Australian Dollar Extends Losses

FX Intervention: Risks for Solos, Not Yet for Accords

More Turmoil to Come?

EUR/USD Due for a Corrective Bounce?

Week Ahead: Central Bank Fallout, More Pain for the Pound, and Inflation Data

Week Ahead – Recession Fears Mounting

Weekly Economic & Financial Commentary: Shot Across the Bow, Japan Intervenes Against Surging Dollar

The Weekly Bottom Line: The FOMC Aims High

Yen Settles Down after Wild Ride

Global September Preliminary PMIs and Economic Outlook

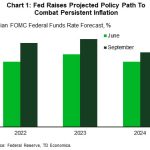

FOMC Hikes Policy Rate by 75 Basis Points, Signals Many More to Come

Pound Falls to New 37-year Low, Fed Looms

Another Fed Hike is Coming; Mind the Dots

Week Ahead: It’s all about the FOMC and the BOE

Cost of Prematurely Crying Victory

UK Inflation to Accelerate; What Does this Mean for the Pound?

Week Ahead: It’s All About the Data!

US CPI Preview: Inflation Could Fall to 8%, but the Fed isn’t Slowing Down Yet

King Dollar Feeds Off Aggressive Fed

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals