Despite initial setback, US equities extended the post-Christmas historic rebound overnight. DOW ended up 1.14% to 23138.82. S&P 500 rose 0.86% and NASDAQ added 0.38%. But the improvement in sentiments isn’t carried over to Asian session. Nikkei is currently down -0.39%. Hong Hong HSI is just up 0.09% while China Shanghai SSE is up 0.15%. Singapore Strait Times is the better performing one and is up 0.73%. In the currency markets, Dollar is trading as the weakest one for today, followed by Canadian. On the other hand, Yen is so far the strongest one, followed by Swiss Franc. But major pairs and crosses generally held in yesterday’s range.

In the bond markets, despite rebound in stocks, US treasury yields weakened again overnight. 10-year yield closed down -0.054% at 2.743. 30-year yield dropped -0.018 to 3.030 after dipping to 3.003. It’s still stubbornly holding on to 3% handle. Yield curve remains inverted from 1-year (2.602) to 2-year (2.572) and 3-year (2.562). It should also be noted that Japan 10 year JGB yield is also extending recent decline, down -0.0139 at 0.01 for now.

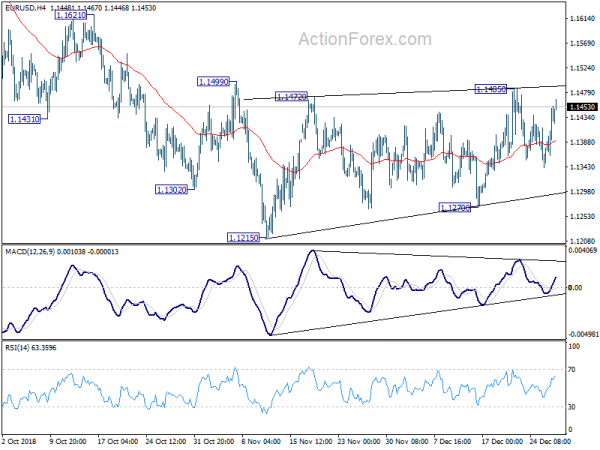

Technically, AUD/USD and USD/CAD extended recent move but are both losing momentum. Dollar might start to top against the two. Also, EUR/USD will possibly challenge 1.1485 resistance today. USD/CHF is pressing 0.9848 key support again. There is prospect of some Dollar weakness before year-end. Yen crosses, including USD/JPY, EUR/JPY and GBP/JPY are staying in consolidation, with EUR/JPY being the stronger one. But recent decline in these Yen crosses are still expected to resume sooner rather than later.

47% Americans blamed Trump for government shutdown

There is no end in sight to the partial US government shutdown as it enters in the the sixth day. Trump continued to blame the Democrats for “OBSTRUCTION of the desperately needed Wall”. White House spokeswoman Sarah Sanders also said yesterday that “the president has made clear that any bill to fund the government must adequately fund border security,” without specially mentioning the border wall.

According to a Reuters/Ipsos poll conducted between Dec 21-26, more Americans blamed Trump for the government shut down. 47% said Trump was responsible, 33% said Congressional Democrats and 8% said Congressional Republicans. Meanwhile, 49% said they opposed to funding for the border wall, and only 36% supported it.

BoJ: Global xatarlar salbiy tomonga siljiydi, noaniqlik oshdi

Dekabr 19 / 20 yig'ilishida Xulosa Xulosasida ko'rsatilgandek, BoJ boshqaruvi a'zolari global o'zgarishlarni ko'proq tashvishga solmoqda. Xulosa qilib aytganda, "global iqtisodiyot nuqtai nazariga qaraganda, xatarlar umuman noaniqliklarni kuchaytirib, umuman olganda, bunday vaziyatning uzilishiga olib keladi".

Xususan, "Xitoyda savdo-sotiq faoliyatiga doir so'nggi ma'lumotlarga qaraganda eksport va import miqdori salbiy o'sish sur'ati bo'yicha bir oyga oshdi va bu Xitoy iqtisodiyotidagi sekinlashuvni ko'rsatmoqda". Yaponiya uchun "tabiiy ofatlardan kelib chiqadigan qayta tiklanadigan talab va ishlab chiqarishning haqiqiy holati kuchli bo'lgan" deya bo'lmaydi. Bundan tashqari, "Xitoyga eksport qilinadigan tovarlar zaiflashdi va eksport butunlay zaiflashdi".

BoJ, shuningdek, "hozirgi kundagi kuchli pul ayirboshlashni qat'iy davom ettirish zarur, chunki inflyatsiya 2 foizga pasayish davom etmoqda". Shuningdek, "narx barqarorligi maqsadiga erishishdan oldin pul-kredit siyosatini normallashtirishga harakat qilish, tomonlarning salbiy tomonlarini kuchaytirishi mumkin" Xulosa, uzoq muddatli rentabellikni "vaqtincha salbiyroq" va "yuqoriga va pastga nolga teng noldan nosimmetrik ravishda yuqoriga va pastga harakat qilish" ga ruxsat berish kerakligini ta'kidladi.

Ma'lumotlar oldida

Japan Tokyo CPI core slowed to 0.9% yoy in December, matched expectations. Unemployment rate rose 0.1% to 2.5% in November. Industrial production dropped -1.1% mom in November versus expectation of -1.6% mom. Retail sales rose 1.4% versus expectation of 2.1%.

Looking ahead, Swiss KOF leading indicator, UK BBA mortgage approvals and Germany CPI flash will be released in European session.

Later in the day, due to partial government shutdown, only Chicago PMI and pending home sales will be release from the US.

EUR / USD kundalik Outlook

Kunlik pivotslar: (S1) 1.1372; (R) 1.1413; (R1) 1.1475; Ko'proq…..

EUR/USD rebounds to as high as 1.1467 so far today but upside is limited below 1.1485 resistance so far. Intraday bias remains neutral first. On the upside, break of 1.1485 resistance will revive the case of near term reversal, on bullish convergence condition in daily MACD. Bias will be turned back to the upside for 1.1621 resistance first. Break will target 1.1814 key resistance next. On the downside, break of 1.1270 will, instead, revive the bearish case that down trend from 1.2555 is still in progress. Bias will be turned back to the downside for 1.1186 key fibonacci level.

Katta rasmda 1.1814 qarshiligi davom etadigan bo'lsa, 1.2555 o'rta muddatli yuqori trend pastga tushish davom etmoqda va keyingi 61.8 da 1.0339 (2017 past) qiymatini 1.2555ga yo'naltirish kerak. Doimiy oromgoh 1.1186ni qayta sinovdan o'tkazadi. Biroq, 1.0339 ning buzilishi bunday pastga yo'nalishni yakunlashni tasdiqlaydi va o'rta muddatli istiqbolda buqa yo'nalishini o'zgartiradi.

Iqtisodiy ko'rsatkichlar yangilanishi

| GMT | Ccy | Tadbirlar | haqiqiy | havo ma'lumoti | avvalgi | Qayta ko'rib chiqildi |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Ishsizlik darajasi Noyabr | 2.50% | 2.40% | 2.40% | |

| 23:30 | JPY | Tokio CPI Core Y / Y Dek | 0.90% | 0.90% | 1.00% | |

| 23:50 | JPY | BOJ xulosalari | ||||

| 23:50 | JPY | Sanoat ishlab chiqarish M / M Noyabr P. | -1.10% | -1.60% | 2.90% | |

| 23:50 | JPY | Chakana savdo Y / y Noyabr | 1.40% | 2.10% | 3.50% | 3.60% |

| 08:00 | CHF | KOF etakchi ko'rsatkichi Dek | 98.8 | 99.1 | ||

| 09:30 | GBP | BBA Ipotekalarni tasdiqlash | 38.9K | 39.7K | ||

| 13:00 | Yevro | Nemis CPI M / M Dekabr P. | 0.30% | 0.10% | ||

| 13:00 | Yevro | Nemis mil. Y / Y dekabr P. | 2.00% | 2.30% | ||

| 14:45 | USD | Chikagodagi PMI Dek | 61.2 | 66.4 | ||

| 15:00 | USD | Kutilayotgan uy-joy sotish M / M Noyabr | 1.10% | -2.60% | ||

| 15:30 | USD | Tabiiy gazni saqlash | -141B | |||

| 16:00 | USD | Xom neft zaxiralari | -0.5M |

Signal2forex.com - Eng yaxshi Forex robotlari va signallari

Signal2forex.com - Eng yaxshi Forex robotlari va signallari