Free fall in major treasury yields remain the main focus in the markets today. German 10-year bund yield hit another record low at -0.397 and is now back at -0.378, down -0.013. It closed at -0.324 last week. UK 10-year gilt yield also dropped to as low as 0.67 but it’s back at 0.699. It closed at 0.833 last week and with this week’s decline, it’s below BoE’s benchmark interest rate for the first time in a decade. US 10-year yield also dips to as low as 1.955 as regular trading starts, lowest level since late 2016.

In the currency markets, Yen remains the strongest broadly for the week. Though, for today, it’s overtaken by Australian and New Zealand Dollar. Aussie was firstly supported by RBA Governor Philip Lowe’s comments yesterday after the highly anticipated rate cut. Trade surplus hit new record in May on iron ore. And at the same time, iron ore prices hit new six-year high this week, on persistently tight supply and news about an easing of the restrictions on steel production in China. Sterling is currently the weakest one after a string of weak PMIs point to slight contraction in GDP in Q2. Euro is the next weakest, followed by Dollar after ADP jobs missed expectations.

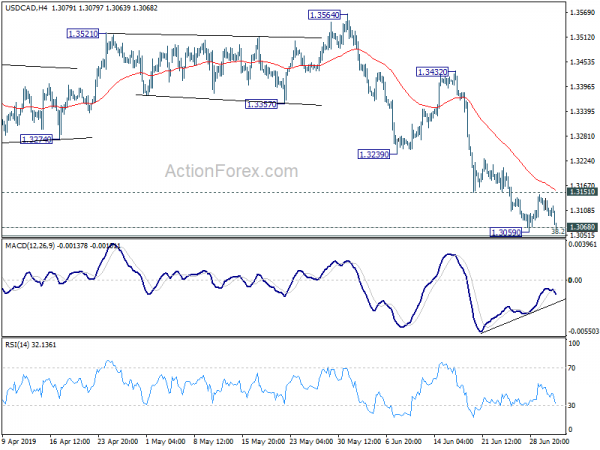

Technically, 0.7022/7034 resistance in AUD/USD is an immediate focus. Sustained break will confirm near term bullish reversal. Similarly, firm break of 1.6052 support in EUR/AUD will confirm near term bearish reversal. USD/CAD is back pressing 1.3052/68 cluster support zone. Firm break there will carry medium term bearish implications.

In Europe, currently, FTSE is up 0.65%. DAX is up 0.64%. CAC is up 0.64%. German 10-year yield is down -0.013 at -0.378. Earlier in Asia, Nikkei dropped -0.53%. Hong Kong HSI dropped -0.07%. China Shanghai SSE dropped -0.94%. Singapore Strait Times dropped -0.09%. Japan 10-year JGB yield dropped -0.015 to -0.158.

Note: our programmers have developed a profitable forex advisor with low risk and stable profit!

ADP jobs growth at 102k, missed expectation, job market continues to throttle back

ADP report shows private sector employment grew 102k in June, below expectation of 140k. Though, it’s already a strong rebound from May’s 27k.

“Job growth started to show signs of a slowdown,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “While large businesses continue to do well, small businesses are struggling as they compete with the ongoing tight labor market. The goods producing sector continues to show weakness. Among services, leisure and hospitality’s weakness could be a reflection of consumer confidence.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market continues to throttle back. Job growth has slowed sharply in recent months, as businesses have turned more cautious in their hiring. Small businesses are the most nervous, especially in the construction sector and at bricks-and-mortar retailers.”

US initial jobless claims dropped -8k to 221k, trade deficit rose 8.4%

US initial jobless claims dropped -8k to 221k in the week ending June 29, slightly above expectation of 220k. Four-week moving average of initial claims rose 0.5k to 222.25k. Continuing claims dropped -8k to 1.686m in the week ending June 22. Four-week moving average of continuing claims dropped -1.75k to 1.687m.

Goods and services trade deficit jumped 8.4% to USD -55.5B in May, wider than expectation of -53.2B. It’s also the highest level this year. Exports rose 2.0% to USD 210.6B while imports rose 3.3% to USD 266.2B. Trade deficit with China widened to USD -31.1B.

UK PMI services dropped to 50.2, all surveys point to -0.1% GDP contraction in Q2

UK PMI Services dropped to 50.2 in June, down from 51.0 and missed expectation of 51.0. That’s a also a three-month low, just above 50 no-change mark. All Sector PMI dropped to 49.2, down from 50.7, signalling a reduction in overall private sector business activity for the first time in 35 months.

Chris Williamson, Chief Business Economist at IHS Markit” “The near-stagnation of the services sector in June is one of the worst performances seen over the past decade and comes on the heels of steep declines in both manufacturing and construction. Collectively, the PMI surveys indicate that the economy has slipped into contraction for the first time since July 2016, suffering the second-steepest fall in output since the global financial crisis in April 2009. The June reading rounds off a second quarter for which the surveys point to a 0.1% contraction of GDP.”

Also, “the worsening picture will put further pressure on the Bank of England to add stimulus. For policymakers to not loosen policy with the all sector PMI at its current level would be unprecedented in the survey’s two-decade history.”

Eurozone PMI Composite finalized at 52.2, indicative of 0.2% growth in Q2

In June, Eurozone PMI Services is finalized at 53.6, revised up from 53.4 and up fro May’s 52.9. PMI Composite is finalized at 52.2, revised up from 52.1 and up from May’s 51.8. Among the member states, Italy PMI Composite was at 3-month high of 50.1. Spain was unchanged at 52.1. Germany was unchanged at 52.6. France hit 7-month high at 52.7.

Chris Williamson, Chief Business Economist at IHS Markit said: “The June PMI surveys indicate that the pace of eurozone economic growth picked up at the end of the second quarter, though it would be wrong to get overly excited by the upturn. The survey is indicative of GDP merely rising by just over 0.2% in the second quarter, and a deterioration of business expectations for the year ahead to one of the lowest seen for over four years suggests the business mood remains sombre. Downside risks to the outlook prevail amid trade war worries, rising geopolitical uncertainty and slowing global economic growth.”

And, “looking at the largest states, the survey data are consistent with GDP growth easing sharply to 0.4% in Spain and only modest 0.2% expansions in both France and Germany. Italy is on course to see a 0.1% decline… Given the relatively weak current and future growth being signalled by the PMI and the accompanying slide in inflationary pressures, we expect to see renewed stimulus from the ECB in coming months.”

BoJ Funo: Necessary to maintain low rates for prolonged period, but no need to ease further

BoJ board member Yukitoshi Funo said it’s necessary to maintain current ultra-loose monetary policy. However, he saw no need to ramp up stimulus for now.

Funo said, “given price growth and inflation expectations aren’t heightening much, it’s necessary to maintain sufficiently low rates for a prolonged period to achieve the BoJ’s price target.” However, he’s also optimistic that “we can expect Japan’s economy to recover in the latter half of this year”. And, “as such, I see no need to ease policy further now,”

He also noted the forward guidance is already leaving open the possibility of the BoJ maintaining current policy for long. “We say ‘at least’ until spring 2020 because there’s a good chance current low rates will be maintained beyond spring next year.”

Australia trade surplus jumped to record high, building approvals recovered

Australia trade surplus widened to a fresh record high of AUD 5.7B in May, up fro AUD 4.8B in April, and beat expectation of USD 5.3B.

Exports rose AUD 1,442M (4%) to AUD41,585m. Non-rural goods rose AUD 1,316M (5%), rural goods rose AUD 46M (1%) and non-monetary gold rose AUD 22M (1%). Net exports of goods under merchanting fell AUD 1M (5%). Services credits rose AUD 58M (1%).

Import rose AUD515m (1%) to AUD 35,839M. Capital goods rose AUD 348M (5%), non-monetary gold rose AUD 68M (17%) and intermediate and other merchandise goods rose AUD 66M (1%). Consumption goods fell AUD 73M (1%). Services debits rose AUD 107M (1%).

Also from Australia, building approvals rose 0.7% (seasonally adjusted) in May, versus expectation of 0.0%. Rise in Victoria (14.4%) drove the national increase. Meanwhile falls were recorded in Queensland (6.3%), Western Australia (4.7%), South Australia (2.9%) and Tasmania (1.2%), while New South Wales was flat. Private dwellings excluding houses rose 1.2%, while private house approvals decreased 0.3%.

Australia AiG Performance of Service Index dropped -0.3 to 52.2.

From China, Caixin PMI Services dropped to 52.0 in June, down from 52.7 and missed expectation of 52.6.

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.3088; (P) 1.3114; (R1) 1.3130

USD/CAD drops notably today but stays above 1.3059 temporary low. Intraday bias remains neutral with focus on 1.3052/68 cluster support zone. Decisive break there will carry larger bearish implication and target 1.2673 fibonacci level next. However, break of 1.3151 support turned resistance will indicate short term bottoming and bring rebound back to 1.3239/3432 resistance zone.

In the bigger picture, medium term outlook stays neutral for now even though the case of bearish reversal is building up. Decisive break of 1.3068 cluster support (38.2% retracement of 1.2061 to 1.3664 at 1.3052) will confirm completion of up trend from 1.2061 (2017 low). Further fall should be seen to 61.8% retracement at 1.2673 next. On the upside, sustained break of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685, is needed to confirm resumption of up trend from 1.2061 (2017 low). Otherwise, risk will stay on the downside.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Service Index Jun | 52.2 | 52.5 | ||

| 01:30 | AUD | Building Approvals M/M May | 0.70% | 0.00% | -4.70% | -3.40% |

| 01:30 | AUD | Trade Balance (AUD) May | 5.75B | 5.25B | 4.87B | 4.82B |

| 01:45 | CNY | Caixin PMI Services Jun | 52 | 52.6 | 52.7 | |

| 07:45 | EUR | Italy Services PMI Jun | 50.5 | 50 | 50 | |

| 07:50 | EUR | France Services PMI Jun F | 52.9 | 53.1 | 53.1 | |

| 07:55 | EUR | Germany Services PMI Jun F | 55.8 | 55.6 | 55.6 | |

| 08:00 | EUR | Eurozone Services PMI Jun F | 53.6 | 53.4 | 53.4 | |

| 08:30 | GBP | Services PMI Jun | 50.2 | 51 | 51 | |

| 11:30 | USD | Challenger Job Cuts Y/Y Jun | 12.80% | 85.90% | ||

| 12:15 | USD | ADP Employment Change Jun | 102K | 140K | 27K | 41K |

| 12:30 | CAD | International Merchandise Trade (CAD) May | 0.8B | -1.7B | -1.0B | -1.1B |

| 12:30 | USD | Trade Balance May | -55.5B | -53.2B | -50.8B | -51.2B |

| 12:30 | USD | Initial Jobless Claims (JUN 29) | 221K | 220K | 227K | 229K |

| 13:45 | USD | Services PMI Jun F | 50.7 | 50.7 | ||

| 14:00 | USD | Factory Orders May | -0.50% | -0.80% | ||

| 14:00 | USD | ISM Non-Manufacturing/Services Composite Jun | 56 | 56.9 | ||

| 14:30 | USD | Crude Oil Inventories | -2.8M | -12.8M | ||

| 16:00 | USD | Natural Gas Storage | 85B | 98B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals