The financial markets are generally in consolidative mode, awaiting the start of the two-day G20 summit in Osaka, Japan tomorrow. For traders, main focus will be on face-to-face meeting of Trump and Chinese President Xi Jinping. Hopes are high for some form of agreement to stop further escalations in trade war. Words from both sides this week were not kind though. Trump threatened to do very substantial additional tariffs if talks break down again. China is insisting on its own principle and urged US to correct wrong practices.

In the forex markets, Yen is trading as the weakest one so far, followed by Euro. German CPI accelerated to 1.6% in June but that provides little help to the common currency. Dollar is not far away with Swiss Franc neither. On the other hand, Sterling is the strongest one for today but it’s going nowhere for now. Kiwi and Aussie are the next strongest.

In Europe, currently, FTSE is down -0.20%. DAX is up 0.26%. CAC is down -0.12%. German 10-year yield is down -0.013 at -0.313. Earlier in Asia, Nikkei rose 1.19%. Hong Kong HSI rose 1.42%. China Shanghai SSE rose 0.69%. Singapore Strait Times rose 0.83%. Japan 10-year JGB yield rose 0.0056 to -0.14.

US initial jobless claims rose 10k to 227k, Q1 GDP finalized at 3.1% annualized

US initial jobless claims rose 10k to 227k in the week ending June 22, above expectation of 220k. Four-week moving average of initial claims rose 2.25k to 221.25k. Continuing claims rose 22k to 1.688m in the week ending June 15. Four-week moving average of continuing claims rose 6.5k to 1.687m.

Q1 GDP growth was finalized at 3.1% annualized, unrevised. .Upward revisions to nonresidential fixed investment, exports, state and local government spending, and residential fixed investment were offset by downward revisions to personal consumption expenditures (PCE) and inventory investment and an upward revision to imports.

Trump-Xi meeting confirmed at 0230GMT on Sat

The Trump-Xi meeting on sideline of G20 in Japan is confirmed to be held at 0230 GMT on Saturday. The South China Morning Post in Hong Kong reported that conditions on stopping further escalation in tariffs are already agreed upon. And the agreement will be laid out after the meeting in form of coordinated press releases, rather than joint statement.

Public comments regarding 25% tariffs on USD 300B of Chinese imports, essentially all untaxed, would end on July 2. Trump could formally make a decision to start imposing the tariffs very soon, should trade negotiations collapse once again. Trump also made himself very clear yesterday and said “I would do additional tariffs, very substantial additional tariffs, if that doesn’t work, if we don’t make a deal.”

China insists on core concerns in US trade talks

Ahead of the Xi-Trump meeting in Japan on Saturday, Chinese reiterated their hard-line stance. Ministry of Commerce spokesman Gao Feng warned that “China’s core concerns must be addressed properly” in trade negotiations. He added, “we hope the U.S. side could drop its wrong practices, and we can solve the problems through equal dialogue and cooperation.” Gao also urged US to ” cancel immediately sanctions on Chinese companies including Huawei to push for the healthy and stable development in Sino-U.S. ties”.

Separately, Foreign Ministry spokesman Geng Shuang said “the Chinese people are not afraid of pressure and never buy this kind of strategy,” referring to Trump’s tariff threats. And, he warned “starting a trade war and adding tariffs harms itself and others.”

On the other hand, WSJ reported that Xi will insist on lifting Huawei ban as part of a set of terms before China would come back to the table. Xi could also request US to lift all punitive tariffs and drop efforts to get China to buy even more US exports than Xi said it would back in December.

Eurozone economic sentiment dropped to 103.3, largest decline in industrial confidence in eight years

Eurozone Economic Sentiment Indicator dropped -1.9 to 103.3 in June, below expectation of 104.7. The deterioration was driven by lower confidence in industrial (-2.7 to -5.6) and services (-1.1 to 11.0). The fall in industrial confidence was largest in eight years. Also, it’s below long-term average for the first time since 2013. On the other hand, Confidence improved in retail trade (+1 to 0.1) and construction (+3.6 to 7.7). Also, the ESI decreased in all of the largest euro-area economies, most so in Germany (-2.9), followed by Italy, the Netherlands (both -1.5), France (-1.0) and Spain (-0.6).

Business Climate Indicator dropped -0.13 to 0.17, below expectation of 0.28. Managers’ production expectations, as well as their views on overall and export order books and the level of stocks deteriorated. Only the assessments of past production improved.

Germany CPI accelerated to 1.6% yoy in June, above expectation of 1.4% yoy.

New Zealand ANZ business confidence dropped to -38.1

New Zealand ANZ Business Confidence dropped to -38.1 in June, down from -32.0. Agriculture scored worse at -54.5, followed by construction at -42.3 and manufacturing at -41.4. Activity Outlook also dropped from 8.5 to 8.0.

ANZ noted: “The outlook for the economy is murky. As things stand, there is no reason for the economy to fall into a deep hole. Commodity prices are good, interest rates are at record lows, and the labour market is tight. But the economy is facing credit and cost headwinds and the global outlook is deteriorating. On the latter, for all that our commodity prices have been resilient, the risks are looking decidedly one-sided. Upside risks to growth appear few and far between and with the inflation outlook not consistent with the target midpoint we expect two more OCR cuts this year.”

GBP/USD Mid-Day Outlook

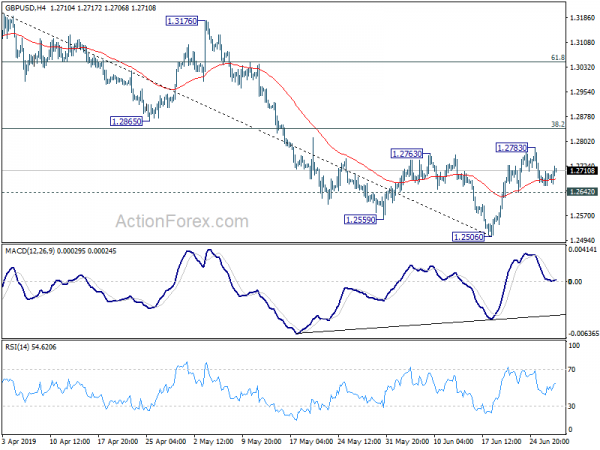

Daily Pivots: (S1) 1.2664; (P) 1.2664; (R1) 1.2709; More….

GBP/USD recovers mildly after drawing support from 4 hour 55 EMA. Intraday bias remains neutral and outlook is unchanged. With 1.2642 minor support intact, corrective rebound from 1.2506 could still extend higher. But upside should be limited by 38.2% retracement of 1.3381 to 1.2506 at 1.2840. On the downside, break of 1.2642 minor support will turn intraday bias back to retest 1.2506 low. However, sustained break of 1.2840 will bring stronger rise to 61.8% retracement at 1.3047 next.

In the bigger picture, down trend from 1.4376 (2018 high) is still in progress. Break of 1.2391 would target a test on 1.1946 long term bottom (2016 low). For now, we don’t expect a firm break there yet. Hence, focus will be on bottoming signal as it approaches 1.1946. In any case, medium term outlook will stay bearish as long as 1.3381 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y May | 1.20% | 1.20% | 0.50% | 0.40% |

| 01:00 | NZD | ANZ Business Confidence Jun | -38.1 | -32 | ||

| 09:00 | EUR | Eurozone Business Climate Indicator Jun | 0.17 | 0.28 | 0.3 | |

| 09:00 | EUR | Eurozone Economic Confidence Jun | 103.3 | 104.7 | 105.1 | 105.2 |

| 09:00 | EUR | Eurozone Industrial Confidence Jun | -5.6 | -3 | -2.9 | |

| 09:00 | EUR | Eurozone Services Confidence Jun | 11 | 12.4 | 12.2 | 12.1 |

| 09:00 | EUR | Eurozone Consumer Confidence Jun F | -7.2 | -7.2 | -7.2 | -6.5 |

| 12:00 | EUR | German CPI M/M Jun P | 0.30% | 0.20% | 0.20% | |

| 12:00 | EUR | German CPI Y/Y Jun P | 1.60% | 1.40% | 1.40% | |

| 12:30 | USD | GDP Annualized Q1 T | 3.10% | 3.10% | 3.10% | |

| 12:30 | USD | GDP Price Index Q1 T | 0.90% | 0.80% | 0.80% | |

| 12:30 | USD | Initial Jobless Claims (JUN 22) | 227K | 220K | 216K | 217K |

| 14:00 | USD | Pending Home Sales M/M May | 1.00% | -1.50% | ||

| 14:30 | USD | Natural Gas Storage | 115B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals