Dollar trades broadly lower in thin holiday market as trades await FOMC rate decision. There is no expectation of a change in interest rate nor Fed’s patient stance. But Fed chair Jerome Powell’s comments on inflation could make or break recent rally in the greenback. For now, Dollar it’s considered just in consolidation against Euro, Swissy and Aussie. Even USD/JPY couldn’t confirm near term reversal yet.

Staying in the currency markets, New Zealand Dollar is indeed the weakest one, after weak employment data. Yen follows and second and then Dollar. Swiss Franc, on the other hand, is the strongest one for today so far, followed by Sterling and then Euro.

Technically, GBP/USD’s break of 1.3019 minor resistance yesterday revived near term bullishness. Further rise might be seen back to retest 1.3381 high. The fortune of EUR/USD could be tied to EUR/GBP which appears to have reversed ahead of 0.8722 resistance. Deeper decline in EUR/GBP towards 0.8747 support could keep EUR/USD steady while lifting GBP/USD.

Dollar to listen to Powell’s comments on growth in inflation, some previews

Dollar is staying generally week today, except versus Kiwi and Yen. But FOMC announcement ahead could change its fortune. There is no chance for Fed to change federal funds rate at 2.25-2.50%. Also, Fed will, without a doubt, maintain its patient stance regarding any monetary policy adjustment.

As a reminder, monetary policy normalization is considered largely completed after December’s rate hike. Balance sheet run-off is also on track to completion later this week. Generally speaking, policymakers would need strong evidence of an emerging trend in either inflation or employment to make another move.

Yet, an important factor to watch is Fed chairman Jerome Powell’s response to strong growth but sluggish inflation. Dollar bears would like to hear Powell mentioning the downside risks in inflation and the readiness to cut interest rate should outlook worsens. On the other hand, Dollar bulls would like to hear Powell dismissing the talks of rate cut as being premature.

Either way, Dollar would pick up its near term direction from there.

Here are some suggested previews:

China to open up banking and insurance sectors as new round of trade negotiation with US starts

New round of US-China trade negotiations started in Beijing today. US Treasury Secretary Steven Mnuchin said he had a “nice working dinner” yesterday and “it’s good to be back here” in Beijing. It widely known that while progress has been made two key sticky points remained unresolved, an enforcement mechanism and the timelines for lifting imposed additional tariffs.

Meanwhile, China Banking and Insurance Regulatory Commission said it will further open up the banking an insurance sectors. And it plans to issue 12 new measures soon. The measures include dropping the USD 10B asset requirements for foreign companies to set up a legal entity in the country. The USD 20B asset requirements for foreign banks to set up a branch will also be removed. Approval procedures for foreign banks to conduct Yuan businesses will be removed.

Australia AiG PMI improved to 54.8, but employment and wage indices dropped

Australia AiG Performance of Manufacturing Index rose 3.8 pts to 54.8 in April, indicating faster growth. All subsectors except machinery & equipment, and metal products improved. Top concerns for manufacturers in April included the upcoming Federal election, high energy prices, high input costs (due to drought, a low dollar and high commodity prices) and tighter credit conditions.

Employment index dropped sharply by -5.1 pts to 51.5. The release also noted ABS data indicated that total manufacturing employment fell dramatically over summer, with a reduction in employment of 41,600 over the three months to February 2019 (-6.3% q/q, trend). Average wage index dropped -3.5 to 57.7, indicating lower wage pressures across the manufacturing sector. Also, this wage index has been trending down since peaking at September 2018.

New Zealand employment dropped -0.2% qoq in Q1, NZD dips

New Zealand Dollar drops notably today after weaker than expected job data. Employment contracted -0.2% qoq in Q1, below expectation of 0.5% qoq growth. Unemployment rate dropped to 4.2%, down from 4.3% and matched expectations. But labor force participation rate dropped -0.5% to 70.4%. Labor cost index rose 0.3% qoq, below expectation of 0.5% qoq.

Today’s data shouldn’t change RBNZ’s view that New Zealand is current staying at maximum sustainable employment. The reduced momentum in job growth and sluggish wage would provide little support to the already low inflation reading. Weak CPI is a key factor around the case of RBNZ rate cut in near term, probably in May, but the meeting remains live.

Looking ahead

In addition to FOMC rate decision, US will release ISM manufacturing, ADP employment and construction spending. UK will release mortgage approvals, M4 and PMI manufacturing earlier in European session

USD/CAD Daily Outlook

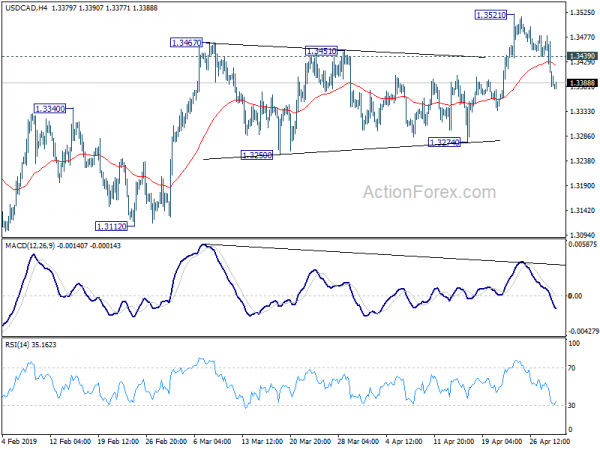

Daily Pivots: (S1) 1.3354; (P) 1.3417; (R1) 1.3454; More…

USD/CAD’s fall from 1.3521 is deeper than expected and break of 1.3399 minor support raises the chance of near term reversal. Intraday bias is turned back to the downside for 1.3274 support first. Break will indicate that choppy rebound from 1.3068 has completed at 1.3521. Near term outlook will be turned bearish for retesting 1.3068 support. On the upside, though, above 1.3439 minor resistance will revive near term bullishness and turn bias back to the upside for 1.3521. Break of 1.3521 will extend the rise from 1.3068 to retest 1.3664 high.

In the bigger picture, USD/CAD is staying well inside medium term rising channel (support at 1.3255). Thus, the up trend from 1.2061 (2017 low) should be in progress. On the upside, decisive break of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685 will pave the way to 78.6% retracement at 1.4127 next. This will remain the favored case as long as 1.3068 support holds. However, sustained break the channel support will be the first sign of medium term reversal. Firm break of 1.3068 would confirm.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Manufacturing Index Apr | 54.8 | 51 | ||

| 22:45 | NZD | Employment Change Q/Q Q1 | -0.20% | 0.50% | 0.10% | |

| 22:45 | NZD | Unemployment Rate Q1 | 4.20% | 4.20% | 4.30% | |

| 22:45 | NZD | Labor Cost Private Sector Q/Q Q1 | 0.30% | 0.50% | 0.50% | |

| 23:01 | GBP | BRC Shop Price Index Y/Y Apr | 0.40% | 0.90% | ||

| 8:30 | GBP | Mortgage Approvals Mar | 64K | 64K | ||

| 8:30 | GBP | Money Supply M4 M/M Mar | 0.30% | 0.30% | ||

| 8:30 | GBP | PMI Manufacturing Apr | 53.1 | 55.1 | ||

| 12:15 | USD | ADP Employment Change Apr | 181K | 129K | ||

| 13:30 | CAD | Manufacturing PMI Apr | 50.5 | |||

| 13:45 | USD | Manufacturing PMI Apr F | 52.4 | 52.4 | ||

| 14:00 | USD | ISM Manufacturing Apr | 55 | 55.3 | ||

| 14:00 | USD | ISM Prices Paid Apr | 55.7 | 54.3 | ||

| 14:00 | USD | ISM Employment Apr | 57.5 | |||

| 14:00 | USD | Construction Spending M/M Mar | 0.10% | 1.00% | ||

| 14:30 | USD | Crude Oil Inventories | 5.5M | |||

| 18:00 | USD | FOMC Rate Decision (Lower Bound) | 2.25% | 2.25% | ||

| 18:00 | USD | FOMC Rate Decision (Upper Bound) | 2.50% | 2.50% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals