Dollar trades broadly higher today as helped by the rebound in US treasury yields. 10 year yield closed up 0.042 at 2.937 overnight. With a base formed at 2.759 last week, TNX will likely head higher to 3.000 handle. The development would be dollar supportive in near term. Meanwhile, Australia Dollar is paring back some of this week’s surprised gains after RBA left cash rate unchanged 1.50% as widely expected. The accompanying statement is largely unchanged from the prior one. RBA reiterated again that pickup in wage growth and inflation will be gradual. Also, the central bank maintained a neutral stance, refraining from indicating a tightening bias.

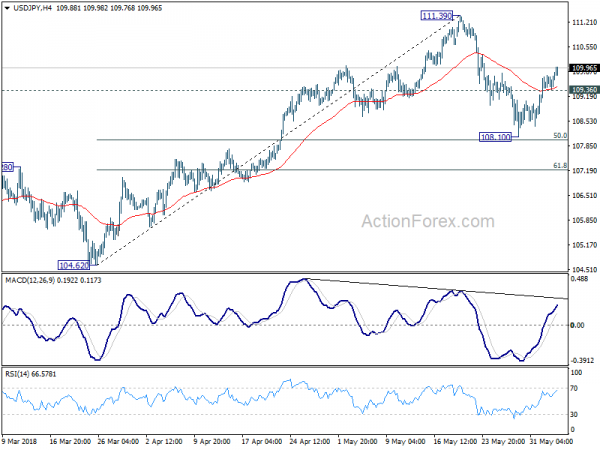

Technically, USD/JPY’s break of 109.82 minor resistance revived bullishness in the pair and more upside could be seen in near term back to 111.39 high. A question is whether the rebound in USD/JPY would take EUR/JPY and GBP/JPY higher through key near term resistance levels at 128.94 and 147.04 respectively. On the other hand, recovery in EUR/USD and GBP/USD appear to have lost steam. Focus will be back on 1.1617 minor support in EUR/USD and 1.3253 in GBP/USD. So it could be the weakness in EUR/USD and GBP/USD that drag down EUR/JPY and GBP/JPY. It’s very interactive.

BoE Tenreyro stood pat in may to wait a little more

– advertisement –

BoE MPC member Silvana Tenreyro said yesterday that “much of the downside Q1 GDP news is likely to be erratic”. However, that still increased the “possibility of some underlying weakness in demand”. Back in the May meeting, Tenreyo said the costs of waiting-and-see for a short period were relatively slow. And BoE will likely get a “significantly clearer picture of the underlying strength of domestic demand quite soon”. Therefore, there were “to leaving policy unchanged.” Overall, Tenreyo said “while I anticipate that a few rate rises will be needed, the timing of those rate rises is an open question.”

Tenreyro’s messages were consistent with BoE’s own forecast in the inflation report that there would be a rate hike in August. That is, BoE opted to wait a little while more in May till August to make a decision. And, that is data dependent.

IMF: Canada outlook subjects to significant risks, domestic and external

In a report released yesterday, IMF noted that the 3% growth in 2017 in Canada was the highest among G7 nations in the year. But going ahead, the economic outlook is subject to “significant risks, domestic and external”.

Domestically, a key risk is sharp correction in the housing market. That could be triggered by a “sudden shift in price expectations or a faster-than-expected increase in mortgage interest rates”. And, the banking system is “heavily exposed to household and corporate debt.” Thus, if housing correction is accompanied by rise in unemployment and sharp contraction in private consumption, “risks to financial stability and growth could emerge”.

Externally, the medium term impact of US tax cuts could make Canada a “less attractive destination for investment”. Failure to reach a NAFTA agreement within a reasonable timeframe could impact investment and growth for an “extended period”. And return to WTO rules could cut GDP growth by -0.4%. Other external risks include weaker growth in key advanced economies, sharp slowdown in China, tighter global financial conditions.

Regarding monetary policy, IMF said BoC should tighten “gradually” as “inflationary pressures are building and higher interest rates will help activity and inflation converge toward more sustainable levels.” But the current balance of risks warrants “gradual policy normalization.”

NZ Treasury: Q1 growth may fall short of 0.7% forecast

In the Monthly Economic Indicator report published today, New Zealand Treasury noted that the tracking of March quarter data suggested real GDP growth may fall short of 0.7% as forecast in the Budget Economic and Fiscal Update (BEFU) 2018. Nonetheless, June quarter activity indicators have been “a little more positive”. Subdued wage pressures are likely contributing to low inflation, and the expectation that RBNZ will keep OCR at 1.75% “for some time to come”.

Risks are skewed to the downside as led by international developments. In particular, the Treasury noted slowdown in Japan, Eurozone and UK in Q1. And it warned that political instability in Italy will drag Eurozone growth further. Nonetheless, the outlook for China and the US “remains relatively positive”.

On the data front

Japan household spending dropped -1.3% yoy in April versus expectation of 0.8% mom. China Caixin PMI services was unchanged at 52.9 in May. Australia current account deficit narrowed to AUD -10.5B in Q1. UK BRC retail sales monitor rose 2.8% yoy in May.

Services data are the major focuses today. In particular, UK PMI services is expected to rise 0.1 in May to 52.9. Eurozone will also release PMI services final. Later in the day, US will release ISM non-manufacturing while Canada will release labor productivity.

USD/JPY Daily Outlook

Daily Pivots: (S1) 109.50; (P) 109.69; (R1) 110.02; More…

Breach of 109.82 minor resistance suggests that pull back from 111.39 has completed at 108.10 already. ahead of 50% retracement of 104.62 to 111.39. The development revived that case that rebound from 104.62 is still in progress. Intraday bias is back on the upside for 111.39 first. Break will target a test on 114.73 key resistance level. On the downside, though, below 109.36 minor support will delay the bullish case and turn bias neutral again.

In the bigger picture, at this point , we’re slightly favoring the case that corrective decline from 118.65 (2016 high) has completed with three waves down to 104.62. Above 111.39 will affirm this view and target 114.73 for confirmation. However, it should be noted that USD/JPY is bounded in medium term falling channel from 118.65 (2016 high). Sustained break of 61.8% retracement of 104.62 to 111.39 at 107.20 will likely resume the fall from 118.65 through 104.62 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Retail Sales Monitor Y/Y May | 2.80% | -4.20% | ||

| 23:30 | JPY | Household Spending Y/Y Apr | -1.30% | 0.80% | -0.70% | |

| 01:30 | AUD | Current Account (AUD) Q1 | -10.5B | -9.9B | -14.0B | -14.7B |

| 01:45 | CNY | Caixin PMI Services May | 52.9 | 53 | 52.9 | |

| 04:30 | AUD | RBA Rate Decision | 1.50% | 1.50% | 1.50% | |

| 07:45 | EUR | Italy Services PMI May | 52.9 | 52.6 | ||

| 07:50 | EUR | France Services PMI May F | 54.3 | 54.3 | ||

| 07:55 | EUR | Germany Services PMI May F | 52.1 | 52.1 | ||

| 08:00 | EUR | Eurozone Services PMI May F | 53.9 | 53.9 | ||

| 08:30 | GBP | Services PMI May | 52.9 | 52.8 | ||

| 09:00 | EUR | Eurozone Retail Sales M/M Apr | 0.50% | 0.10% | ||

| 12:30 | CAD | Labor Productivity Q/Q Q1 | 0.30% | 0.20% | ||

| 13:45 | USD | US Services PMI May F | 55.7 | 55.7 | ||

| 14:00 | USD | ISM Non-Manufacturing Composite May | 57.4 | 56.8 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals