The forex markets are generally in range today except New Zealand Dollar, which tumbles broadly following business confidence data. The US continued to step up its verbal attack on trade partners, but the financial markets are not too bothered about it. Asian indices are mixed with Nikkei trading nearly flat at the time of writing. Chinese stocks are leading HK stocks down, both at around -0.5%. Singapore Straits Time index is up 0.17%. WTI crude oil is staying above 70 handle with this wee’s rally. Meanwhile, gold extends recent sharp decline and hits as low as 1253 so far.

For the week, Yen remains the strongest one even though it’s limited below last week’s high against all but Kiwi. Dollar and Euro are taking turns to be the second strongest. Commodity currencies are generally lower with Kiwi leading the decline ahead of RBNZ rate decision. There is little chance for RBNZ to turn more upbeat in its statement.

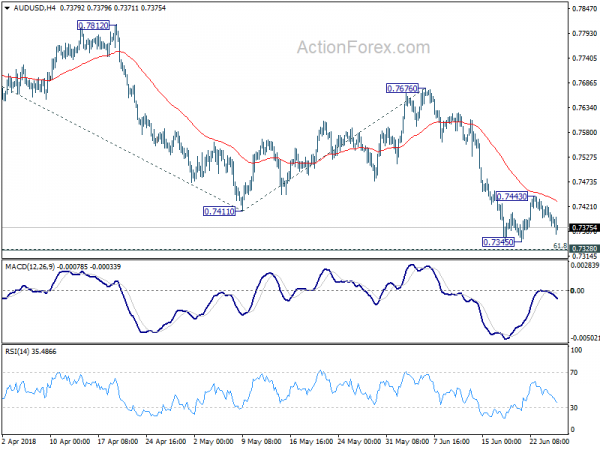

Technically, 1.1628 minor support in EUR/USD is a focus today. Break there should indication completion of this week’s rebound and could send the pair back to 1.15. The rebounds in Australian Dollar and Canadian Dollar against the US Dollar are both disappointing. Focus could be back on 0.7345 in AUD/USD and 1.3381 in USD/CAD today should Dollar picks up some momentum.

USTR Lighthizer on EU’s complete hypocrisy and distortion of WTO rules

US Trade Representative Robert Lighthizer condemns retaliatory tariffs from EU and other WTO members in a statement released overnight. He claimed that the US actions on steel and aluminum tariffs were “wholly legitimate and fully justified”. But the EU has concocted a groundless legal theory to justify immediate tariffs on U.S. exports.

Lighthizer went further to say that “these retaliatory tariffs underscore the complete hypocrisy that governs so much of the global trading system.” According to him, the EU and others claimed to champion the WTO but “their recent tariffs prove that they simply ignore WTO rules whenever doing so is convenient.”

Also, “when the EU and others falsely assert the U.S. steel and aluminum duties are safeguard measures, and impose retaliatory duties under this pretense, they do great damage to the multilateral trading system. Indeed, they show that they are willing to distort WTO rules to mean whatever they want, whenever they want.”

Atlanta Fed Bostic could move away from four hikes as trade spat worsens

While Fed is projecting four rate hikes in total this year, Atlanta Fed President Raphael Bostic said there is “some likelihood I will be moving away from four as a real possibility” due to the development of US trade policy. He commented on the “progresses the way it has been the last couple of days” regarding the trade threats of Trump’s administration to trading partners. And Bostic noted that “the more it progresses in this more contentious way, the more it leads me to feel the risks are on the downside for the broader economy.”

He added that “the disruption that comes from this type of trade war is not going to be good for the cost basis for businesses and it makes me a bit concerned how robust the economy will perform moving forward.”

Dallas Fed Kaplan: Let’s fight the big threat China, not others

Dallas Fed President Robert Kaplan trade with Canada and Mexico boosts US employment and competitiveness. And he warned that the US risks losing such competitiveness as the trade spat continues. He emphasized that the real threats come from China. Kaplan noted that “intellectual property rights and technology transfer are very big issues, where China is using the joint ventures to get technology and then compete globally” And, “let’s fight what I think is actually a very big threat, which is the relationship with China.”

Regarding monetary policy, he reiterated the view that neutral rate is between 2.50-2.75%. And Fed is “still accommodative” at the current 1.75-2.00%. Kaplan also felt reluctant to dismiss the yield curve signal on recession as it reflections expectations of future growth. Flattening yield curve can also affect behavior of businessmen.

BoJ Amamiya: Don’t change public perceptions with a shock blow

BoJ Deputy Governor Masayoshi Amamiya said Japan is having “steady progress” towards 2% inflation even though that could take time. And he emphasized that “instead of trying to change public perceptions with a shock blow, we should guide inflation toward our target through steady improvements in the output gap and inflation expectations.”

He added that BoJ will “scrutinise factors that are preventing inflation from accelerating” and “look very carefully into what is happening.” He doesn’t rule out fine-tuning of the ultra-loose monetary policy and “an adjustment could happen if that’s necessary to stably achieve our price target.

New Zealand business confidence deteriorated, trade surplus widened

New Zealand ANZ Business Confidence deteriorated again in June and dropped to -39.0, down from -27.2. The Own Activity index also dropped from 14 to 9. ANZ noted in the release that the GDP growth growth indicator remained expansionary but “the economy may continue gently losing steam over coming months, despite the support coming from fiscal stimulus and high commodity prices.” And, “tailwinds in the form of fiscal stimulus and strong terms of trade will see the economy continue to grow at about par. However, cost, credit and capacity headwinds have strengthened, and firms have noticed.”

New Zealand trade surplus widened to NZD 294m in May, beat expectation of NZD 100m. Goods exports rose 10% to NZD 5.4B, hitting a new high for total exports in a May month, and the second largest for any month. Goods imports rose 5.7% to 5.1B, also a new high for total imports in a May month.

Looking ahead

Eurozone M3 is the main feature in European session. US will release durable goods orders, trade balance, wholesale inventories and pending home sales later in the day.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7374; (P) 0.7398; (R1) 0.7417; More…

AUD/USD’s rebound from 0.7345 stalled at 0.7443 and was rejected below 4 hour 55 EMA. Intraday bias is turned neutral with focus back on 0.7345 and 0.7328 cluster support (61.8% retracement of 0.6826 to 0.8135 at 0.7326). Decisive break of this support zone will extend the larger fall from 0.8315 to 61.8% projection of 0.8135 to 0.7411 from 0.7676 at 0.7229 next. On the upside, above 0.7443 will bring another recovery. But upside should be limited below 0.7676 resistance to bring fall resumption.

In the bigger picture, medium term rebound from 0.6826 (2016 low) is seen as a corrective move that should be completed at 0.8135. Deeper decline would be seen back to retest 0.6826 low. Firm break there will resume the long term down trend from 1.1079 and take 0.6008 support next (2008 low). This will now remain the favored case as long as 0.7676 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance May | 294M | 100M | 263M | 193M |

| 1:00 | NZD | ANZ Business Confidence Jun | -39.0 | -27.2 | ||

| 8:00 | EUR | Eurozone M3 Money Supply Y/Y May | 3.80% | 3.90% | ||

| 12:30 | USD | Wholesale Inventories M/M May P | 0.20% | 0.10% | ||

| 12:30 | USD | Advance Goods Trade Balance May | -68.9B | -67.3B | ||

| 12:30 | USD | Durable Goods Orders May P | -0.90% | -1.60% | ||

| 12:30 | USD | Durables Ex Transportation May P | 0.50% | 0.90% | ||

| 14:00 | USD | Pending Home Sales M/M May | 1.10% | -1.30% | ||

| 14:30 | USD | Crude Oil Inventories | -5.9M | |||

| 21:00 | NZD | RBNZ Rate Decision | 1.75% | 1.75% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals