Forex traders remain rather uncommitted today. Euro was weighed down by renewed weakness in German 10-year bund yield, which hit as low as 0.594. The common currency hit new 2019 low against Dollar but there is no follow through selling. Australian Dollar also recovers notably after initial weakness. On the other hand, Dollar is turning softer again after another rally attempt. The economic data released today trigger no sustainable price actions.

Technically, 1.0926 in EUR/USD remains a major focus. Decisive break will confirm resumption of medium term down trend from 1.2555. 117.55 and 132.17 minor support levels in EUR/JPY and GBP/JPY will also be watched. Break will pave the way back to 115.86 and 126.54 lows respectively.

In Europe, FTSE is up 1.24%. DAX is up 0.47%. CAC is up 0.73%. German 10-year yield is down -0.008 at -0.581. Earlier in Asia, Nikkei rose 0.13%. Hong Kong HSI rose 0.37%. China Shanghai SSE dropped -0.89%. Singapore Strait Times closed flat. Japan 10-year JGB yield rose 0.0115 to -0.246.

US Q2 GDP growth finalized at 2.0% annualized, unrevised

US Q2 GDP growth was finalized at 2.0% annualized rate, unrevised. It’s down from Q1’s 3.1% annualized growth. Downward revisions to personal consumption expenditures (PCE) and nonresidential fixed investment were primarily offset by upward revisions to state and local government spending and exports. Imports, which are a subtraction in the calculation of GDP, were revised down.

The deceleration in real GDP in the second quarter primarily reflected downturns in inventory investment, exports, and nonresidential fixed investment. These downturns were partly offset by accelerations in PCE and federal government spending.

US initial jobless claims rose to 213k, slightly above expectation

US initial jobless claims rose 3k to 213k in the week ending September 21, slightly above expectation of 212k. Four-week moving average of initial claims dropped -0.75k to 212k. Continuing claims dropped -15k to 1.65m in the week ending September 14. Four-week moving average of continuing claims dropped -12.75k to 1.668m.

Also from US, goods trade balance widened slightly to USD -72.8B in August, below expectation of USD -73.3B.

ECB Bulletin: Differences across countries becoming more noticeable

In the Monthly Economic Bulletin, ECB noted that Eurozone growth remained “moderate” in the first two quarters of the year. “Differences across countries becoming more noticeable” in Q2. Labor markets are still improving with recent data and survey-based indicators continue to point to “positive” employment growth, with “some further moderation”.

Private consumption continues to be driven by labor market recovery. Business investment growth should be supported by accommodative financing conditions, offset partly by subdued earnings expectations. Exports growth “weakened further” in Q2. Latest economic indicators and surveys confirmed “ongoing downside risks” to growth outlook.

Meanwhile “measures of underlying inflation remained generally muted” even though “wage growth has remained robust.” Market-based measures of longer-term inflation expectations have remained at very low levels, while survey-based expectations also stand at historical lows.

German Gfk consumer sentiment rose to 9.9, recession risk not eliminated

German Gfk Consumer Sentiment for October rose to 9.9, up from 9.7 and beat expectation of 9.7. Economic Expectations improved from -12 to -9. However, it was still down -33.6 pts from 24.6 from a year ago.

Gfk noted: “According to consumers, the risk of a recession still cannot be eliminated. The trade conflict with the US as well as the lack of clarity as to whether there will be a no-deal Brexit are above all affecting export-driven companies and their suppliers though are certainly impacting the rest of the economy as well.”

“Should the German economy shrink again following the decline in the second quarter, which is already seen as a possibility by many experts, this would constitute a technical recession.”

BoJ Kuroda: Will re-examine economic and price developments at next meeting

BoJ Governor Haruhiko Kuroda warned that risks to economic outlook are “skewed to the downside, mainly from overseas economies.” He cited US-China trade war, China’s stimulus measures, Brexit, geopolitical risks and emerging markets are major uncertainties. He added that “global economy is slowing down and it shows no clear sign of turning for the better. Downside risks from overseas economies are heightening. US-China trade friction appears to be prolonged.”

Thus, “we are facing a situation where we need to pay more attention to the risk of the momentum toward 2% price target being undermined”. And, “with such situation in mind, we will re-examine economic and price developments at the next policy-setting meeting.” Though for now, “a moderate uptrend in wages and prices remain intact,” he said. “Prices are expected to accelerate gradually toward 2%.”

RBNZ Orr: Rates will remain low for a number of years

RBNZ Governor Adrian Orr said in a speech that some people view global low interest rates as “signs of concern”. But he added “they can also be an opportunity” as “we are confident that rates will remain low for a number of years, providing a great environment to invest.”

Orr said “the good news for New Zealand, unlike many other OECD economies, is that our government’s books are in good shape, with room to expand investment, and there is already a strong fiscal impulse underway from public spending and investment.” Also, “we have the trifecta of sound government finances, clear infrastructure demands, and low hurdle rates for investing. The same can be said for corporate balance sheets in New Zealand. With relatively low levels of debt, and ongoing demand for goods and services, our businesses are well positioned.”

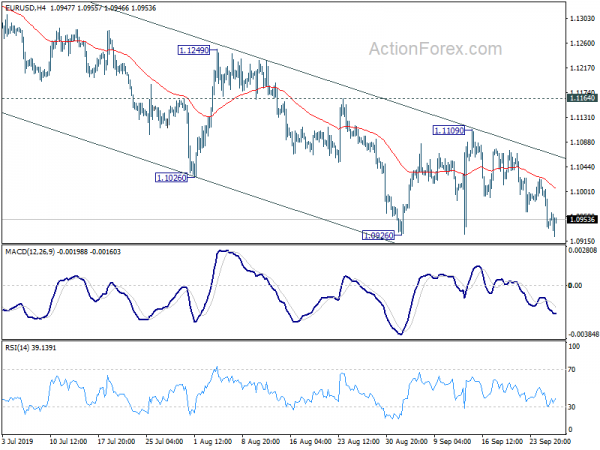

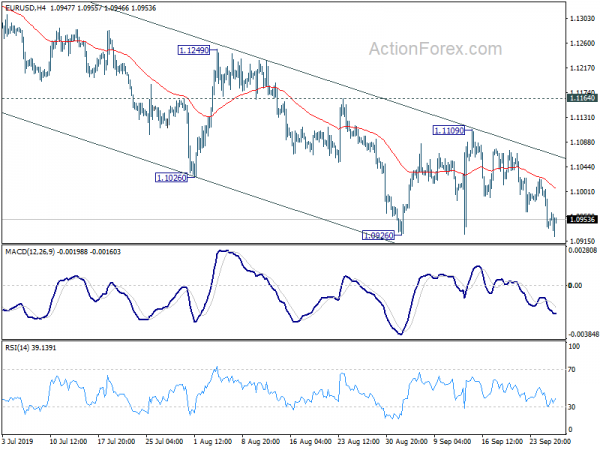

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0914; (P) 1.0968; (R1) 1.0998; More…

EUR/USD breached 1.0926 low but quickly recovered. Intraday bias remains neutral first. On the downside, decisive break of 1.0926 will confirm resumption of larger down trend from 1.2555 for 1.0813 fibonacci level next. In case of another rise, upside should be limited by 1.1164 resistance to bring down trend resumption eventually.

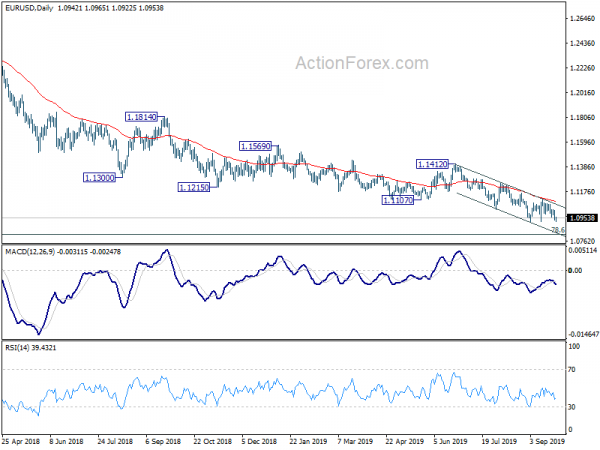

In the bigger picture, down trend from 1.2555 (2018 high) is in progress. Prior rejection of 55 week EMA also maintained bearishness. Further fall should be seen to 78.6% retracement of 1.0339 to 1.2555 at 1.0813. Decisive break there will target 1.0339 (2017 low). On the upside, break of 1.1412 resistance is needed to indicate medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 08:00 | EUR | M3 Money Supply Y/Y Aug | 5.70% | 5.00% | 5.20% | 5.10% |

| 12:30 | USD | Initial Jobless Claims | 213K | 212K | 208K | 210K |

| 12:30 | USD | GDP Annualized Q2 F | 2.00% | 2.00% | 2.00% | |

| 12:30 | USD | GDP Price Index Q/Q Q2 F | 2.60% | 2.40% | 2.50% | |

| 12:30 | USD | Goods Trade Balance (USD) Aug | -72.8B | -73.3B | -72.3B | -72.5B |

| 12:30 | USD | Wholesale Inventories M/M | 0.40% | 0.30% | 0.20% | 0.10% |

| 14:00 | USD | Pending Home Sales M/M Aug | 1.00% | -2.50% | ||

| 14:30 | USD | Natural Gas Storage | 90B | 84B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals