New Zealand Dollar strengthens broadly today after CPI picked up in Q2. On the other hand, Australian Dollar trades slightly softer after RBA minutes affirmed easing bias. Euro and Dollar strengthen mildly in Asian session. But both will face tests from economic data, including US retail sales and German ZEW. Sterling is also mixed as markets await UK job data.

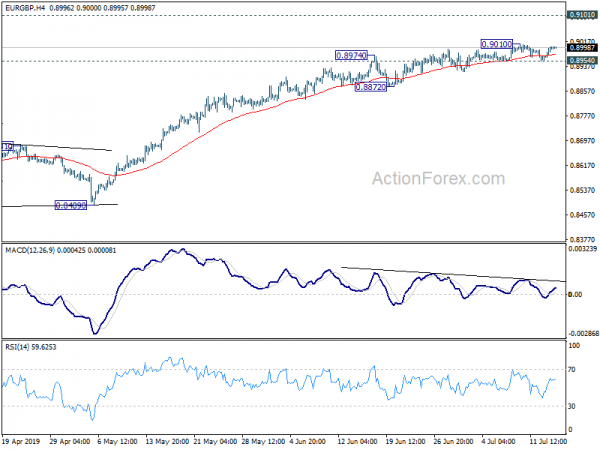

Technically, despite rally attempt this week, AUD/USD and AUD/JPY are both limited below near term resistance at 0.7047 and 76.28 respectively. Buying momentum in Aussie is not too apparent for now. EUR/GBP will be a focus today with Germany and UK data featured. A range breakout is likely. Break of 0.9010 temporary top will resume EUR/GBP’s recent rise but we’d expect strong resistance from 0.9101 to limit upside. Meanwhile, break of 0.8954 minor support will indicate near term reversal.

In Asia, currently, Nikkei is down -0.64%. Hong Kong HSI is up 0.22%. China Shanghai SSE is down -0.29%. Singapore Strait Times is up 0.15%. Japan 10-year JGB yield is down -0.0048 at -0.119. Overnight, DOW rose 0.10%. S&P 500 rose 0.02%. NASDAQ rose 0.17%. 10-year yield dropped -0.014 to 2.092.

RBA daqiqalari yumshatilishning noto'g'ri ekanligini ko'rsatadi, lekin birinchi navbatda kuting va ko'ring

Iyul 2 RBA tezkor uchrashuvlari bayonnomasida "Kengash kadrlar bozoridagi o'zgarishlarni yaqindan kuzatib boradi va iqtisodiyotda barqaror o'sishni qo'llab-quvvatlash uchun zarur bo'lganda pul-kredit siyosatini takomillashtirib boradi va vaqt davomida inflyatsiya maqsadiga erishishi mumkin". Xulosa shuni ko'rsatadiki, RBA hali ham iyun, ham iyul oylarida foiz stavkasini pasaytirgandan keyin yumshatish tendentsiyasini qabul qilmoqda. Biroq, navbatdagi qadam "agar kerak bo'lsa" keladi, chunki markaziy "avvalgi o'zgarishlarni kuzatib boradi", chunki iqtisodning avvalgi kurslarga qanday ta'sir qilishini ko'rish uchun.

Yangi Zelandiyadagi CPI bahosi 0.6% ga ko'tarildi, RBNZ hali ham osonlashdi

Yangi Zelandiyadagi CPI 0.6% gacha 1.7% yxni Q2da, kutilgan taxminlar. 1.5% yillik yillik Q1 foizga tezlashdi. Biroq, inflyatsiya darajasining oshishi, asosan, 5.8%, 0.25% ga teng bo'lgan neft bahosining 0.6% choraklik o'sishiga bog'liq. Bu shuni anglatadiki, yig'ish jarayoni yillik CPI 2% ning RBNZ ning 1-3% maqsadli oralig'idan past darajada saqlanib turishini eslatmaslik kerak.

Inflyatsiya darajasini barqaror ravishda ko'tarish uchun 2% maqsadiga erishish uchun kuchli pul-kredit stimuli va iqtisodiy o'sish talab etiladi. Shunga qaramay, ichki va global bo'ronlar qolmoqda. Shunday qilib, RBNZ uchun yana OCR qisqartirish kutilmoqda. Avgust oyining oxirigacha bo'lishi mumkin, ammo bu hali aniq emas.

US Mnuchin: Debt ceiling deal soon, another call with China this week

US Treasury Secretary Steven Mnuchin said yesterday that a deal is close on raising debt ceiling. and he didn’t see another government shutdown looming over the issue. Trump’s administration and Congress have been discussing a possible two-year budget that sets that overall federal spending for fiscal 2020 and 2021. He added “we’re getting closer”.

He emphasized that all parties wanted to reach an agreement on the budget issues. And, if a deal on all issues couldn’t be reached before summer recess, lawmakers would either stay put or approve an increase in the debt ceiling. He noted, “I think we’re very close to a deal, but as you know, these deals are complicated.”

Separately, he also noted that there will another telephone call with Chinese officials this week regarding resuming trade negotiations. And, “to the extent that we make significant progress, I think there’s a good chance we’ll go there later.”

Oldinga qarab

UK employment data will be a major focus in the European session. Eurozone will also release trade balance and German ZEW economic sentiment. Later in the day, US retail sales will take center stage. Import price, industrial production, NAHB housing index and business inventories will also be featured.

EUR / GBP kundalik Outlook

Kunlik pivotslar: (S1) 0.8969; (R) 0.8985; (R1) 0.9011; Ko'proq…

EUR/GBP is staying in range below 0.9010 temporary top and intraday bias remains neutral. With 0.8954 minor support intact, another rise cannot be ruled out yet. But considering loss of upside momentum, we’d look for topping signal as it approaches 0.9101 key resistance. On the downside, break of 0.8954 support will indicate short term topping. In this case, deeper pull back could be seen to 55 day EMA (now at 0.8868) first.

Katta rasmda 0.9305 (2017 yuqori) dan o'rta muddatli pasayish tuzatuv harakati sifatida ko'riladi. Ushbu ko'rinishdagi o'zgarishlar yo'q. Mavjud rivojlanish, 0.8472 oylik EMAga (hozir 38.2) urilganidan so'ng, 0.6935-ga 2015-ga 0.9306 (0.8400 past) ni 55-ga olib chiqishdan oldin, 0.8545-ga uchta to'lqinni to'ldirishi mumkinligini ta'kidlaydi. 0.9101 qarshilikning keskin burilishi bu yukori vaziyatni tasdiqlaydi. Shunga qaramasdan, EUR / GBP hali ham uzoq vaqt davomida tushib ketgan kanal ichida qolmoqda, chunki 0.9305 tomonidan tuzatishlar 0.8400 tomonidan rad etilsa, hali ham 0.9101 fibonacci darajasiga qadar uzaytirilishi mumkin.

Iqtisodiy ko'rsatkichlar yangilanishi

| GMT | Ccy | Tadbirlar | haqiqiy | havo ma'lumoti | avvalgi | Qayta ko'rib chiqildi |

|---|---|---|---|---|---|---|

| 22:45 | NZD | CPI Q / Q Q2 | 0.60% | 0.60% | 0.10% | |

| 22:45 | NZD | CPI Y / Y Q2 | 1.70% | 1.70% | 1.50% | |

| 1:30 | AUD | RBA daqiqa Jul | ||||

| 8:30 | GBP | Da'vogar hisoblash darajasi Iyun | 3.10% | |||

| 8:30 | GBP | Ishsiz talablar o'zgarishi | 18.9K | 23.2k | ||

| 8:30 | GBP | Haftalik o'rtacha daromad 3M / Y may | 3.10% | 3.10% | ||

| 8:30 | GBP | Haftalik yutuqlar bonusi 3M / Y may | 3.50% | 3.40% | ||

| 8:30 | GBP | XMMX-2014-yilgi XMTning ishsizlik darajasi | 3.80% | 3.80% | ||

| 9:00 | Yevro | Evrozona savdo balansi (EUR) may | 16.4B | 15.3B | ||

| 9:00 | Yevro | Germaniyadagi ZEW iqtisodiy markazi | -22 | -21.1 | ||

| 9:00 | Yevro | Nemis ZEW Mavjud vaziyat Jul | 5 | 7.8 | ||

| 9:00 | Yevro | Yevro hududi ZEW iqtisodiy tasavvur Jul | -20.9 | -20.2 | ||

| 12:30 | SAPR | Xalqaro qimmatli qog'ozlar operatsiyalari (CAD) may | -12.80B | |||

| 12:30 | USD | Import narxlari indeksi M / M Iyun | -0.70% | -0.30% | ||

| 12:30 | USD | Chakana savdo savdosi Advance M / M Iyun | 0.10% | 0.50% | ||

| 12:30 | USD | Chakana savdo sotuvi Ex Auto M / M Iyun | 0.10% | 0.50% | ||

| 13:15 | USD | Sanoat ishlab chiqarish M / M Iyun | 0.10% | 0.40% | ||

| 13:15 | USD | Imkoniyatlarni ishga tushirish | 78.10% | 78.10% | ||

| 14:00 | USD | NXXI Uy-joy bozori indeksi iyul | 64 | 64 | ||

| 14:00 | USD | Biznes zaxiralari may | 0.40% | 0.50% |

Signal2forex.com - Eng yaxshi Forex robotlari va signallari

Signal2forex.com - Eng yaxshi Forex robotlari va signallari