Daniel Kahneman, a Nobel Prize-winning economist, said Tuesday financial advisors still play a major role in the finance world — despite recent technological disruptions in the industry — as they act as therapists for investors.

As an advisor, you have to find out “what the client’s needs are, what the client’s capabilities are in terms of taking risks,” as well as their dreams and fears, Kahneman, known for his work in behavioral economics, said in a keynote at the Morningstar Investment Conference in Chicago. “When bad things happen, you have to be there. [Clients] need to have a sense that there’s someone that they trust and has their interests in mind and who knows what they want.”

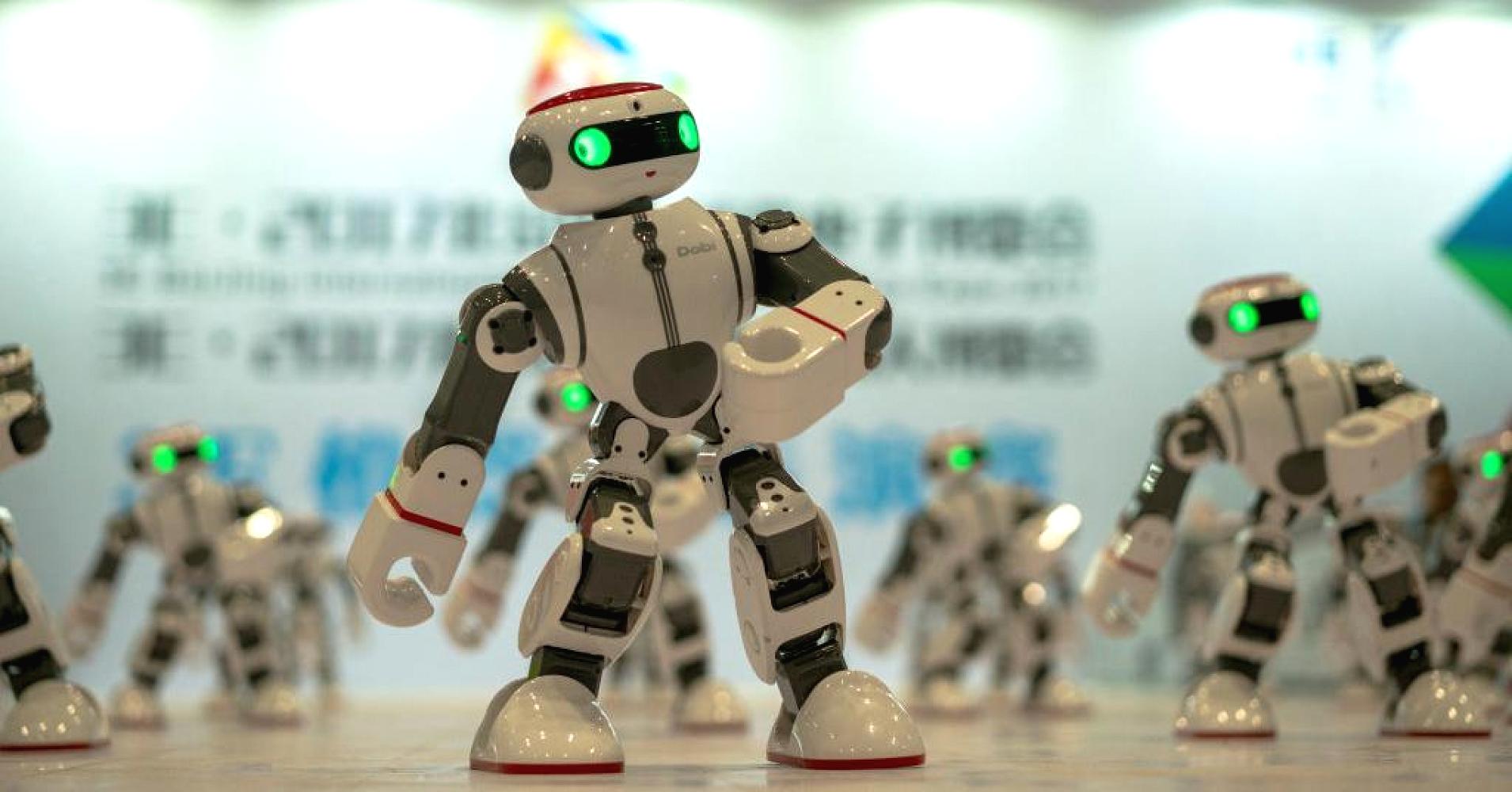

In recent years, the financial industry has been disrupted by technological advances that have led to job losses as well as lower fees for advisors. One of the biggest disruptions has been the rise in so-called robo-advisors, which provide financial advice to investors with next to no human interaction and at a far lower price.

Robo-advisors are also growing at a very fast rate, surpassing $200 billion in assets under management last year, according to BackEnd Benchmarking, which releases quarterly data on robo-advisors. Other major wealth management firms have developed their own internal versions of robo-advisors.

Still, Kahneman said, “There is a hand-holding function” for advisors which is “very important.” Kahneman won the Nobel in 2002 for his work in behavioral economics.

The Nobel laureate also said he is researching “unsystematic errors,” which refer to random mistakes made by individuals or a group of people.

“During my career, I’ve done a lot of work on systematic errors that people make,” Kahneman said. “In recent years, I’ve become more convinced that there is something more important than systematic error. That’s unsystematic error. We call that noise.”

Kahneman gave an example of two insurance underwriters presented with the same case in a study to illustrate his point. In theory, there should be about a 10 percent difference between the two estimates provided by the underwriters. However, that difference totaled 50 percent.

“There’s a lot of noise when making a decision. Not in the decision itself, but in the making of the decision,” he said. “It is possible that an algorithm, and even an unsophisticated algorithm, will do better because the main characteristic of algorithms is they’re noise-free. You give them the same problem twice, you get the same result. People don’t.”

Link to the source of information: www.cnbc.com

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals