 0.7295 to 0.6831 from 0.7082 at 0.6618.

Dina gambar badag, turunna ti 0.8135 (2018 tinggi) katempona resuming trend turun jangka panjang ti 1.1079 (2011 tinggi). putus teguh tina 0.6826 (2016 low) kedah mastikeun view bearish ieu. ragrag salajengna kudu ditempo ka 0.6008 (2008 low) salajengna. Dina tibalik, putus lalawanan 0.7082 diperlukeun pikeun jadi tanda mimiti bottoming istilah sedeng. Upami teu kitu, outlook bakal tetep bearish sanajan rebound kuat.

Ékonomi Indikator Update

| GMT | Ccy | kajadian | saleresna | ramalan | saméméhna | dirévisi |

|---|---|---|---|---|---|---|

| 01:30 | AUD | RBA Menit Agustus | ||||

| 06:00 | eur | Jérman PPI M/M Jul | 0.10% | 0.00% | -0.40% | |

| 06:00 | eur | Jérman PPI Y/Y Jul | 1.10% | 1.00% | 1.20% | |

| 10:00 | GBP | CBI Trends Jumlah Pesenan Aug | -25 | -34 | ||

| 12:30 | CAD | Penjualan Manufaktur M/M Jun | -1.80% | 1.60% |

Signal2forex.com - robot Best Forex jeung sinyal

Signal2forex.com - robot Best Forex jeung sinyal