Yen and Dollar are trading as the strongest ones today as risk aversion intensifies again in European session. Stronger than expected Q3 GDP growth in the US is giving Dollar some support. But it’s so far not enough to turn the tide with Yen. Commodity currencies are the weakest ones, led by New Zealand and then Australian Dollar. Euro and Sterling are actually not to far away. The markets are rather one-sided on Yen and Dollar.

Technically, AUD/JPY’s breach of 78.67 low suggests that medium term down trend from 90.29 is ready to resume. USD/CAD’s break of 1.3132 resistance also turns near term outlook bullish. A focus before weekly close is whether US stocks will reverse all of yesterday’s rebound to close at a new low. Also, if more selloff is seen in stocks, whether Dollar and Yen have enough momentum to close further higher.

In other markets, major European stock indices are all in red. FTSE is down -1.10%, DAX down -1.17%, CAC is down -1.64%. German 10 year yield id down -0.0369 at 0.364. It was above 0.5 handle just 10 days ago. Italian 10 year yield is down -0.037 at 3.453, it pared back some earlier gains. Earlier in Asia, Nikkei closed down -0.40%, Singapore Strait Times dropped -1.35%, Hong Kong Kong HSI fell -1.11%, China Shanghai SSE lost -0.19.

US Q3 GDP grew 3.5% annualized, deceleration reflected downturn in export and non-residential fixed investment

US GDP grew 3.5% annualized in Q3, slowed from Q2’s 4.2% but beat expectation of 3.2%. BEA noted in the release that “The increase in real GDP in the third quarter reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, state and local government spending, federal government spending, and nonresidential fixed investment that were partly offset by negative contributions from exports and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased”.

Also, “The deceleration in real GDP growth in the third quarter reflected a downturn in exports and a deceleration in nonresidential fixed investment. Imports increased in the third quarter after decreasing in the second. These movements were partly offset by an upturn in private inventory investment.” (if you want to make money in financial markets, use our forex auto trading robot)

ECB: Professional forecasters lowered core inflation and GDP growth forecasts

The latest ECB Survey of Professional Forecasters (SPF) showed unchanged projections for headline inflation for 2018, 2019 and 2020. But Core inflation, excluding food and energy forecasts were revised slightly lower. Also, expectations for real GDP growth were also revised lower.

Headline inflation is projected to be at 1.7% in 2018, 1.7% in 2019 and 1.7% in 2020, unrevised. Core inflation is projected to be at 1.1% in 2018, 1.4% in 2019 and 1.7% in 2020, revised slightly down. ECB noted “he expected pick-up in underlying inflation remained underpinned by a pick-up in annual growth in compensation per employee, which was expected to increase to 2.3% by 2020.” The convergence with between headline and core inflation is still a development that’s welcomed by the ECB.

GDP growth is projected to be at 2.0% in 2018, 1.8% in 2019 and 1.6% in 2020. There were downward revision of -0.2% for 2018 and -0.1% for 2019. ECB noted “respondents typically attributed their revisions to external factors such as higher energy prices weighing on disposable income, with many also noting that they had now incorporated into their baseline forecasts at least some dampening impact on exports and investment due to increased uncertainty surrounding the outlook for world trade. ”

NIESR on no-deal Brexit: BoE to hike to above 2.5% on surge in inflation, but sharp slowdown in growth

The UK National Institute of Economic and Social Research (NIESR) said the UK economy has “recently gained momentum” with Q3 GDP growth at 0.7%. Under the main forecasts scenario, based on “soft” Brexit, 2019 growth forecasts were revised up to 1.9%, reflecting the stronger momentum. However, NIESR also warned that here is “an enormous amount of uncertainty” around the forecasts.

Under a no-deal Brexit scenario which UK has to revert to trade under WTO rule, growth is projected to slow sharply down to just 0.3% in 2019. Unemployment rate will jump to 5.8% in 2020. Inflation will surge above BoE’s target range in 2019, forcing BoE to raise interest rate to above 2.5% in 2019, next year.

The summary of new forecasts show, under a soft Brexit scenario, GDP to grow 1.4% in 2018, 1.9% in 2019 and than slow to 1.6% in 2020. CPI is expected to slow from 2.3% in 2018 to 1.9% in 2019 and then climb back to 2.1% in 2020. Unemployment is projected to drop from 4.1% to 4.0% in 2019 then rise back to 4.5% in 2020. BoE interest rate will rise from 0.8% to 1.3% in 2019 and then 1.8% in 2020.

However, under a no-deal Brexit, GDP growth will slow sharply from 1.4% to 0.3% in 2019, and 0.3% in 2020. Inflation will surge to 3.2% in 2019 before falling back to 2.6% in 2020. Unemployment rate will jump to 5.3% in 2019 and rise further to 5.8% in 2020. BoE will have to raise interest rate much faster to 2.6% in 2019 before dropping to 2.5% in 2020.

Full forecast will be published later on October 31.

NOTE: if you do not have time to search for strategies and study all the tools of the trade, you do not have the extra funds for testing and errors, tired of taking risks and incurring losses – trade with the help of our best forex robots developed by our professionals. You can free download forex robot based on stop and reverse system for testing results in Metatrader.

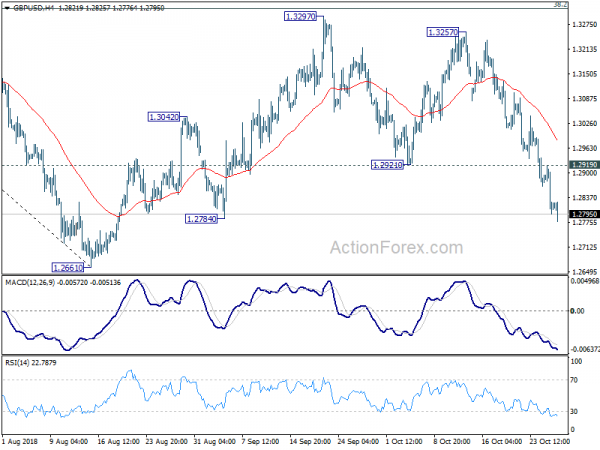

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2770; (P) 1.2845; (R1) 1.2893; More…

GBP/USD falls to as low as 1.2776 so far today and breached 1.2784 support. Intraday bias stays on the downside for retesting 1.2661 low first. Decisive break there will resume larger down trend from 1.4376. On the upside, break of 1.2919 minor resistance is needed to indicate short term bottoming. Otherwise, outlook will remain mildly bearish even in case of recovery.

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA. The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend. And this will be the preferred case as long as 38.2% retracement of 1.4376 to 1.2661 at 1.3316 holds. However, firm break of 1.3316 would bring stronger rebound to 61.8% retracement at 1.3721. And, the eventual depth of the fall from 1.4376, and the chance of hitting 1.1946 low, will depend on the strength of the interim corrective rebound from 1.2661.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y Oct | 1.00% | 1.00% | 1.00% | |

| 12:30 | USD | GDP Annualized Q3 A | 3.50% | 3.20% | 4.20% | |

| 12:30 | USD | GDP Price Index Q3 A | 1.7% | 2.1% | 3.00% | |

| 14:00 | USD | U. of Mich. Sentiment Oct F |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals