The Bank of Canada reiterated at its policy meeting on Wednesday that the economy will likely pick up growth in the second quarter of 2019. Market specialists, however, predict that GDP growth data could show early signs of recovery on Friday at 1230 GMT despite the global trade risks.

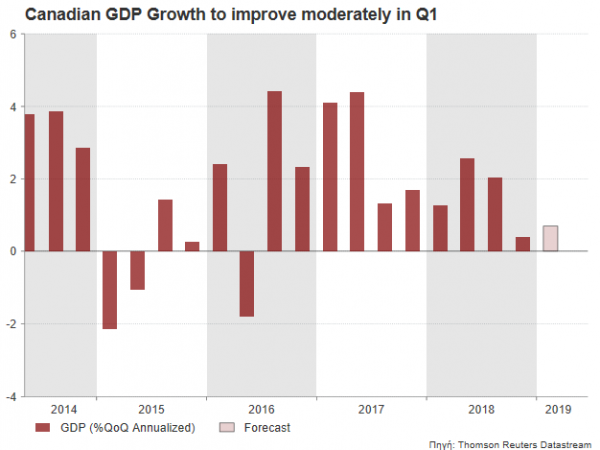

After recording the smallest expansion of 0.4% in more than two years in Q4, the Canadian annualized GDP growth is expected to have inched up to 0.7% q/q in the first three months of this year. While such an outcome would still undershoot the two-year average of around 2.4%, investors could raise their confidence in the economy as the continued jobs growth and further improvement in average hourly earnings shows that economic weakness in previous quarters was likely temporary.

The decision by the US administration to remove tariffs on Canadian aluminum and steel imports earlier this month provides additional reasoning why Canada could experience better days ahead. Getting rid of the tariffs, Canada could move with ratifying the new USMCA trade deal before national elections in October, creating a more fruitful environment for exports and investments. The endless trade dispute between Washington and Beijing, however, remains a source of uncertainty for the commodity-depended economy and a cause of caution for the BoC policymakers who wisely wait for all sides to secure an agreement before hiking rates. Note that trade relations between Canada and China are also at a freezing point after the arrest of Huawei’s finance chief in Vancouver in December on a US warrant.

In market reaction, the loonie may attract demand should GDP growth beat expectations, but gains could appear limited as the BoC has clearly signaled that steady interest rates are the appropriate policy for current conditions. In such a case, USDCAD could shift south to retest support between 1.3480 and 1.3440.

In the negative scenario, lower than expected readings could undermine hopes for a stronger economic recovery in the second quarter, helping USDCAD to reach resistance between 13520-1.3546. A bigger disappointment could also open the door for the 1.36 level.

Signal2forex.com - Best robots Forex sy famantarana

Signal2forex.com - Best robots Forex sy famantarana