Risk aversion is the main theme even though trading is generally subdued today. Yen is currently the strongest one, followed by Sterling and then Swiss Franc. The Pound is trying to recover upside is so far capped by no-deal Brexit risks. Commodity currencies are generally lower, led by Australian Dollar. Euro and Dollar are so far mixed, with Dollar having a slight upper hand.

Technically, though, weakness is Euro is worth a note as EUR/JPY breaks 117.67 to resume recent decline. EUR/GBP also lost some upside momentum and could turn into consolidation. EUR/CHF is heading back to 1.0863 temporary low and break will further indicate weakness on Euro. 0.9695 support in USD/CHF will also be a level to watch, and break will resume recent down trend.

In Europe, currently, FTSE is down -0.50%. DAX is down -0.32%. CAC is down -0.55%. German 10-year yield is down -0.0123 at -0.585. Earlier today, Hong Kong HSI dropped -0.44%. China Shanghai SSE rose 1.45%. Japan and Singapore was on holiday.

Germany pledges principle of balanced budget

German Finance Minister Olaf Scholz emphasized today that the government ” can fulfill the tasks that we’re tackling without new debt”. The comments came after Reuters reported last week that the finance ministry was considering issuance of new debt. Scholz noted policies could be implemented by abolishing an income tax surcharge for most employees, etc.

Chancellor Angela Merkel’s spokesman Steffen Seibert also said “the chancellor has never left any doubt … that she stands by the principle of a balanced budget.” And, “we have a policy that is not being called into question that we had balanced budgets in recent years and we continue to strive for those.”

German Ifo: Experts expect significantly weaker growth in world trade

German Ifo World Economic Climate Indicator dropped from -2.4 to -10.1 in Q1. Current Situation Indicator dropped from 1.4 to -5.4. Expectations Indicator dropped from -6.1 to -14.7.

Ifo President Clemens Fuest warned that “experts expect significantly weaker growth in world trade”. And, “trade expectations are at their lowest level since the outbreak of the trade conflict last year.” “Respondents also expect weaker private consumption, lower investment activity, and declining short- and long-term interest rates.

Italy Borghi pledges tax cut and VAT freeze for League’s campaign

Italy’s chairman of the House Budget Committee Claudio Borghi told La Stampa newspaper, as the party’s plan for 2020 elections, there will be cut in personal income tax and freeze in VAT. And, budget deficit will stand at 3% of GDP. He said that the 15% tax cut must be “achieved gradually”. Though, he added “we must start immediately and guarantee it to many”. He’s aiming at net tax savings of EUR 10-15B.

Matteo Salvini, the Deputy Prime Minister of Italy, announced last Friday that he would submit a no-confidence motion against Prime Minister Giuseppe Conte. This marks the collapse of the M5S- League coalition government. Two possibilities arise after Salvini’s move: snap election or a technocrat government. What makes the situation more complicated is that Italy is expected to submit the 2020 budget draft by October 15. More in Political Turmoil In Italy Signals Further Widening Yield Spread.

South Korea to put Japan into new export category, starting September

South Korea announced to move Japan to a newly created export category, away from the so fast-tack trade “white list”, starting September. It’s an expected tit-for-tat move in response to Japan’s measures on South Korea. In short, companies exporting strategic materials and products to Japan are required to submit five documents — up from three — with the process taking up to 15 days, as opposed to the current five.

At this point, Japan is the only country in the category. Industry Minister Sung Yun-mo said, “since it’s hard to work closely with a country that frequently violates the basic rules… we need an export control system that addresses this,” Sung also said, “we are pushing for this regulation revision according to our own examinations… we are doing this legitimately in line with both domestic and international laws.”

RBNZ could cut to -0.35% theoretically, during crisis

According to a Bloomberg report, RBNZ has begun scoping a project to refresh its unconventional monetary policy strategy and implementation this year. Though it’s said o be “at a very early stage” and the central bank declined to made no further comment, nor release any further information.

On interest rate, RBNZ expected rates could drop to as low as -0.35% “before risking the hoarding of physical cash. And this will “only partially mitigate any large economic shock”. Large scale asset purchase is another option but such measures are unlikely to fully delivered the desired results in a major downturn. “targeted use of fiscal policy” is likely required to support any unconventional policy.

USD/JPY Mid-Day Outlook

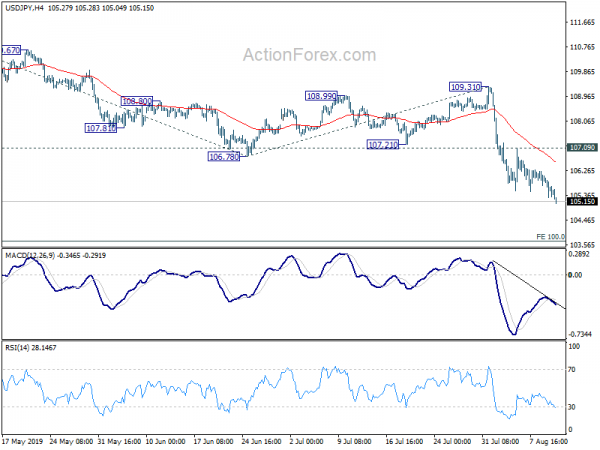

Daily Pivots: (S1) 105.28; (P) 105.68; (R1) 106.09; More…

USD/JPY’s decline continues today and intraday bias remains on the downside. Current decline should target 104.69 low. Break will target 100% projection of 112.40 to 106.78 from 109.31 at 103.69. On the upside, though, break of 107.09 resistance will indicate short term bottoming and bring lengthier consolidations first.

In the bigger picture, decline from 118.65 (Dec 2016) is still in progress and the pair is staying well inside long term falling channel. Break of 104.62 will target 100% projection of 118.65 to 104.62 from 114.54 at 100.51. For now, we’d expect strong support above 98.97 (2016 low) to contain downside to bring rebound. In any case, break of 112.40 is needed to the first serious sign of medium term bullishness. Otherwise, further decline will remain in favor in case of rebound.3

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:00 | CHF | Total Sight Deposits CHF (AUG 9) | 585.5B | 582.7B | ||

| 18:00 | USD | Monthly Budget Statement (USD) Jul | -120.0B | -8.5B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals