Dollar is back in selloff mode in early US session after slightly worse than expected jobless claims numbers. Though, at the time of writing, Yen underperforms mildly. On the other hand, buying focus is back on commodity currencies today. Australian Dollar is leading others higher. European majors are generally mixed. European indices are mixed for now while US futures point to just slightly higher top. Trading could be relatively subdued.

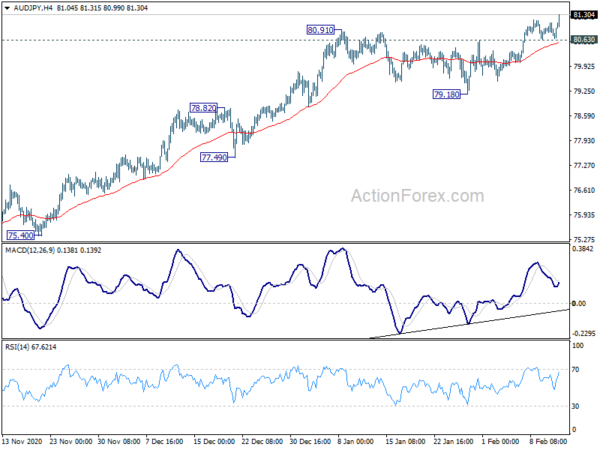

Technically, AUD/JPY is leading other commodity-yen crosses for the moment, resuming near term rally after brief consolidations. Further rise is now expected as long as 80.63 minor support holds, for 61.8% projection of 59.89 to 78.46 from 73.13 at 84.60. Eyes will also be on 82.69 temporary top in CAD/JPY and 76.12 temporary top in NZD/JPY.

In Europe, currently, FTSE is flat. DAX is up 0.70%. CAC is up 0.05%. Germany 10-year yield is down -0.027 at -0.462. Earlier in Asia, Nikkei rose 0.19%. Hong Kong HSI rose 0.45%. China Shanghai SSE rose 1.43%. Singapore Strait Times dropped -0.01%. Japan 10-year JGB yield rose 0.0096 to 0.080.

Počiatočné nároky na nezamestnanosť v USA klesli na 793 tis

US initial jobless claims dropped -19k to 793k in the week ending February 6, above expectation of 775k. Four-week moving average of initial claims dropped 33.5k to 823k.

Continuing claims dropped -145k to 4545k in the week ending January 30. Four-week moving average of continuing claims dropped -158k to 4749k.

European Commission expects economy to return to pre-crisis levels earlier

In the Winter 2021 Economic Forecast, European Commission downgraded 2021 growth projection of EU to 3.7% (from Autumn’s 4.1%) and Eurozone to 3.8% (from 4.2%. But it upgraded 2022 growth projection of EU to 3.9% (from 3.0%) and Eurozone to 3.8% (from 3.0%).

Eurozone and EU economies are now expected to reach pre-crisis levels “earlier than anticipated” in Autumn, “largely because of the stronger than expected growth momentum projected in the second half of 2021 and in 2022.”. Growth is “set to resume in the spring and gather momentum in the summer as vaccination programmes progress and containment measures gradually ease.” Inflation, however, is set to remain subdued.

Valdis Dombrovskis, Executive Vice-President for an Economy that Works for People said: “Today’s forecast provides real hope at a time of great uncertainty for us all. The solid expected pick-up of growth in the second half of this year shows very clearly that we are turning the corner in overcoming this crisis.”

Paolo Gentiloni, Commissioner for Economy said: “Europeans are living through challenging times. We remain in the painful grip of the pandemic, its social and economic consequences all too evident. Yet there is, at last, light at the end of the tunnel. As increasing numbers are vaccinated over the coming months, an easing of containment measures should allow for a strengthening rebound over the spring and summer.”

ECB Villeroy: Green central bank action is not about easing

ECB Governing Council member Francois Villeroy de Galhau said he proposed to “decarbonizing the ECB’s balance sheet with a pragmatic, progressive and targeted approach to all corporate assets whether they be held on the central bank’s balance sheet as purchases or taken as collateral.”

Villeroy noted that the stagflationary nature of climate change was the reason to take it into account. It could challenge the price stability mandate by pushing up prices while weighing on the economy.

Though, he also noted, “the greening of central bank action is not about additional monetary policy easing but recalibrating our tools”.

RBA Harper: V ekonomike je stále veľa prebytočnej kapacity

Člen predstavenstva RBA Ian Harper povedal, že v ekonomike je „stále veľa prebytočnej kapacity“. Tendencia monetárnych stimulov vytvárať bublinu cien aktív je „ďaleko tam, kam v súčasnosti smerujeme“. Politici skutočne chceli, aby sa ceny aktív zvyšovali, aby sa urýchlili investície. Harper dodal: "Banka môže pokračovať v nákupe dlhopisov, ako dlho chce, nie je v tom žiadna prekážka."

"Nedávne zmeny, ktoré urobil Fed, ich priviedli tam, kde v podstate sme," povedal. "Nikdy sme nábožensky alebo rigidne neinterpretovali časový rámec, počas ktorého by sme sa snažili, aby miera inflácie bola v cieľovom pásme."

Výhľad v polovici dňa EUR / USD

Denné otáčky: (S1) 1.2103; (P) 1.2124; (R1) 1.2138; Viac ...

Intraday bias in EUR/USD remains on the upside for 1.2188 resistance. As noted before, corrective fall from 1.2348 should have completed with three waves down to 1.1951. Break of 1.2188 resistance will bring retest of 1.2348 high. On the downside, below 1.2087 minor support will dampen this bullish case and turn intraday bias neutral first.

Vo všeobecnejšom obraze sa nárast z 1.0635 považuje za tretiu časť modelu z 1.0339 (minimum z roku 2017). Ďalej bolo vidieť, že rezistencia klastrov je o 1.2555 ďalej (38.2% retracement 1.6039 na 1.0339 o 1.2516). Toto zostane zvýhodneným prípadom, pokiaľ bude platiť podpora 1.1602 1.2516. Boli by sme upozornení na polevu okolo 55/XNUMX. Trvalý zlom však bude mať dlhodobé býčie dôsledky.

Aktualizácia ekonomických indikátorov

| GMT | CCY | diania | Aktuálne | Predpoveď | predchádzajúce | revidovanej |

|---|---|---|---|---|---|---|

| 00:00 | AUD | Očakávania inflácie spotrebiteľov február | 3.70% | 3.40% | ||

| 13:30 | USD | Počiatočné žiadosti o zamestnanie (5. februára) | 793K | 775K | 779K | 812K |

| 15:30 | USD | Skladovanie zemného plynu | -180B | -192B |

Signal2forex.com - Najlepšie Forex roboty a signály

Signal2forex.com - Najlepšie Forex roboty a signály