JANUARY

SoftBank chief executive Masayoshi Son declares 2019 the “Year of the fee” and invites banks to an everlasting pitch.

“Our goal is to be the number-one fee payer to banks in the world and also the universe,” says Son. “We have at least $1 billion to hand out this year – let’s call it $5 billion – and the Japan telecom IPO is just the start. Uber is up next, then WeWork, which by our own internal robot valuation is now worth at least $50 billion, or maybe $500 billion.

“Of course, we have to set some ground rules for the ever-lasting pitch,” he adds. “Obviously nobody can mention the Saudis, but we must also insist that no Wall Street analysts question the way we drive up valuations for our tech portfolio companies. Remember: we are all in this together!”

FEBRUARY

Bank of America’s new investment bank head, Matthew Koder, unveils his plan to win back lost deal-making market share.

“We are all going to do one-armed push-ups at the start of every client meeting to show what a lean, mean deal machine we have here at BofA,” says Koder.

“The real boss Tom Montag thought this was such a good idea that he said: ‘Sure, whatever’ and challenged me to a year-end arm wrestling match for my entire bonus pool – no tears. He also said we can’t lend any money to SoftBank, which might be a bit of a problem, but I think that working out at 4am every day is the real key to banking success.”

MARCH

Billionaire Ray Dalio decides to share more secrets of his success at Bridgewater, the world’s biggest hedge fund.

“I am a keen student of history and I have recently been reading intensively to anticipate the market of the future,” says Dalio. “For instance, did you know that Britain, France and Germany were in World War II a couple of years before we got involved? Amazing! I think that gives a clear signal about sterling/dollar/euro parity. And maybe even the return of the deutsche franc.”

Investors who were already alarmed by Dalio’s publication of ‘Bridgewater: Radical transparency and the way of the Samurai trader’ renew their flight from its risk parity funds.

“He’s basically just hedging stocks with bonds, and they are both going down this year, so what’s the point?” asks one disillusioned client.

APRIL

Goldman Sachs chief executive David Solomon delivers the findings of the long-awaited internal investigation into the 1MDB scandal.

“To show our contrition, we are going to claw back bonuses from every one of the 30 top executives who approved the deals in the first place, dating back to 2012,” says Solomon. “And that includes both me and Lloyd, who is apparently still knocking around here somewhere.

“Just kidding – April Fool!” he continues. “We’re actually going to set up a new governance oversight committee led by Carlos Ghosn, if and when he’s available, with input on the political aspects of complex trade structuring provided by Hillary Clinton. I am also glad to announce that we have completed our transition from a tech company, with all the stock volatility that entails, to a dependable consumer lender called Goldman Marcus.”

MAY

Ashok Varadhan, the last trader on the management committee at Goldman Sachs, announces his resignation.

“I’m off to join Ed Eisler and Sam Wisnia at Eisler Capital, where I’m pretty sure we can run rings round the millennials trying to make sense of the algorithmic outputs on Wall Street dealing desks,” says Varadhan.

“These kids don’t know the first thing about moving a market to where you want it to be and, with fixed income volatility back with a bang, I think we have every chance of becoming the SAC Capital of the macro markets.”

JUNE

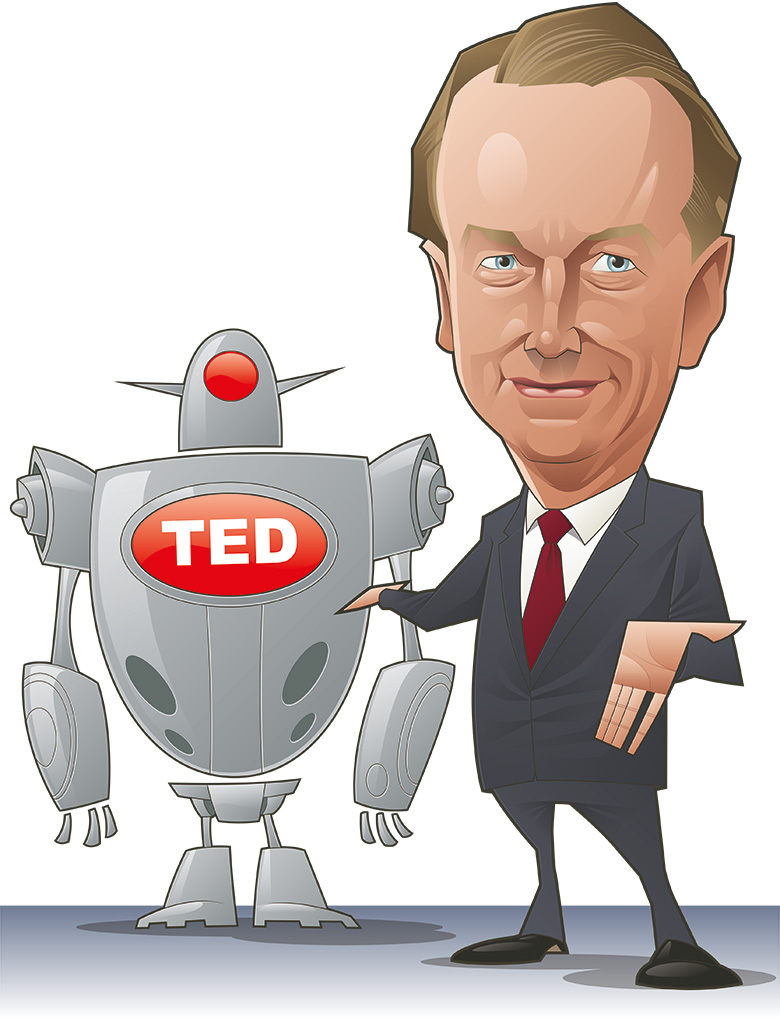

Morgan Stanley chief executive James Gorman announces that he will retire and be replaced by an artificial intelligence device.

“AI is the way of the future, and I can now reveal that my expected successor, Ted Pick, was in fact an experiment that we conducted to see if a robot boy can run a modern wealth management and securities firm,” says Gorman.

“His name was actually a joke by the nerds in our AI lab – TED stands for ‘Trader Exit Device’ – and we can now retire this prototype too, and move towards a formal system of management by the Nine Boxes of Success algorithm.”

As part of an initiative to ensure employee engagement with the new approach, the Morgan Stanley AI chief executive offers all staff a zero compensation sabbatical as soon as their revenue dips below the target for a given 90-day period.

JULY

Barclays chief executive Jes Staley reveals that the firm will relocate to New York from London. “It is time to take the ‘trans’ out of our goal of becoming a transatlantic bank in order to focus on being a high-risk trading firm in a friendly regulatory regime,” says Staley.

“We had already ring-fenced the UK consumer bank, and who wants to be stuck in Canary Wharf talking to regulators from any and every corner of Europe about another decade of Brexit transition details? Bill Winters might like that sort of stuff, but I certainly don’t. Our trading head Tim ‘Danger’ Throsby and I are both looking forward to ramping up the risk limits even further and going toe to toe with our old buddies at JPMorgan in New York.”

AUGUST

HSBC’s corporate finance managers cause a stir when they resign en masse in protest at chief executive John Flint’s refusal to address their letter of complaint about “rewards for persistent failure” within its global banking and markets unit.

“It is a year now since we delivered our elegantly crafted letter seeking redress and a full 18 months since we began our internal debate over what font to use for said communiqué,” the anonymous corporate finance managers say.

“Yet since then, answer came there none from the executive suite. Admittedly, we haven’t been doing anything for the last year ourselves and it is of course possible that Mr Flint and his confrères are toiling in some far field of finance of which we know little. Nevertheless, it is with heavy hearts that we announce that we shall seek employment elsewhere, perhaps after a final bottle of this rather agreeable Haut-Brion.”

SEPTEMBER

Deutsche Bank and UBS confirm that they plan to merge and provide details of a new management structure. Deutsche chief executive Christian Sewing will become chefinspektor for domestic branches (Postbank), while UBS chief executive Sergio Ermotti will oversee the merger before being succeeded as group head by DB CFO James von Moltke.

“James combines a much more impressive surname with the experience of international banking that Christian lacks,” says UBS chairman Axel Weber, the driving force behind the deal. “I think perhaps if Deutsche Bank had appointed me to succeed Ackermann in 2011 it would not now be in such a mess, but here we have an opportunity to make good again.”

Analysts note that there could be big cost savings from combining the modern art collections and related sponsorship budgets at the two firms.

OCTOBER

Credit Suisse announces that it will merge with Commerzbank, in a move that is widely viewed as a reaction to the Deutsche Bank/UBS tie-up.

“We are number two to UBS in global wealth management and now we want to also be number two in the exciting, though admittedly unprofitable, field of German domestic banking,” says Credit Suisse chief executive Tidjane Thiam.

“Someone just told me that Commerz has already sold the ETF business that would have been the best fit with our private banking operations, but I’ll think about that after I finally get my head around whatever it is that our legacy securitized product traders do all day.”

NOVEMBER

Cryptocurrency trading legend Michael Novogratz calls a bottom in the price of bitcoin after another year of declines punctuated by occasional spikes.

“I dug out one of those charts the nerds used to draw up (on paper!) when I was at Goldman in the 1990s. Actual bottom line? There’s no way bitcoin can go below $100,” tweeted Novogratz.

“I know I called bottoms at $9,000, $8,000, $7,000 and $5,000 back in 2018, but that was just my way of making sure the volatility we all need as expert risk managers was baked into the price. I’ve totally made a ton of money trading this thing,” he said in a follow-up tweet.

As the bitcoin price falls further, Gary Cohn reportedly earns $100 million from the sale of his stake in Dullchain, a distributed-ledger technology company that promises to cut the settlement time for trading bales of hay from 50 days to 45 days.

DECEMBER

JPMorgan chief executive and chairman Jamie Dimon formalizes the unwritten policy that no manager who is over 55 will be eligible to succeed him as head of the firm. Managers who are under 55 but not currently heading a big revenue-producing division will also be ineligible for the succession.

“Sadly that means that Marianne Lake, Dan Pinto, Gordon Smith and the rest of them are out of the running,” says Dimon. “They can stick around if they want. What do I care? But the takeaway here is that I’m in charge until the day I decide to go. I’m the fittest 63-year-old you ever met, and this bitcoin BS is just another reminder that nobody does it better.”

As 2019 closes, reports emerge that Dimon is in talks with Amazon chief executive Jeff Bezos and Berkshire Hathaway head Warren Buffett about a three-way merger that will be accompanied by sponsorship of a 2020 presidential bid by Michael Bloomberg.

#VotefortheRealPresidentBusiness proves surprisingly popular with potential voters who are too young to remember the 2008 financial crisis.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals