It appears that the stock markets couldn’t care less about the last debate before US Presidential election. Major Asian indices are trading in right range with mild gains. Nevertheless, Yen is trying to lead Dollar for a comeback while European majors are losing their strong position. In particular, Euro is pressured against Sterling and Swiss Franc and it’s prone to deeper selloff. With PMIs from Eurozone and UK featured, we might see more volatility in the European session ahead.

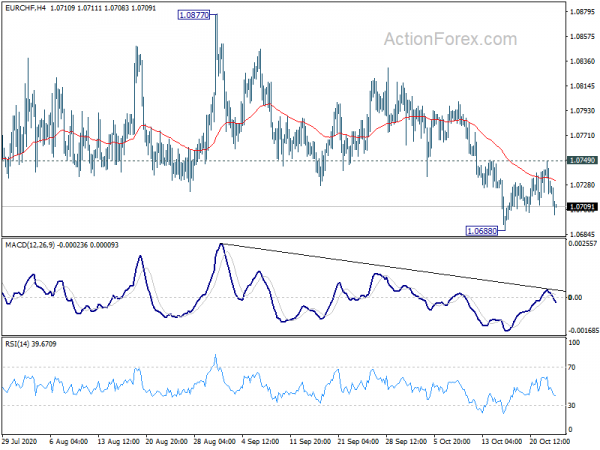

Technically, EUR/GBP and EUR/CHF are both worth a watch today. Break of 0.9007 temporary low in EUR/GBP will resume the corrective decline from 0.9291 high. While we’d expect strong support above 0.8866 support to contain downside, such development could cap Euro’s upside elsewhere. EUR/CHF was rejected by 1.0749 resistance, keeping near term outlook bearish. Focus is back on 1.0688 and break would extend the fall from 1.0877 to 1.0602 support. Nevertheless, it’s uncertain for now whether such development would drag down EUR/USD or USD/CHF more.

In Asia, currently, Nikkei is up 0.34%. Hong Kong HSI is up 0.71%. China Shanghai SSE is up 0.16%. Singapore Strait Times is up 0.24%. Japan 10-year JGB yield is up 0.0080 at 0.044. Overnight, DOW rose 0.54%. S&P 500 rose 0.52%. NASDAQ rose 0.19%. 10-year yield extended recent strong rally, rose 0.032 to 0.848.

Yaponiyaning PMI ishlab chiqarishi 48.0 gacha o'sdi, sekin tiklanish saqlanib qolishi mumkin

Yaponiya PMI ishlab chiqarish oktyabr oyida 48.0dan 47.7 ga biroz ko'tarildi, ammo kutilgan natijani 48.4 o'tkazib yubordi. Markitning ta'kidlashicha, bu "yanvar oyidan beri ishlab chiqarish sektori sog'lig'ining eng sekin pasayishi". PMI xizmatlari 46.6-ga tushib, sentyabrning 46.9-dan pastga tushdi. PMI Composite 0.1 ga ko'tarilib, 46.7 ga etdi.

IHS Markit-ning asosiy iqtisodchisi Bernade Aw: "tiklanish sust va kelgusi oylarda saqlanib qolishi mumkin, chunki COVID-19 holatlarining global qayta tiklanishi Yaponiya iqtisodiy faoliyatiga, ayniqsa tashqi qarama-qarshi sohalarga ta'sir qilishi mumkin".

Yaponiya CPI yadrosi -0.3% gacha ko'tarildi, olti oy davomida narxlar o'sishi kuzatilmadi

Yaponiya CPI yadrosi (barcha oziq-ovqat mahsulotlari) sentyabr oyida kutilganidan ko'ra avgust oyining -0.3% dan -0.4% gacha ko'tarildi. May oyidan beri olti oy davomida asosiy CPI ijobiy emas. Salbiy o'qishga asosan hukumatning sayohat uchun chegirma kampaniyasi sabab bo'ldi. Shunga qaramay, ushbu fakotni hisobga olgan holda, asosiy CPI tekis edi. Barcha CPI elementlari 0.0% gacha pasayib, 0.2% dan kam. CPI yadrosi (barcha oziq-ovqat mahsulotlari va energiya) 0.0% gacha, -0.1% gacha.

BoJ o'zining choraklik iqtisodiy istiqbolini 29-oktabr kuni e'lon qilingan bayonot bilan birga e'lon qiladi. Uchrashuvda hech qanday siyosat o'zgarishi kutilmaydi. Garchi inflyatsiya prognozlari Bosh vazir Yosixide Suganing "Go To Travel" kampaniyasining vaqtincha pasayish bosimini aks ettirish uchun pasaytirilishi mumkin.

UK signs trade deal with Japan, opens a pathway to TPP

In Tokyo today, UK International Trade Secretary Liz Truss and Japan Foreign Minister Toshimitsu Motegi formally signed a trade agreement, putting in pen the deal they agreed in principle back in September. That’s the first major trade deal UK came to since Brexit. The deal is seen as largely preserving the terms which UK traded with Japan as part of the EU. UK expected it to boost GDP by 0.07% over the next 15 years.

The deal “has a much wider strategic significance”, Truss hailed. “It opens a clear pathway to membership of the Comprehensive Trans-Pacific Partnership — which will open new opportunities for British business and boost our economic security.”

Avstraliyada CBA PMI kompozitsiyasi 53.6 ga ko'tarildi, ammo yangi ishbilarmonlik ko'tarilish chidamliligiga shubha tug'diradi

Avstraliya CBA PMI ishlab chiqarish sentyabr oyida 54.2dan pastga tushib, oktyabr oyida 55.4 ga tushdi. PMI xizmatlari 53.8 dan 50.8 ga ko'tarildi. PMI Composite 53.6dan 51.1 ga ko'tarildi.

IHS Markit-ning asosiy iqtisodchisi Bernard Avning aytishicha, cheklovlar yumshatilgandan so'ng "firmalar odatdagi bozor sharoitlarining qaytishini kutishmoqda" deb biznesga bo'lgan ishonch kuchayadi. Ammo biznesning "bo'ysundirilgan" yangi o'sishi "hozirgi ko'tarilishning chidamliligi" ga shubha tug'diradi. Firmalar "ishlatilmaydigan quvvat bilan o'ralgan", kompaniyalar yana "ishchi kuchini qisqartirgan".

Yangi Zelandiya CPI 0.7-choragida 3 foizga o'sdi, kutilmagan natijalar va RBNZ prognozi o'tkazib yuborildi

Yangi Zelandiya CPI III chorakda 0.7% qoq ko'tarilib, Q3 ning -2% qoqdan ijobiy tomonga o'zgargan, ammo kutilgan 0.5% qoqni o'tkazib yuborgan. Har yili CPI 0.9% gacha sekinlashdi, bu Q1.4 ning 2% gacha, 1.5% kutishni o'tkazib yubormadi. Alohida chiqarilgan, tarmoq omillari modeliga asoslangan RBNZ yadrosi CPI o'zgarmadi, har yili 1.7%.

Inflyatsiya ko'rsatkichlari RBNZ-ning avgust oyi MPS-da ko'rsatilgandek 1.1% qoq va 1.8% yillik prognozidan ancha past. Iqtisodiyot pandemiya pasayishidan yaxshi tiklanayotgandek ko'rinsa-da, inflyatsiya istiqbollari uchun xavflar salbiy tomoni aniq. Inflyatsiya yanada sekinlashishi kutilayotganligi sababli, ko'proq RBNZ yumshatish masalasi davom etmoqda. Salbiy stavkalar qachon qabul qilinishi vaqt masalasidir.

Oldinga qarab

The calendar is rather busy in European session with UK retail sales and PMIs, as well as Eurozone PMIs featured. US PMIs will be the focus later in the day.

EUR / CHF kundalik versiyasi

Kunlik pivotslar: (S1) 1.0712; (R) 1.0730; (R1) 1.0741; Ko'proq…

EUR/CHF drops sharply after being rejected by 1.0749 resistance, but stays above 1.0688 temporary low. Intraday bias remains neutral first and further decline is still expected. Fall from 1.0877 is seen as the third leg of the corrective pattern from 1.0915. Break of 1.0688 will target 1.0602 support next. However, on the upside, break of 1.0749 minor resistance will mix up the near term outlook again.

Kattaroq rasmda 1.0503 narxlari harakatlari hali ham konsolidatsiya modeli sifatida qaralmoqda. 1.1059 klaster qarshiligi bilan (38.2-dan 1.2004% retracement 1.0503-ga 1.1076-ga), 1.2004-dan pastga tushish tendentsiyasi (2018 yuqori) keyingi bosqichda 1.0503-ning eng past darajasiga qadar davom etadi. Shu bilan birga, 1.1059 / 76 ning doimiy tanaffusi 1.0503dan ko'tarilish yangi o'sish tendentsiyasini boshlayotganligini va 61.8 va undan yuqori darajadagi 1.1431% retracementni maqsad qilib qo'yishini ta'kidlaydi.

Iqtisodiy ko'rsatkichlar yangilanishi

| GMT | Ccy | Tadbirlar | haqiqiy | havo ma'lumoti | avvalgi | Qayta ko'rib chiqildi |

|---|---|---|---|---|---|---|

| 21:45 | NZD | CPI Q / Q Q3 | 0.70% | 0.90% | -0.50% | |

| 21:45 | NZD | CPI Y / Y Q3 | 1.40% | 1.70% | 1.50% | |

| 22:00 | AUD | CBA xizmatlari PMI Oct P | 53.8 | 50.8 | ||

| 22:00 | AUD | CBA ishlab chiqarish PMI Oct P | 54.2 | 55.4 | ||

| 23:01 | GBP | GfK iste'molchilar ishonchi Okt | -31 | -28 | -25 | |

| 23:30 | JPY | Milliy inflyatsiya indeksi Y / I | -0.30% | -0.40% | -0.40% | |

| 00:30 | JPY | Ishlab chiqarish PMI Oct P | 48 | 48.4 | 47.7 | |

| 06:00 | GBP | Chakana savdo sotish M / M Sentyabr | 0.60% | 0.80% | ||

| 06:00 | GBP | Chakana savdo Y / Y | 3.70% | 2.80% | ||

| 06:00 | GBP | Chakana savdosi sobiq yoqilg'i M / M sentyabr | 0.60% | 0.60% | ||

| 06:00 | GBP | Yoqilg'i quyish mavsumi Y / Y Sentyabr | 4.90% | 4.30% | ||

| 07:15 | Yevro | Frantsiya ishlab chiqarish PMI Oktyabr P. | 51 | 51.2 | ||

| 07:15 | Yevro | Frantsiya Xizmatlar PMI Okt P | 47 | 47.5 | ||

| 07:30 | Yevro | Germaniya ishlab chiqarish PMI Okt P | 55.5 | 56.4 | ||

| 07:30 | Yevro | Germaniya Xizmatlar PMI Okt P | 49 | 50.6 | ||

| 08:00 | Yevro | Eurozone ishlab chiqarish PMI Oktyabr P. | 53.1 | 53.7 | ||

| 08:00 | Yevro | Evro hududi xizmatlari PMI Oktyabr P. | 47 | 48 | ||

| 08:30 | GBP | Ishlab chiqarish PMI Oct P | 53.1 | 54.1 | ||

| 08:30 | GBP | Xizmatlar PMI Oct P | 54 | 56.1 | ||

| 13:45 | USD | Ishlab chiqarish PMI Oct P | 53.3 | 53.2 | ||

| 13:45 | USD | Xizmatlar PMI Oct P | 54.5 | 54.6 |

Signal2forex.com - Eng yaxshi Forex robotlari va signallari

Signal2forex.com - Eng yaxshi Forex robotlari va signallari