China will seek permission from the World Trade Organization (WTO) to impose sanctions on the U.S. next week, according to the WTO’s meeting agenda.

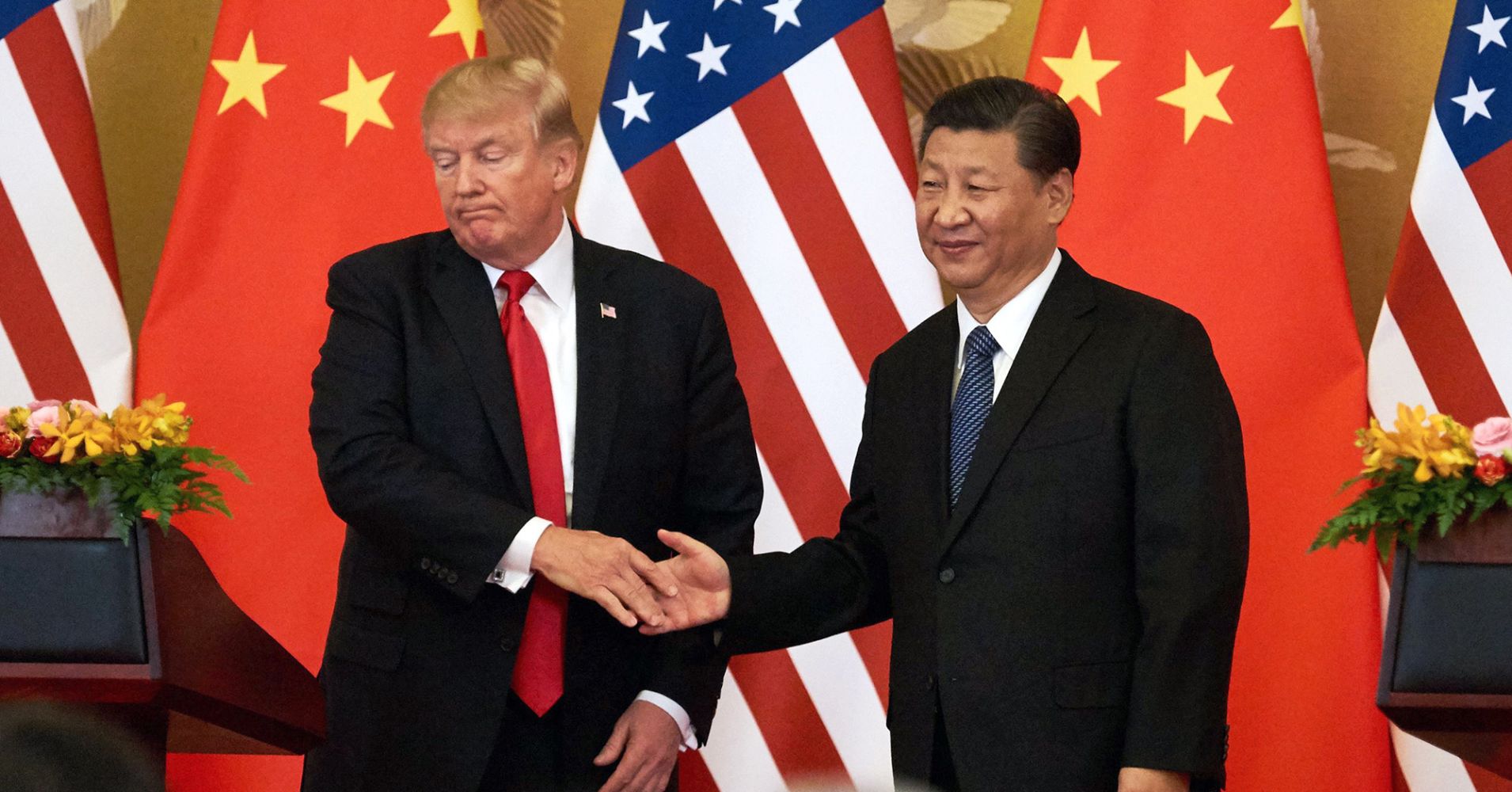

The request comes at a time of escalating trade tensions between the world’s two largest economies, with President Donald Trump saying last week he was “ready to go” on tariffs for another $267 billion on Chinese goods “if he wants.”

That would follow planned charges on $200 billion of Chinese goods in several industries, including technology. Beijing has vowed to retaliate if the U.S. takes any new steps on trade.

China’s WTO request cites Washington’s non-compliance with a ruling in a dispute over U.S. dumping duties. It is likely to lead to years of legal wrangling over the case for sanctions.

China will seek authorization at a special meeting of the WTO’s Dispute Settlement Body on Friday September 21.

The Asian nation initiated the dispute in 2013, complaining about U.S. dumping duties related to several industries including machinery and electronics, light industry, metals and minerals — with an annual export value of up to $8.4 billion.

The case concerns the U.S. Commerce Department’s process of calculating the amount of “dumping,” which refers to Chinese exports that are priced to undercut American-made goods on the U.S. market.

The U.S. calculating method was found to have been illegal in a string of trade disputes brought to the global trade regulator over recent years. Trump has since warned the world’s largest economy could soon withdraw from the WTO if “they don’t shape up.”

It follows a separate WTO Dispute Settlement Body meeting late last month, with China claiming U.S. tariffs targeting $16 billion worth of Chinese imports are inconsistent with the regulator’s rules.

China’s WTO request was seen as impacting sentiment across global markets on Tuesday morning. U.S. stock index futures pulled back on the news, with the Dow indicating a negative open of more than 60 points at around 6:35 a.m. ET.

European markets also erased earlier gains Tuesday, after a further escalation in the Sino-U.S. trade dispute haunted investors. The pan-European Stoxx 600 was down around 0.3 percent during late-morning deals.

— Reuters contributed to this report.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals