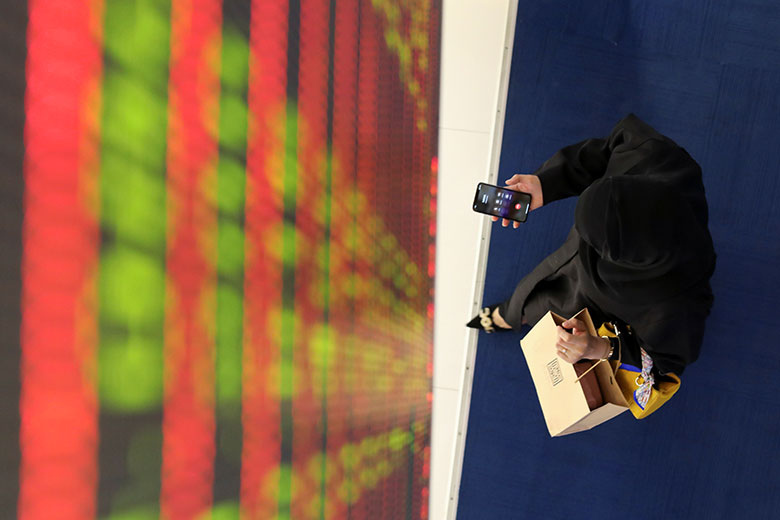

The facilitation of digital payments in Saudi Arabia is one of several projects overseen by the Saudi Arabian Monetary Authority (SAMA), which aims to achieve the Kingdom’s vision of a cashless society and to promote innovation in the financial sector.

A digitally transformed economy is one of the key pillars of Saudi’s Vision 2030.

BayanPay has graduated from SAMA’s digital sandbox to operate digital wallets, as well as an e-commerce platform to facilitate transactions between business, businesses and consumers, and businesses and government.

|

Binay Shetty, |

“We’ve just launched a digital wallet business in Saudi Arabia, which is one of three licences issued recently,” says Binay Shetty, vice-chairman and CEO of BRS Ventures, which owns payment-based solutions business Finablr, headquartered in Abu Dhabi. “The independent licence given by the regulator allows us to start transactions in this space.”

Shetty says BRS Ventures had been looking for an entry point into the Saudi market for a while, but because it was deemed a mobile exchange operator – due to its ownership of Travelex – it needed to develop a more innovative offering.

“Saudi Arabia limited any money exchange operators and they combined all of them into a bank,” he says. “This was one way to enter the market.”

E-commerce market

The Kingdom is committed to increasing non-cash transactions from 18% in 2016 to 28% by 2020, according to its financial sector development program charter. Saudi Arabia’s e-commerce market is expected to be worth $22 billion by 2022.

The MENA e-commerce market was worth $8.3 billion in 2017, with an annual growth rate of 25%, according to analysis by Google and Bain & Company. It is forecast to hit $28.5 billion by 2022.

At the time of the study, Saudi Arabia was the second most-advanced e-commerce market in the region, with a penetration rate of 3.8%, behind United Arab Emirates at 4.2%.

As well as Travelex, Finablr’s other portfolio companies include UAE Exchange and Xpress Money.

Finablr has also recently signed an agreement with telecommunications company Airtel Africa. Finablr’s technology will allow Airtel Africa customers to receive payments from more than 100 countries without the need for a third party to facilitate the transaction.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals