After a stunning plunge in the price of oil over the last seven weeks, President Donald Trump has rooted for oil prices to fall even further.

Yet the U.S. oil and gas industry, a pillar of Trump’s political base, might be decidedly likely less enthusiastic.

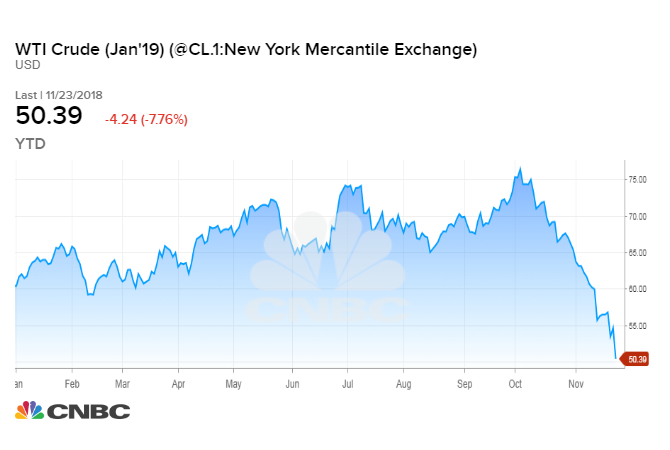

This year’s oil prices rally has swiftly collapsed as fears of potential oil shortages give way to forecasts that crude supply will swamp demand next year. The sell-off is pushing U.S. crude prices to levels that may impact drillers’ spending plans and their ability to return cash to shareholders.

On Sunday, the president cheered the steep drop in crude and its effects on the broader economy. For added measure, Trump even hinted that the Federal Reserve — which he considers a scourge of his economic agenda — should take note.

Trump tweet

“Exxon, Chevron, BP will survive because they are so big, but some of the smaller companies might have problems as costs are rising and revenue is falling,” said Andrew Lipow, president of Lipow Oil Associates.

U.S. crude futures tumbled from a nearly four-year high at $76.90 on Oct. 3 to a more than one-year low at $50.15 on Friday. From peak to trough, U.S. crude has lost more than a third of its value.

Oil’s drop below $55 earlier this week was apparently not enough for Trump. On Wednesday, the president took to Twitter to praise Saudi Arabia for hiking output and helping to cap oil prices. Trump implored the kingdom to keep at it, saying “let’s go lower!”

@realDonaldTrump: Oil prices getting lower. Great! Like a big Tax Cut for America and the World. Enjoy! $54, was just $82. Thank you to Saudi Arabia, but let’s go lower!

Trump sent the tweet one day after he declared his support for Saudi Arabia, shrugging off bipartisan calls to punish the kingdom after Saudi agents murdered journalist and U.S. resident Jamal Khashoggi last month. The CIA has reportedly concluded Saudi Crown Prince Mohammed bin Salman ordered the killing, but Trump has been casting doubt on that assessment throughout the week.

The president’s defense of Saudi Arabia comes about two weeks before a critical OPEC meeting on Dec. 6. Trump wants the Saudi-led group to keep pumping at full tilt, which would keep a lid on oil prices.

In recent weeks, the 15-nation OPEC cartel and several other exporters have signaled that they will agree to a price-boosting output cut. But Trump’s overtures to the Saudis could make it more difficult for the kingdom to support throttling back output.

“It looks like they’re going to be backing off on that,” John Kilduff, founding partner at energy hedge fund Again Capital, told CNBC’s “Squawk Box” on Wednesday. “Our relationship with them appears to be bought and paid for now, and the oil market’s MVP, President Trump, is helping to keep a lid on prices.”

By driving down oil prices, the populist American president hopes to pad voters’ pocketbooks through savings at gas stations. The national average for a gallon of regular gasoline has fallen more 25 cents over the last month to about $2.58.

But by pressuring the Saudis to forego an output cut, Trump also stands to put financial strain on the energy companies that have pushed U.S. output to all-time highs — a feat he frequently touts. The Trump administration has rolled back a wide range of energy and environmental regulations and promoted U.S. fossil fuel exports in pursuit of American dominance in the global energy market.

“I think it’s a very interesting dynamic that must be unfolding right now in the White House, between on the one hand, wanting to help the U.S. consumer by having low oil prics, but you have a very important US industry, the US shale industry, that will be really hurt if prices continue to fall further,” Helima Croft, global head of commodity strategy told RBC Capital Markets, told CNBC’s “Squawk on the Street” on Wednesday.

The industry is recovering from the punishing oil price downturn of 2014-2016, which forced drillers to cut costs and boost efficiency. American “frackers” rely on an expensive process called hydraulic fracturing to free oil and gas from shale rock formations.

Many frackers can now break even on new wells with crude prices below $50 a barrel. But with U.S. crude falling towards $50 on Friday, the comfort zone is shrinking.

In the Permian basin, the nation’s most productive shale oil field underlying Texas and New Mexico, companies typically need oil prices in the upper-$40s to lower-$50s to cover the full costs of developing new oil fields, according to Muhammed Ghulam, senior research associate at Raymond James.

“We’re at the point where we’re nearing full cycle break-evens for Permian producers and depending on how long this lasts, we might see an impact on capex budgets over the next few months,” said Ghulam.

That could mean drillers will issue more conservative guidance for 2019 capital spending plans, he said. While companies are unlikely to cut dividends, Ghulam warns that weak oil prices could influence whether some drillers restore share buyback programs or increase current payouts to shareholders.

OPEC’s role in balancing the oil market is a point of contention between Trump and his energy industry backers. American drillers largely support the OPEC alliance’s decision in January 2017 to cut output to drain a glut of crude and prop up prices.

Continental Resources CEO Harold Hamm, an energy adviser to Trump, said OPEC’s “did the right thing” and “acted very responsibly” by extending the production curbs into 2018 at its final meeting last year.

A few months later, Trump began lambasting OPEC on Twitter for pushing oil prices higher. At the UN General Assembly this year, he told world leaders the group is ripping them off.

Ultimately, Croft thinks Saudi Arabia will act in its own self interest by backing a production cut when the group gathers on Dec. 6.

“I think it’s going to be very interesting to see what happens right after that OPEC meeting. If they pull those barrels, how does President Trump respond?” she said.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals