The financial markets are generally steady today, with stock and bond markets bounded in tight range. Most major currency pairs and crosses are also staying inside yesterday’s range. Swiss Franc is currently the firmer one, followed by Sterling is mildly firmer on solid employment data, but upside is capped. Meanwhile, New Zealand Dollar leads Australian lower, followed by Euro. The common currency is awaiting ECB rate decisions later this week, where new round of stimulus is widely expected.

Technically, Yen crosses start to lose upside momentum but there is no clear sign of topping yet. As noted before, we’re treating current rebound in USD/JPY, EUR/JPY and GBP/JPY as corrective. Thus, we’d continue to watch for topping signal ahead. Both Australian and Canadian Dollars are also losing some upside momentum. But further rise remains in favor in AUD/USD as long as 0.6807 minor support holds. Also, further decline is expected in USD/CAD as long as 1.3247 minor resistance holds.

In Europe, currently, FTSE is down -0.16%. DAX is up 0.28%. CAC is down -0.09%. German 10-year yield is up 0.0163 at -0.568. Earlier in Asia, Nikkei rose 0.35%. Hong Kong HSI rose 0.01%. China Shanghai SSE dropped -0.12%. Singapore Strait Times rose 0.30%. Japan 10-year JGB yield rose 0.0308 to -0.225.

UK unemployment rate dropped to 3.8%, wage growth solid

UK unemployment rate dropped to 3.8% in the three months to July, down from 3.9% and beat expectation of 3.9%. That’s also the lowest level since 1974. estimated unemployment rate for men was at 4.0%, for women at 3.6%. Wage growth was also solid. Average weekly earnings including bonus rose 4.0% 3moy, above expectation of 3.7% 3moy. Weekly earnings excluding bonus slowed to 3.8% 3moy, matched expectations.

EU Hogan: Trump has to see the error of his ways and abandon reckless behavior

Phil Hogan, EU’s Agriculture Commissioner, urged US President Donald Trump to see the “error” of his protectionist way when it comes to trade negotiation with EU. Hogan is expected the be appointed by incoming European Commission president, Ursula von der Leyen, to be the next EU Trade Commissioner starting November 1.

Hogan told Irish national broadcaster RTE that “Mr Trump certainly has indicated his clear preference for trade wars rather than trade agreements. If he keeps up this particular dynamic of protectionism, I expect that the European Union will continue to forge deals around the world,”

“But obviously we are going to do everything we possibly can to get Mr Trump to see the error of his ways and hopefully that he will be able to abandon some of the reckless behavior that we have seen from him in relation to his relationship with China and describing the European Union as a security risk.”

Germany in position to counter economic crisis with many, many billions of euros

Finance Minister Olaf Scholz told the Bundestag lower house of parliament that “it will be very important for us as the largest economy in the middle of the European Union, whether we are actually able to counteract a negative economic trend”.

And, “with the solid financial foundations we have today, we are in a position to counter an economic crisis with many, many billions of euros if one actually breaks out in Germany and Europe.” He added, “we’ll really do it then, it’s Keynesian economics, if you want to put it that way, it’s an active policy against the crisis.”

He also urged US and China to resolve their trade tension quickly. He told the parliament that “everywhere in the world companies are waiting to finally get a positive signal that things are moving in another direction again so they can finally invest.” And, “it is urgently necessary for the U.S. and China to reach an agreement in the trade dispute,” he added.

آسٽريليا نيب جي ڪاروباري حالت ۽ اعتماد ختم ٿي ويو

آسٽريليا نيب ڪاروباري اعتماد آگسٽ ۾ 1 تائين گهٽجي ويو، 4 کان هيٺ. ڪاروباري حالت 1 کان گهٽجي ويو، 3 کان هيٺ. ٻئي پڙهائي ڊگهي هلندڙ اوسط کان هيٺ آهن. ۽ نتيجو اهو ظاهر ڪري ٿو ته "ڪاروباري شعبي ۾ رفتار ڪمزور ٿي رهي آهي، ٻنهي اعتماد ۽ حالتن سان گڏ 2018 ۾ ڏٺو ويو سطح کان هيٺ". نيب وڌيڪ شامل ڪيو ته نتيجا "Q2 قومي اڪائونٽس ۾ خانگي شعبي جي ڪمزور نتيجن جي مطابق آهن، اسان کي سود جي شرح لاء اسان جي نقطه نظر جو جائزو وٺڻ جي ترغيب ڏني".

Released earlier, Japan machine tools orders dropped -37.1% yoy in August. Japan M2 rose 2.4% yoy in August, matched expectations. China CPI was unchanged at 2.8% yoy in August, above expectations of 2.6% yoy. PPI dropped further to -0.8% yoy, down from -0.3% yoy, but beat expectations of -0.9% yoy.

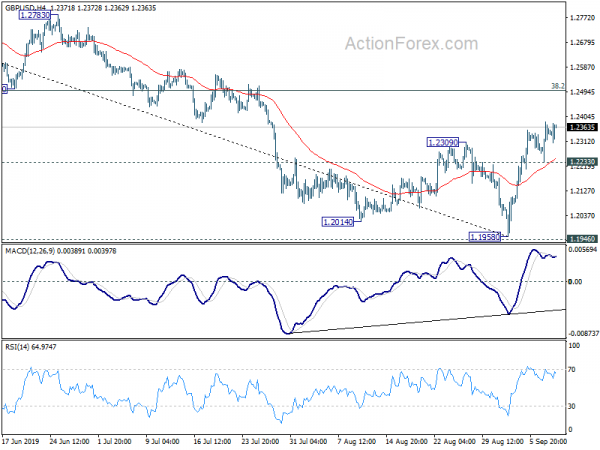

GBP / آمريڪي مڊ ڏينهن جو Outlook

روزاني پيوٽ: (S1) 1.2257؛ (P) 1.2321؛ (R1) 1.2407؛ وڌيڪ….

Intraday bias in GBP/USD remains mildly on the upside with 1.2233 minor support intact. Rebound from 1.1958 short term bottom is still in progress. Further rise would be seen to 38.2% retracement of 1.3381 to 1.1958 at 1.2502 first. Break will target 61.8% retracement at 1.2837. On the downside, however, break of 1.2233 minor support will turn bias back to the downside for 1.1958 support instead.

وڏي تصوير ۾، اسان 1.1946 (2016 گھٽ) جي ڀرسان وچولي مدت جي هيٺان تي محتاط رهنداسين. 55 هفتي EMA مٿان مسلسل واپار (هاڻي 1.2779 تي) 1.1946 کان 1.4376 مزاحمت تائين هڪ ٻي اڀار سان گڏ استحڪام جي نموني کي وڌايو ويندو. ان جي باوجود، 1.1946 جو فيصلو ڪندڙ وقفو 2.1161 (2007 هاء) کان 61.8 تي 1.7190 کان 1.1946 کان 1.4376 تائين 1.1135٪ پروجئشن کان هيٺ رجحان ٻيهر شروع ڪندو.

اقتصادي اشارن جي تازه ڪاري

| GMT | سي سي | سرگرمين | اصل ۾ | اڳڪٿي | نظارو | سڌاريل |

|---|---|---|---|---|---|---|

| 23:50 | JPY | جاپان مني اسٽاڪ M2+CD Y/Y آگسٽ | 2.40٪ | 2.40٪ | 2.40٪ | 2.30٪ |

| 01:30 | CNY | CPI Y/Y آگسٽ | 2.80٪ | 2.60٪ | 2.80٪ | |

| 01:30 | CNY | PPI Y/Y آگسٽ | -0.80٪ | -0.90٪ | -0.30٪ | |

| 01:30 | AUD | نيب ڪاروباري اعتماد آگسٽ | 1 | 4 | ||

| 01:30 | AUD | نيب ڪاروباري حالتون آگسٽ | 1 | 2 | ||

| 06:00 | JPY | مشين ٽول آرڊر Y/Y Aug P | -37.10٪ | -33.00٪ | ||

| 08:30 | GBP | بيروزگار دعوائون تبديل ٿي آگسٽ | 28.2K | 29.3K | 28.0K | 19.8K |

| 08:30 | GBP | دعويدار ڳڻپ جي شرح آگسٽ | 3.30٪ | 3.20٪ | ||

| 08:30 | GBP | ILO بيروزگاري جي شرح 3 مھينا جولاء | 3.80٪ | 3.90٪ | 3.90٪ | |

| 08:30 | GBP | سراسري هفتيوار آمدني 3M/Y Jul | 4.00٪ | 3.70٪ | 3.70٪ | 3.80٪ |

| 08:30 | GBP | هفتيوار آمدني اڳوڻو بونس 3M/Y Jul | 3.80٪ | 3.80٪ | 3.90٪ | |

| 10:00 | ناشر | NFIB Small Business Optimism Aug | 103.1 | 103.5 | 104.7 | |

| 12:15 | CAD | هائوسنگ شروع ٿئي ٿو آگسٽ | 227K | 213K | 222K | |

| 12:30 | CAD | بلڊنگ پرمٽس M/M Jul | 3.00٪ | 2.10٪ | -3.70٪ | -3.10٪ |

Signal2forex.com - بهترين فاریکس روبوٽ ۽ سگنل

Signal2forex.com - بهترين فاریکس روبوٽ ۽ سگنل