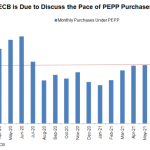

ECB முன்னோட்டம் - அதிகரித்து வரும் பணவீக்கம் இருந்தபோதிலும் சந்தை குறைந்த வட்டி விகிதம் இன்னும் அவசியம் என்பதை ECB நம்ப வைக்கும்

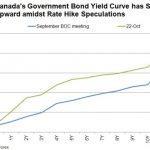

BOC முன்னோட்டம் - மேலும் QE டேப்பரிங்

FOMC Minutes: QE Tapering can Come in As Soon As Mid-November

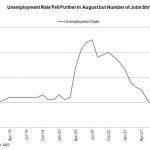

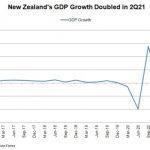

RBNZ 7 ஆண்டுகளில் முதல் முறையாக பாலிசி விகிதத்தை உயர்த்தியது

RBA 2024 வரை விகித உயர்வை உறுதிப்படுத்தவில்லை, கொள்கை வேறுபாட்டை கவுண்டர்பார்ட்ஸுடன் விரிவுபடுத்துகிறது

RBA முன்னோட்டம் - வரலாற்றில் விகிதாச்சாரத்தை தக்கவைத்துக்கொள்ள, எதிரணியினர் இறுக்கத் தொடங்குகின்றனர்

RBNZ முன்னோட்டம் - விகித உயர்வு சுழற்சி தொடங்குகிறது

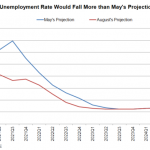

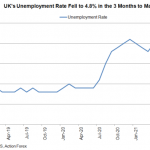

BOE குறுகிய கால வளர்ச்சியைக் குறைத்தது, ஆனால் இறுக்குவது பற்றி இன்னும் கொஞ்சம் ஹாக்கிஷாக மாறியது

FOMC Review: Tapering will Start “Soon” while First Rate Hike may Come in as Soon as 2022

BOE Preview – How will New Members Shift the Views of Rate Hike Conditions?

FOMC Preview: Fed to Affirm Tapering Could Come This Year. Focus Turns to Dot Plot

ECB to Slow Asset Purchases via PEPP. Growth and Inflation Outlook Upgraded

BOC ஸ்டூட் பேட் ஆனால் எச்சரிக்கையுடன் நம்பிக்கையான செய்தியை வழங்கியது

BOC முன்னோட்டம் - QE 2Q21 இல் சுருக்கப்பட்ட பொருளாதாரம் என இடைநிறுத்தப்படும்

3Q இல் வளர்ச்சியை பாதிக்கும் என எதிர்பார்க்கப்படும் டெல்டா வெடிப்பு என RBA டோவிஷ் டேப்பரிங்கை ஏற்றுக்கொள்கிறது

ECB முன்னோட்டம் - சொத்து வாங்குதல்களைக் குறைப்பதற்கான நேரம்?

சமீபத்திய பூட்டுதலுக்கு மத்தியில் RBNZ இடது OCR மாறவில்லை. பருந்துத்தன்மை பராமரிக்கப்படுகிறது

RBNZ முன்னோட்டம் - குறைந்த வருத்தம் விருப்பமாக விகிதத்தை உயர்த்துவது

BOE சமிக்ஞைகள் முன்னதாக இருப்புநிலைக் குறிப்பைத் திறக்கவில்லை. வழியில் மிதமான இறுக்கம்

Signal2forex.com - சிறந்த அந்நிய செலாவணி ரோபோக்கள் மற்றும் சமிக்ஞைகள்

Signal2forex.com - சிறந்த அந்நிய செலாவணி ரோபோக்கள் மற்றும் சமிக்ஞைகள்