Strong rally in Chinese stocks is lifting Asian markets broadly higher today. Chinese president Xi Jinping is set to visit Italy, France and Monaco from March 21 to 26 this week. While there’s no detail on the visits yet, it’s believed that there could be signing of an agreement for Italy to join the Belt and Road infrastructure investment initiative. But while that might lift sentiments, the could look is still clouded by uncertainty in trade negotiations with the US. The highly anticipated Trump-Xi summit might only happen in April at the earliest, or in June alongside G20 summit in Japan, or might not happen at all.

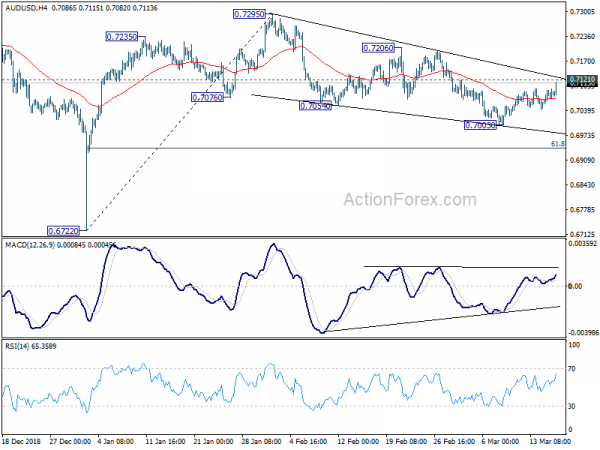

Nevertheless, the currency markets are following strong risk appetite with Australian Dollar leading other commodity currencies higher. Yen and Dollar are the weakest ones. Sterling is also sluggish ahead of another meaning vote on Brexit deal, most likely on Tuesday. Technically, an immediate focus is 0.7121 minor resistance in AUD/USD. Break will suggest that recent decline from 0.7295 has completed and further rise would likely be seen back to 0.7206 resistance at least.

In other markets, Nikkei is currently up 0.67%. Hong Kong HSI is up 0.73%. China Shanghai SSE is up 1.26%. Singapore Strait Times is up 0.41%. Japan 10-year JGB yield is down -0.0037 at 0.039.

UK Hammond: Significant number of colleagues changed minds and backed the Brexit deal

The UK Parliament will have meaningful vote on Prime Minister Theresa May’s Brexit deal for the third time this week. Ahead of that Chancellor of Exchequer Philip Hammond said a significant number of Conservatives have changed their mind last week to back the plan. And he expected more to come even though the government hasn’t had enough numbers yet. And, “it is a work in progress”.

Hammond said “What has happened since last Tuesday is that a significant number of colleagues, including some very prominent ones who have gone public, have changed their view on this and decided that the alternatives are so unpalatable to them that they on reflection think the prime minister’s deal is the best way to deliver Brexit,”

Last Tuesday, the Commons voted 391-242 to reject May’s “improved” deal. Back in January, the deal was voted down by 432-202.

BCC因脫歐和全球經濟放緩而下調英國成長預測

英國商會(BCC)下調了英國成長預測,理由是「由於英國脫歐持續不確定性和全球經濟成長預期放緩,商業投資和貿易前景疲軟」。 2019年成長預測從1.3%下調至1.2%。 2020年成長預測從1.5%下調至1.3%。 2021 年,成長率預計將小幅回升至 1.4%。

此外,BCC 指出,1.0 年商業投資預計將萎縮 -2019%。這將是自 2009 年金融危機以來十年來最疲軟的結果。BCC 指責「英國與歐盟未來關係的持續不確定性預計將繼續影響投資意向。”而且,“為無協議脫歐做準備的資源轉移以及在英國開展業務的高昂前期成本預計也將限制投資活動在短期內反彈的程度。”

Looking ahead, three central banks to meet, two to release minutes

Three central banks will meet this week, including Fed, SNB and BoE. BoJ and RBA will release meeting minutes too. Fed is expected to keep federal funds rate unchanged at 2.25-2.50%. “Patience” will remain the central tone of the statement and other communications. Fed might also announce the plan to end the balance sheet roll-off and that could catch some attentions. But main focus will be on the new economic projections. Since late December, Fed officials have sung a chorus indicating they’re in no hurry to lift interest rates unchanged. They finally have a chance to tell the markets the reasons for the change in stance with concrete numbers.

SNB is expected to keep the sight deposit rate at -0.75%. The three-month Libor target range should be held at -1.25% to -0.25% too. The central bank should also maintain that it’s necessary to keep interest rate negative and pledge to intervene in the forex markets when needed. Such measures will keep the attractiveness of Swiss franc investments low and reduce upward pressure on the currency.

預計英國央行還將維持銀行利率在0.75%不變。 資產購買目標應維持在 435B 英鎊。 英國央行還將重申,經濟前景將在很大程度上取決於英國脫歐的性質,無論是硬脫歐還是軟脫歐、突然脫歐還是順利脫歐。 此外,我們將重申,英國脫歐後的貨幣路徑不會是自動的,並且可能朝任一方向發展。

In addition to central bank activities, there are a number of economic data to watch too. Eurozone PMIs will give some hints on whether the slowdown in Eurozone has past its worst. UK CPI will also be watched but it’s likely to be overshadowed by Brexit vote and BoE. Downward surprises in Australian house price and job data will add to the case of two RBA rate cut this year. Canada CPI and retails sales could also be market moving.

- Monday: Japan trade balance; Eurozone trade balance; Canada foreign securities purchases; US NAHB housing index

- Tuesday: RBA minutes, Australia house price index; Swiss trade balance; UK employment; German ZEW; US factory orders

- Wednesday: BoJ minutes; German PPI; UK CPI, PPI, CBI orders; FOMC rate decision

- Thursday: New Zealand GDP; Australia employment; SNB rate decision; BoE rate decision; Canada wholesale sales; US Philly Fed survey, jobless claims

- Friday: Japan PMI manufacturing, national CPI core; Eurozone PMIs, current account; Canada CPI, retail sales; US PMIs, existing home sales, wholesale inventories

澳元/美元每日展望

每日樞軸:(S1)0.7066; (P)0.7082; (R1)0.7102; 更多…

AUD/USD rises strongly today and focus is now on 0.7121 minor resistance. Firm break there will argue that decline from 0.7295 has completed at 0.7003. In that case, further rise should be seen to 0.7206 resistance to confirm. More importantly, in that case, corrective three wave structure of the fall fro 0.7296 to 0.7003 would suggest that rise from 0.6722 low is extending through 0.7295. On the downside, though, break of 0.7003 will extend the fall from 0.7295 to 61.8% retracement of 0.6722 to 0.7295 at 0.6941 and below.

從更大的角度來看,只要0.7393阻力持續,我們就會將0.8135的下跌視為從1.1079(2011高點)恢復長期下跌趨勢。 決定性突破0.6826(2016低點)將確認這一看跌觀點,並恢復下行趨勢至0.6008(2008低點)。 然而,0.7393的堅定決定將證明0.8135的下跌已經完成。 來自0.6826的糾正模式已經開始第三回合,再次針對0.8135。

經濟指標更新

| GMT | CCY | 最新活動 | 實際 | 預測 | 前一頁 | 修訂 |

|---|---|---|---|---|---|---|

| 23:50 | JPY | 貿易餘額(日元)2月 | 0.12T | 0.09T | -0.37T | -0.29T |

| 0:01 | 英鎊 (GBP) | Rightmove 房價月月三月 | 企業排放佔全球 0.40% | 企業排放佔全球 0.70% | ||

| 4:30 | JPY | 工業生產 M/M Jan F | -3.40% | -3.70% | -3.70% | |

| 10:00 | 歐元 (EUR) | 歐元區貿易收支(歐元)1月 | 17.2B | 15.6B | ||

| 12:30 | CAD | 國際證券交易(加元)一月 | - 18.96B | |||

| 14:00 | USD | XNUMX 月 NAHB 住房市場指數 | 63 | 62 |

Signal2forex.com - 最佳外匯機器人和信號

Signal2forex.com - 最佳外匯機器人和信號