Yen jumps broadly today as risk appetite continues to recede in Asian session. Investors turned a bit cautious as it’s still uncertain when and where US and China would sign the phase one trade agreement. Currently, Swiss Franc is the second strongest, followed by Dollar. On the other hand, New Zealand and Australian Dollars are the weakest one.

Sterling is slightly softer as markets await BoE rate decisions. The Pound turned into consolidation after mid-October, with another Brexit delay granted while UK heads for snap election. There is some downside risk in the Pound on dovish BoE economic forecasts. But downside will likely be limited even in that case as traders would stay mostly on the sideline before clearing political and Brexit uncertainties.

Technically, EUR/USD’s breach of 1.1062 support is a sign of weakness, which suggests completion of corrective rebound from 1.0879. Though, there is no clear sign of corresponding strength in Dollar yet. Ideally, we should at least see a break in 0.9970 in USD/CHF and 1.3208 in USD/CAD to indicate a comeback of the greenback. Meanwhile, USD/JPY seems to be rejected by 109.28/31 resistance. Deeper fall in USD/JPY could drag down other Yen crosses.

In Asia, currently, Nikkei is down -0.09%. Hong Kong HSI is down -0.34%. China Shanghai SSE is down -0.30%. Singapore Strait Times is down -0.04%. Japan 10-year JGB yield is down -0.004 at -0.086. Overnight, DOW ended flat. S&P 500 rose 0.07%. NASDAQ dropped -0.29%. 10-year yield dropped -0.052 at 1.814.

BoE to stand pat, quarterly Inflation Report eyed

BoE rate decision will be the major focus today. Bank rate is widely expected to stay unchanged at 0.75%. Asset purchase target will be held at GBP 435B. There is practically no chance for a change in monetary policy given that it’s the last BoE meeting before December 12 general election. Brexit deadline was also delayed to January 31, 2020.

Attentions will mainly be on the new economic projections to be published with the quarterly Inflation Report. Known BoE hawk Michael Saunders recently warned that a rate cut was plausible if Brexit uncertainty continued to act as a “slow puncture” for the economy. Even if smooth Brexit is the eventual end-result, some monetary accommodation might be needed given that the damages of uncertainties were done. Such views might be reflected in the projections.

Suggested reading: BOE Preview – Maintaining Dovish Stance although No-Deal Brexit Less Likely.

US and China may not sign trade deal until Dec, location undecided

It’s reported that US and China might not be able to sign the phase one trade deal until December. Terms of the deal, regarding the size of China’s agricultural purchase and remove of some imposed tariffs, were still being negotiated. Data and locations are also undecided yet after Chile canceled the APEC summit this month.

Two locations inside the US, Iowa and Alaska, appeared to be ruled out. London is a possibility where presidents of the two country could meet after NATO summit on December 304. Sweden and Switzerland are also among the possibilities in Europe. Asia appears less likely as the destination There are calls for the Trump-Xi meeting to take place in Hong Kong, but no one from either side showed any “interest” to touch the city.

White House spokesman Judd Deere said earlier that “negotiations are continuing and progress is being made on the text of the phase one agreement. We will let you know when we have an announcement on a signing location.”

Australia trade surplus widened to AUD 7.18B, construction index improved slightly

In seasonally adjusted terms, Australia trade surplus widened to AUD 7.18B in September, up from AUD 6.62B, beat expectation of AUD 5.10B. Exports rose 3% to AUD 43.2B. Imports rose 3% to AUD 36.0B.

Also released, AiG Performance of Construction index rose to 43.9 in October, up from 42.6. The data reflected less pronounced reductions in activity, new orders and employment. However, highlighting the subdued overall state of business conditions, deliveries from suppliers declined at a steeper rate in the month.

Elsewhere

Swiss will release foreign currency reserves in European session. Germany will release industrial production. ECB will release monthly bulletin while EU will release new economic forecasts. But major focus will say on BoE rate decision. Later in the day, US will release jobless claims.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2835; (P) 1.2866; (R1) 1.2888; More….

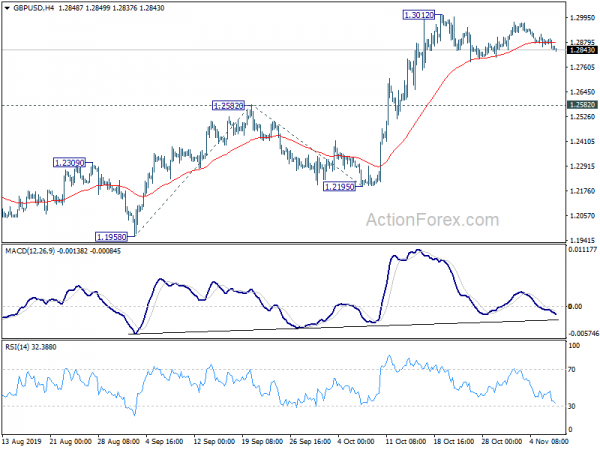

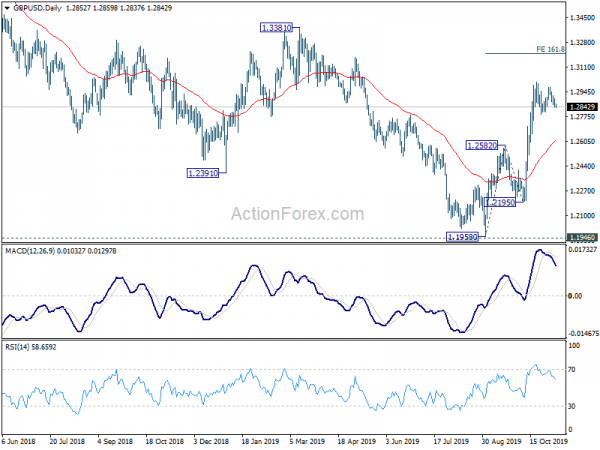

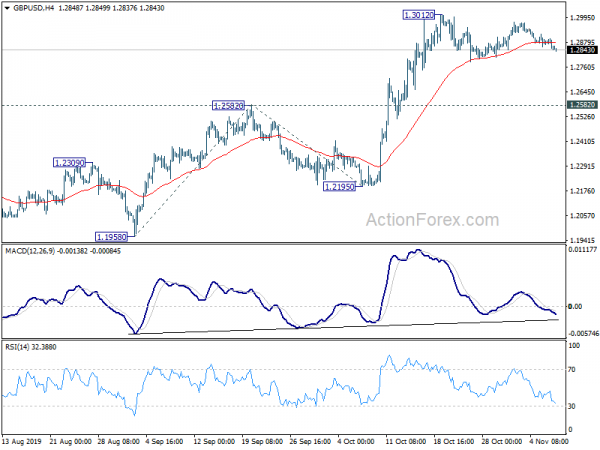

Intraday bias in GBP/USD remains neutral as consolidation from 1.3012 is extending. Deeper retreat could still be seen. But downside should be contained above 1.2582 resistance turned support to bring rise resumption. On the upside, break of 1.3012 will resume the rise from 1.1958 to 161.8% projection of 1.1958 to 1.2582 from 1.2195 at 1.3205 next.

In the bigger picture, current development affirms the case of medium term bottoming at 1.1958, ahead of 1.1946 (2016 low). At this point, rise from 1.1958 is seen as the third leg of consolidation from 1.1946. Further rise would be seen back towards 1.4376 resistance. For now, this will remain the favored case as long as 1.2582 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Construction Index Oct | 43.9 | 42.6 | ||

| 0:30 | AUD | Trade Balance (AUD) Sep | 7.18B | 5.10B | 5.93B | 6.62B |

| 7:00 | EUR | Germany Industrial Production M/M Sep | -0.30% | 0.30% | ||

| 8:00 | CHF | Foreign Currency Reserves (CHF) Oct | 777B | |||

| 8:00 | CNY | Foreign Exchange Reserves M/M Oct | $3.089T | $3.092T | ||

| 9:00 | EUR | ECB Economic Bulletin | ||||

| 10:00 | EUR | EU Economic Forecasts | ||||

| 12:00 | GBP | BoE Interest Rate Decision | 0.75% | 0.75% | ||

| 12:00 | GBP | BoE Asset Purchase Facility | 435B | 435B | ||

| 12:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | ||

| 12:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | ||

| 12:00 | GBP | Bank of England Quarterly Inflation Report | ||||

| 13:30 | USD | Initial Jobless Claims (Nov 1) | 215K | 218K | ||

| 15:30 | USD | Natural Gas Storage | 89B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals