Yen, Swiss Franc and Dollar weaken mildly today as risk markets stabilized. On the other hand, commodity currencies recover generally. But the movements are so far limited. Investors remain vigilant on the development of China’s Wuhan coronavirus outbreak, but there is no breakthrough in either direction yet. FOMC minutes will be a focus today but inspirations from there is unlikely. We’d expect the trend of weak Euro and strong Dollar.

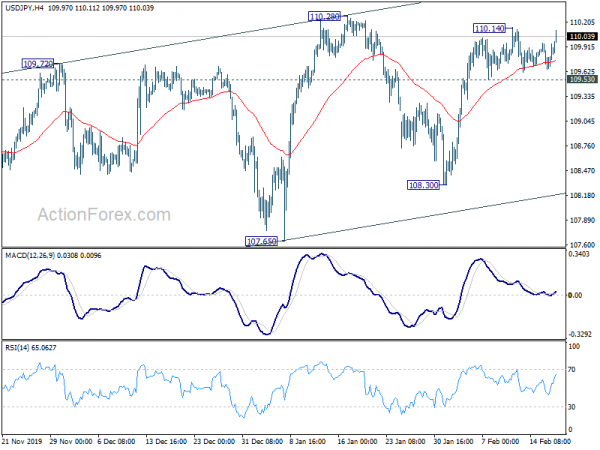

Technically, USD/JPY recovers strongly today and focus is back on 110.14 temporary top. Break there will target 110.28 resistance. Break will confirm resumption of whole rise from 104.45. EUR/GBP is still holding above 0.8276 low. But there is no sign of sustainable rebound yet. Firm break there will resume whole fall from 0.9324.

In Asia, currently, Nikkei is up 1.02%. Hong Kong HSI is up 0.44%. China Shanghai SSE is up 0.30%. Singapore Strait Times is up 0.68%. Japan 10-year JGB yield is up 0.008 at -0.042. Overnight, DOW dropped -0.56%. S&P 500 dropped -0.29%. NASDAQ rose 0.02%. 10-yaer yield dropped -0.032 to 1.556.

Fed Kaplan expect solid growth this year, interest rate roughly appropriate

Dallas Fed President Robert Kaplan said yesterday that he expects US to have “solid” growth this year. And, “based on my base-case outlook for the U.S. economy, the current setting of the federal funds rate at 1.5 to 1.75 percent is roughly appropriate.”

Kaplan saw boosts to the economy from ratification of the USMCA, trade deal phase one with China, and clarity over Brexit. And, “these developments, combined with a strong U.S. consumer … should lead to solid growth in 2020.” Though, he added that he will continue to monitor risks, in particular from China’s coronavirus. But, “still too soon to predict with confidence the ultimate impact of this virus on the US and global economies.”

FOMC minutes will be featured today they’re unlikely to deliver any deviation from chair Jerome Powell’s press conference. The minutes will likely repeat the message that policy is in a good place and Fed is in wait-and-see mode, monitoring the effect of last year’s three rate cuts, as well as the play out of global risks.

WHO Tedros warned coronavirus is public enemy number one

WHO Director-General Tedros Adhanom Ghebreyesus warned yesterday that China’s Wuhan coronavirus, or COVID-19, is the “public enemy number one”. And, “viruses can have more powerful consequences than any terrorist action.” The first vaccine is estimated to be 18 month from now. AT this point, Tedros said there have been 92 cases of human-to-human transmission in 12 countries outside China. But the WHO had not seen sustained local transmission yet, except in specific cases like the Diamond Princess liner.

Some experts estimated that each infected person would transmit the virus to about 2.5 other people. That would result in an attack rate of 60-80%. Prof Gabriel Leung, the chair of public health medicine at Hong Kong University, said in London that “60% of the world’s population is an awfully big number.” He added: “We need to get a clear view of the contagion and plug the holes in our understanding of the disease to inform public health decisions that affect hundreds of millions of lives.”

According to China’s National Health Commission, on February 18, Wuhan coronavirus cases added 1749 to 74185. Death tolls added 136 to 2004.

RBNZ Orr: Potešujúce, aká odolná bola novozélandská ekonomika

Guvernér RBNZ Adrian Orr dnes Výboru pre financie a výdavky povedal, že je „potešujúce, aká odolná bola novozélandská ekonomika“ počas „obdobia oslabovania globálneho rastu a zvýšenej globálnej neistoty“. Dodal, že menová politika je „v dobrej pozícii“, pričom inflácia je v „strednom bode nášho inflačného cieľa“. Zamestnanosť je tiež „na alebo mierne nad“ maximálnou udržateľnou zamestnanosťou.

Orr tiež povedal, že RBNZ je „dobre pokročilá v chápaní toho, ako by sme splnili svoj mandát menovej politiky, ak by sme sa priblížili k nulovým úrokovým sadzbám“. Centrálna banka zverejní prácu na týchto alternatívnych prístupoch menovej politiky v najbližších týždňoch, „aj keď neočakávame, že ich použijeme“.

Na fronte údajov

Australia Westpac leading index rose 0.1% mom in January. Wage price index rose 0.5% qoq in Q4, matched expectations. Japan trade deficit widened to JPY -0.22T in January. Machine orders dropped -12.5% mom in December versus expectation of -0.9% mom.

UK inflation data will be the main focus in European session, with CPI, RPI and PPI featured. Later in the day, US will release PPI, housing starts and building permits. Canada will release CPI.

Denný výhľad USD / JPY

Denné otáčky: (S1) 109.71; (P) 109.83; (R1) 110.00; Viac ..

USD/JPY recovers notably today but stays below 110.14 temporary top. Intraday bias remains neutral first. Further rise remains in favor as long as 109.53 minor support holds. Firm break of 110.28 will resume whole rally from 104.45 for channel resistance (now at 111.16). On the downside, however, break of 109.53 will turn bias to the downside for 108.30 support instead.

Na väčšom obrázku sa medvedí výhľad nevyskytuje, a to ani napriek zotaveniu z 104.45. Pár ostáva v dlhodobo klesajúcom kanáli, ktorý sa začal na 118.65 (december 2016). Nárast z 104.45 sa považuje za korekciu a klesajúci trend by sa mohol stále zvyšovať až na 104.45. Trvalé prerušenie rezistencie kanála však bude dôležitým znakom býčieho zvratu a cieľovej rezistencie 114.54 na potvrdenie.

Aktualizácia ekonomických indikátorov

| GMT | CCY | diania | Aktuálne | Predpoveď | predchádzajúce | revidovanej |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Vedúci index Westpac M / M Jan | 0.10% | 0.10% | 0.00% | |

| 23:50 | JPY | Obchodná bilancia (JPY) Jan | -0.22T | -0.10T | -0.11T | |

| 23:50 | JPY | Objednávky strojov M / M Dec | -12.50% | -9.00% | 18.00% | |

| 0:30 | AUD | Index miezd Q / Q Q4 | 0.50% | 0.50% | 0.50% | |

| 9:00 | EUR | Bežný účet eurozóny (EUR) Dec | 34.5B | 33.9B | ||

| 9:30 | GBP | DCLG Index cien nehnuteľností medziročne dec | 2.30% | 2.20% | ||

| 9:30 | GBP | CPI M / M Jan | -0.50% | 0.00% | ||

| 9:30 | GBP | CPI Y / Y Jan | 1.40% | 1.30% | ||

| 9:30 | GBP | CPI Core Y / Y Jan | 1.40% | 1.40% | ||

| 9:30 | GBP | RPI M / M Jan | -0.70% | 0.30% | ||

| 9:30 | GBP | RPI Y / Y Jan | 2.40% | 2.20% | ||

| 9:30 | GBP | PPI vstup M / M Jan | -0.40% | 0.10% | ||

| 9:30 | GBP | Vstup PPI Áno Jan | 3.50% | -0.10% | ||

| 9:30 | GBP | PPI výstup M / M Jan | -0.10% | 0.00% | ||

| 9:30 | GBP | Výstup PPI Áno Jan | 1.20% | 0.90% | ||

| 9:30 | GBP | PPI výstupné jadro M / M Jan | 0.10% | -0.10% | ||

| 9:30 | GBP | Výstup PPI Core Y / Y Jan | 0.60% | 0.90% | ||

| 13:30 | USD | Stavebné povolenia Jan | 1.450M | 1.420M | ||

| 13:30 | USD | Bývanie začína Jan | 1.390M | 1.608M | ||

| 13:30 | USD | PPI M / M Jan | 0.20% | 0.10% | ||

| 13:30 | USD | PPI Y / Y Jan | 1.40% | 1.30% | ||

| 13:30 | USD | PPI Core M / M Jan | 0.20% | 0.10% | ||

| 13:30 | USD | PPI Core Y / Y Jan | 1.20% | 1.10% | ||

| 13:30 | CAD | CPI M / M Jan | 0.30% | 0.00% | ||

| 13:30 | CAD | CPI Y / Y Jan | 2.20% | 2.20% | ||

| 13:30 | CAD | CPI spoločné Y / Y Jan | 2.00% | 2.00% | ||

| 13:30 | CAD | CPI Medián Y / Y Jan | 2.20% | 2.20% | ||

| 13:30 | CAD | CPI Orezané Y / Y Jan | 2.20% | 2.10% | ||

| 19:00 | USD | FOMC Zápis |

Signal2forex.com - Najlepšie Forex roboty a signály

Signal2forex.com - Najlepšie Forex roboty a signály