The forex markets are generally in tight range today. Risk sentiments improved slightly after US Treasury Secretary Steven Mnuchin indicated there would be a high-level trade talks with China in two weeks. New Zealand and Australian Dollars are trading mildly higher. On the other hand, European majors are generally weak, led by Swiss Franc for now. Euro might suffer fresh selling if German Ifo disappoints today.

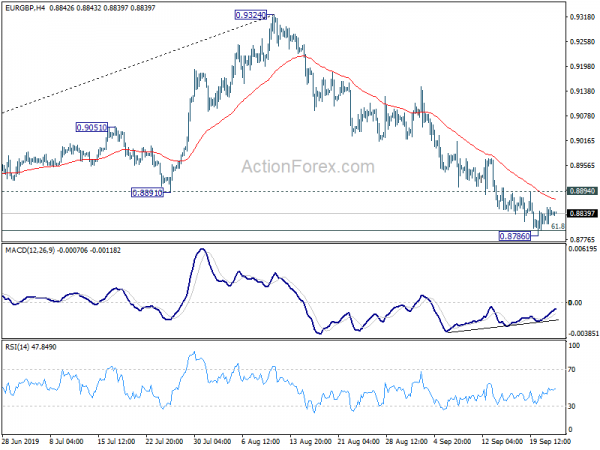

Technically, 1.0926 low in EUR/USD remains the major focus. Recent consolidations could extend as long as 1.0926 holds but decisive break will resume medium term down trend. Euro and Sterling are vulnerable against Dollar and Yen. But which one will lead the declines would depend on development in EUR/GBP. EUR/GBP is drawing support from 0.8797 fibonacci level. Break of 0.8894 minor resistance will indicate short term bottoming and give the Pound additional pressure elsewhere.

In Asia, Nikkei is currently up 0.08%. Hong Kong HSI is up 0.32%. China Shanghai SSE is up 0.77%. Singapore Strait Times is up 0.47%. Japan 10-year JGB yield is down -0.021 at -0.239. Overnight, DOW rose 0.06%. S&P 500 dropped -0.01%. NASDAQ dropped -0.06%. 10-year yield dropped -0.047 to 1.708.

US Mnuchin to meet Chinese Liu on trade in two weeks

US Treasury Secretary Steven Mnuchin told Fox Business that some progress were made in last week’s deputy-level meetings with China on trade. He also indicated that he would meet Chinese Vice Premier Liu He in two weeks. He added that Chinese purchases of US farm products were “good news”.

The cancellation of Chinese official’s visit to US farms were on request of the US, as Mnuchin confirmed. He noted, “we just decided the timing of the trip wasn’t necessarily the perfect timing, so they’ll be rescheduling that to after our trade meetings.” Still, “it’s a sign of good gesture that they are back at the table buying agriculture.”

Japan still aiming for a US trade deal by the end of the month

Japanese Foreign Ministry spokesman Masato Ohtaka reiterated the target to sign a trade agreement with US by the end of this month. He noted that “we still have some time and all my colleagues in the government are making their best efforts to actually meet this target”. Separately, Japanese Chief Cabinet Secretary Yoshihide Suga also said that “With the U.N. General Assembly meeting in mind, we are accelerating the remaining work, including the wording of a trade agreement.”

Japan officials and business executives have expressed concern of signing a trade deal with assurance from the US on not imposing tariffs on Japanese cars. That’s the key issue that might drag the negotiations through the self-imposed deadline. However, Japanese Foreign Minister Toshimitsu Motegi, said alongside US Trade Representative Robert Lighthizer, that he had no concern on the auto tariff threats. Motegi expected no much of a delay on the trade agreement.

Japan PMI manufacturing dropped to 48.9, strong external headwinds

Japan PMI Manufacturing dropped to 48.9, down from 49.3 and missed expectation of 49.5. That’s also the lowest reading since June 2016. PMI Services dropped to 52.8, down from 53.3. PMI Composite dropped to 51.5, down from 51.9.

Joe Hayes, Economist at IHS Markit, said: “The resilience of Japan’s service sector to the struggles of the country’s manufacturers continued to shine through during September. As a result, it’s looking like Japan will boast what will be a robust rate of growth in the current climate for the third quarter”.

However, “anecdotal evidence further highlighted the strong external headwinds Japanese manufacturers were faced with, namely US-China trade tensions, the Hong Kong protests, Brexit and the diplomatic dispute between Japan and South Korea”. Q4 would be challenging for both businesses and consumers with the planned sales tax hike.

Looking ahead

Germany Ifo business climate is the major focus in European session. Given the shockingly poor Eurozone PMIs released yesterday, any disappointment could give Euro fresh selling pressure. UK will release public sector net borrowing. Later in the day, US consumer confidence is the major focus while house price indices will be featured.

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8819; (P) 0.8837; (R1) 0.8860; More…

Intraday bias in EUR/GBP is turned neutral as it recovered after breaching 61.8% retracement of 0.8472 to 0.9324 at 0.8797. On the downside, sustained break of 0.8786 will extend the fall from 0.9328 towards 0.8472 key support next. However, considering bullish convergence condition in 4 hour MACD, break of 0.8894 minor resistance will indicate short term bottoming. Intraday bias would then be turned back to the upside for 55 day EMA (now at 0.8977).

In the bigger picture, the failure to sustain above 0.9305 (2017 high) suggests that consolidation from there is extending. Breach of 0.8472 cannot be ruled out but downside should be contained by 38.2% retracement of 0.6935 (2015 low) to 0.9305 at 0.8400. On the upside, firm break of 0.9327 will confirm up trend resumption.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | JPY | Manufacturing PMI Sep | 48.9 | 49.5 | 49.3 | |

| 5:00 | JPY | Leading Index Jul | 93.7 | 93.6 | 93.6 | |

| 8:00 | EUR | German Ifo Business Climate Sep | 94.5 | 94.3 | ||

| 8:00 | EUR | German Ifo Expectations Sep | 91.9 | 91.3 | ||

| 8:00 | EUR | German Ifo Current Assessment Sep | 97 | 97.3 | ||

| 8:30 | GBP | Public Sector Net Borrowing (GBP) Aug | 6.7B | -2.0B | ||

| 13:00 | USD | House Price Index M/M Jul | 0.30% | 0.20% | ||

| 13:00 | USD | S&P/CS HPI Composite – 20 Y/Y Jul | 2.20% | 2.10% | ||

| 14:00 | USD | CB Consumer Confidence Sep | 133.8 | 135.1 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals