The forex markets are trading in rather tight range today. Risk appetite turn weaker on renewed worries over US-China trade negotiations. Asian stocks responded by opening lower. Yen could extend the rebound started on Friday if sentiments worsen ahead. But for now, the risk aversion currency is trading slightly lower below Friday’s high. Australian Dollar recovers mildly on strong PMI services reading, but there is not clear sign of bottoming yet. Dollar and Euro are mixed, awaiting further guidance.

Technically, 107.45 minor support in USD/JPY is an immediate focus today. Break will be the first sign of completion of rebound from 104.45. EUR/AUD is pressing 1.6308 support turned resistance. Break there should confirm completion of corrective fall from 1.6786. USD/CAD’s rebound from 1.3133 might resume through 1.3310 temporary top to1.3382 resistance next.

In Asia, Japan is on holiday. Hong Kong HSI is down -0.78%. China Shanghai SSE is down -1.31%. Singapore Strait Times is down -0.30%.

Australia PMI manufacturing dropped to 49.4, but services rebounded notably

Australia CBA PMI Manufacturing dropped to 49.4 in September, down from 50.9 and missed expectations. That’s the first contraction reading since survey began in May 2016. On the other hand, PMI services improved from 49.1 to 52.5. PMI Composite rebounded from 49.3 to 51.9. CBA added that “overall, new order growth picked up and stronger confidence was recorded, but the rate of job creation softened to a fractional pace”.

CBA Senior Economist, Gareth Aird said: There are early signs that the combination of rate cuts, tax rebates and rising dwelling prices is having a positive impact on the services sector…. The dip in the manufacturing reading was a touch disappointing, particularly given the ongoing weakness in the Australian dollar. It may be the case that the raft of so-called geopolitical tensions are having a dampening impact on the local manufacturing sector.”

Asian stocks lower on US-China trade worries

Asian stocks opened generally lower today and worries over US-China trade tension weighed on sentiments. The deputy-level meeting in Washington “appeared” to be fruitful based on statements from both sides. the US Trade Representative Office said the talks were “productive” and a principal-level meeting would be held next month as planned. China’s Ministry of Commerce also said the meetings were “constructive” with good discussion on “detailed arrangements” for the high-level talks in October.

However, the biggest problem was that Chinese officials cut short term trip and cancelled the planned visit to farms in Montana and Nebraska this week. The abrupt announcement raised question over progress of the trade meetings. Additionally, US President Donald Trump told reporter that he’s looking for a “complete deal”, not a “partial deal”. He added that he didn’t need trade agreement with China to happen before the 2020 presidential election. Chance of an interim trade deal of some sort in the near term was lowered by such developments.

The week ahead – RBNZ to stand pat

RBNZ is expected to stand pat this week. The central bank should still have room to wait-and-see after the -50bps cut just in August. Bo will release meeting minutes while ECB will release monthly economic bulletin. Fed is, for now, more likely to stand pat through the of the year. But that would remain data dependent, like those featured this week including consumer confidence, durable goods orders and PCE inflation. ECB has already delivered policy easing this month. German Ifo and Eurozone PMIs are important data but are unlikely to trigger any further ECB actions yet.

- Monday: Australia PMIs; Japan PMI manufacturing; Eurozone PMIs; Canada wholesale sales; US PMIs.

- Tuesday: German Ifo business climate; UK public sector net borrowing; US house price index, consumer confidence.

- Wednesday: New Zealand trade balance, RBNZ rate decision; BoJ minutes, Japan SPPI; German Gfk consumer climate; UK CBI realized sales; US new home sales.

- Thursday: ECB monthly bulletin, Eurozone M3; US GDP final, goods trade balance, wholesale inventories, jobless claims, pending home sales.

- Friday: Japan Tokyo CPI; US durable goods orders, personal income and spending, U of Michigan sentiments.

AUD/USD Daily Outlook

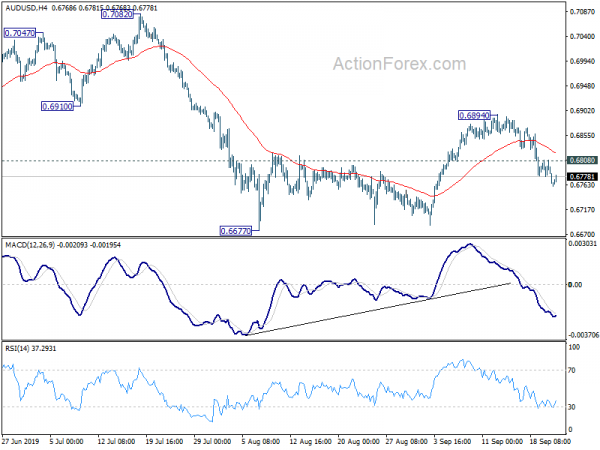

Daily Pivots: (S1) 0.6746; (P) 0.6778; (R1) 0.6795; More…

AUD/USD recovers mildly today but with 0.6808 minor resistance intact, intraday bias remains on the downside. Corrective rise from 0.6677 should have completed with three waves up to 0.6894. Further decline should be seen to retest 0.6677 first. Break will resume larger down trend. On the upside, above 0.6808 minor resistance will turn intraday bias neutral first. But risk will stay on the downside as long as 0.6894 resistance holds.

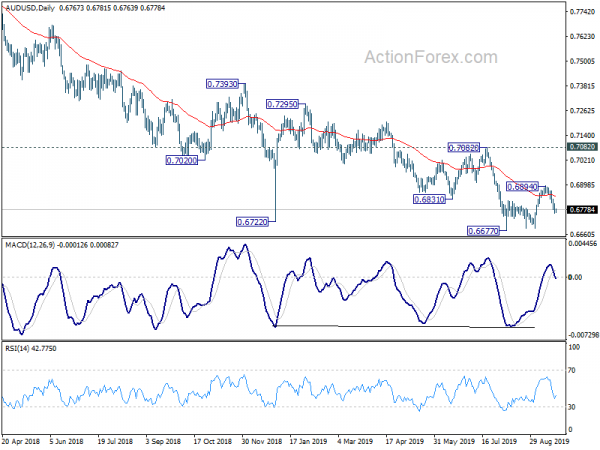

In the bigger picture, decline from 0.8135 (2018 high) is seen as resuming the long term down trend from 1.1079 (2011 high). Next target is 0.6008 (2008 low). On the upside, break of 0.7082 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | Manufacturing PMI Sep P | 49.4 | 50.9 | 50.9 | |

| 23:00 | AUD | Services PMI Sep P | 52.5 | 45.3 | 49.1 | |

| 07:15 | EUR | French Manufacturing PMI Sep | 51.2 | 51.1 | ||

| 07:15 | EUR | French Services PMI Sep | 53.2 | 53.4 | ||

| 07:30 | EUR | German Manufacturing PMI Sep | 44.6 | 43.5 | ||

| 07:30 | EUR | German Services PMI Sep | 54.3 | 54.8 | ||

| 08:00 | EUR | Manufacturing PMI Sep | 47.3 | 47 | ||

| 08:00 | EUR | Services PMI Sep | 53.3 | 53.5 | ||

| 10:00 | GBP | CBI Industrial Trends Orders Sep | -14 | -13 | ||

| 10:00 | EUR | German Buba Monthly Report | ||||

| 12:30 | CAD | Wholesale Sales M/M Jul | 0.30% | 0.60% | ||

| 13:45 | USD | Manufacturing PMI Sep P | 50.3 | 50.3 | ||

| 13:45 | USD | Services PMI Sep | 51.5 | 50.7 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals